- Hong Kong

- /

- Energy Services

- /

- SEHK:2883

Did Scrapping Its Supervisory Committee Just Shift China Oilfield Services’ (SEHK:2883) Investment Narrative?

Reviewed by Sasha Jovanovic

- On December 2, 2025, China Oilfield Services Limited held its First Extraordinary General Meeting, where shareholders approved cancelling the Supervisory Committee and amending the Articles of Association.

- This governance overhaul signals a shift toward a leaner oversight framework that could alter how responsibilities, accountability, and risk controls are organized across the company.

- Next, we will examine how cancelling the Supervisory Committee may reshape China Oilfield Services’ existing investment narrative around governance and growth.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

China Oilfield Services Investment Narrative Recap

To own China Oilfield Services, you need to believe in steady offshore activity, disciplined capital spending and more reliable earnings from long term international contracts. The governance overhaul on 2 December 2025 looks incremental rather than a clear swing factor for near term catalysts or the key risks around customer concentration, aging assets and well services pressure, so its impact may be more about process than near term performance.

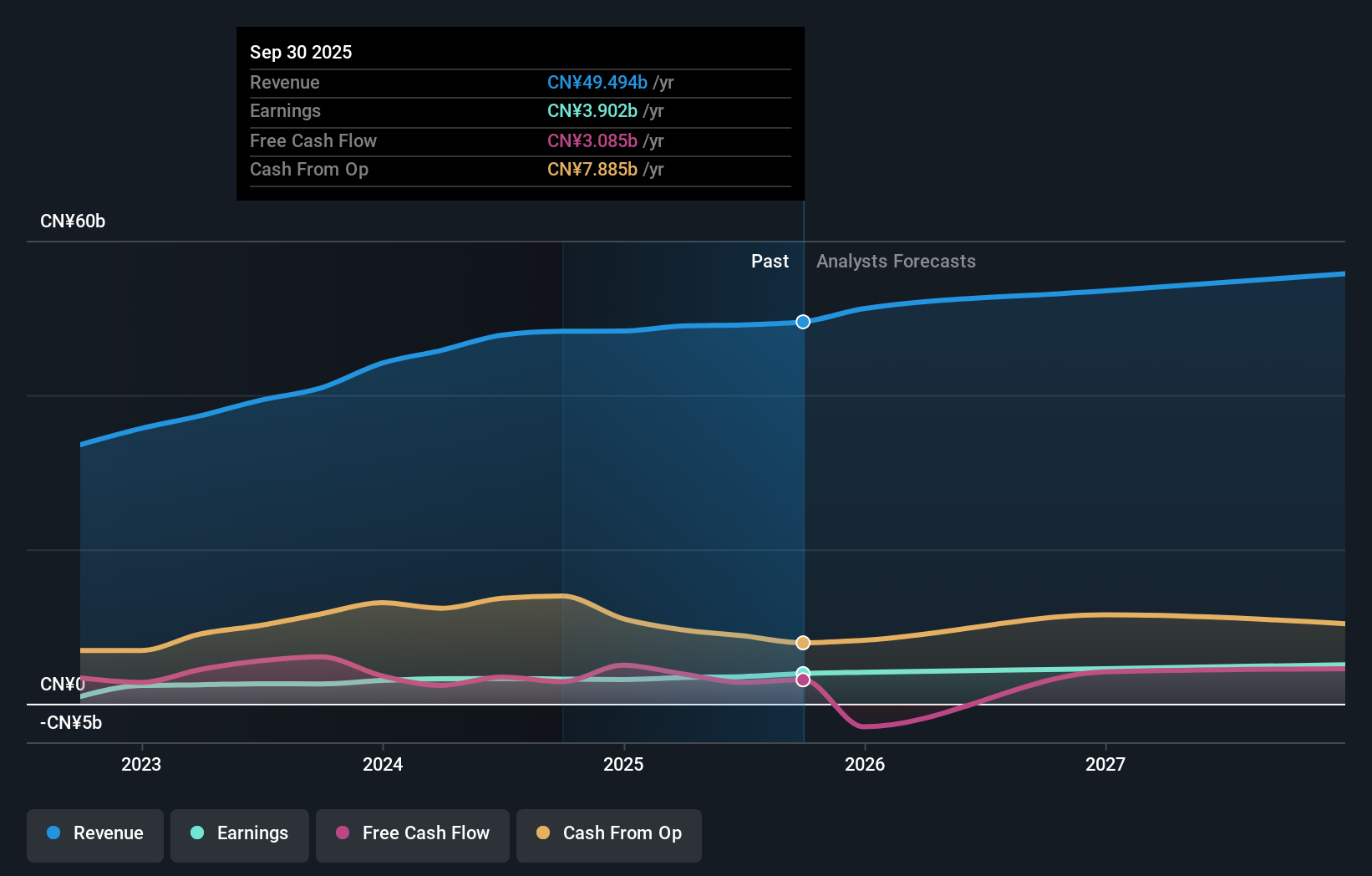

The most relevant recent announcement is the 9M 2025 result, where revenue and net profit both increased year on year. Against that backdrop, the governance changes matter mainly for how effectively the board can oversee risks such as contract quality, capital allocation and exposure to CNOOC, rather than altering the underlying earnings drivers in the short run.

Yet beneath improving earnings, investors should also be aware of how concentrated domestic demand and aging offshore assets could...

Read the full narrative on China Oilfield Services (it's free!)

China Oilfield Services' narrative projects CN¥57.5 billion revenue and CN¥5.5 billion earnings by 2028. This requires 5.4% yearly revenue growth and about CN¥2.0 billion earnings increase from CN¥3.5 billion today.

Uncover how China Oilfield Services' forecasts yield a HK$9.50 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for COSL span from HK$9.50 to HK$23.22, highlighting how far apart individual views can be. Set that against the current focus on governance reforms and contract quality, and you can see why it pays to compare several perspectives before forming a view on the company’s prospects.

Explore 2 other fair value estimates on China Oilfield Services - why the stock might be worth just HK$9.50!

Build Your Own China Oilfield Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Oilfield Services research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Oilfield Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Oilfield Services' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2883

China Oilfield Services

Provides integrated oilfield services in China, Indonesia, Mexico, Norway, the Middle East, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026