- Hong Kong

- /

- Energy Services

- /

- SEHK:206

CM Energy Tech And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced a significant rally, with major U.S. indices reaching record highs following the election results and a Federal Reserve rate cut. Amid these developments, investors are increasingly exploring diverse opportunities, including penny stocks, which despite their vintage label, continue to hold potential value for those seeking growth in smaller or newer companies. With strong financial foundations, these stocks can offer an intriguing mix of affordability and potential growth; this article will explore several penny stocks that stand out for their financial strength and long-term promise.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.78 | MYR135.97M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB1.92 | THB1.67B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.615 | A$71.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR287.13M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR761.86M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$140.36M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.8789 | £385.78M | ★★★★☆☆ |

Click here to see the full list of 5,781 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

CM Energy Tech (SEHK:206)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CM Energy Tech Co., Ltd. is an investment holding company involved in the design, manufacture, installation, and commissioning of land and offshore rigs globally, with a market cap of approximately HK$616.25 million.

Operations: The company's revenue is primarily derived from equipment manufacturing and packages at $121.13 million, followed by assets management and engineering services at $58.19 million, and supply chain and integration services contributing $31.45 million.

Market Cap: HK$616.25M

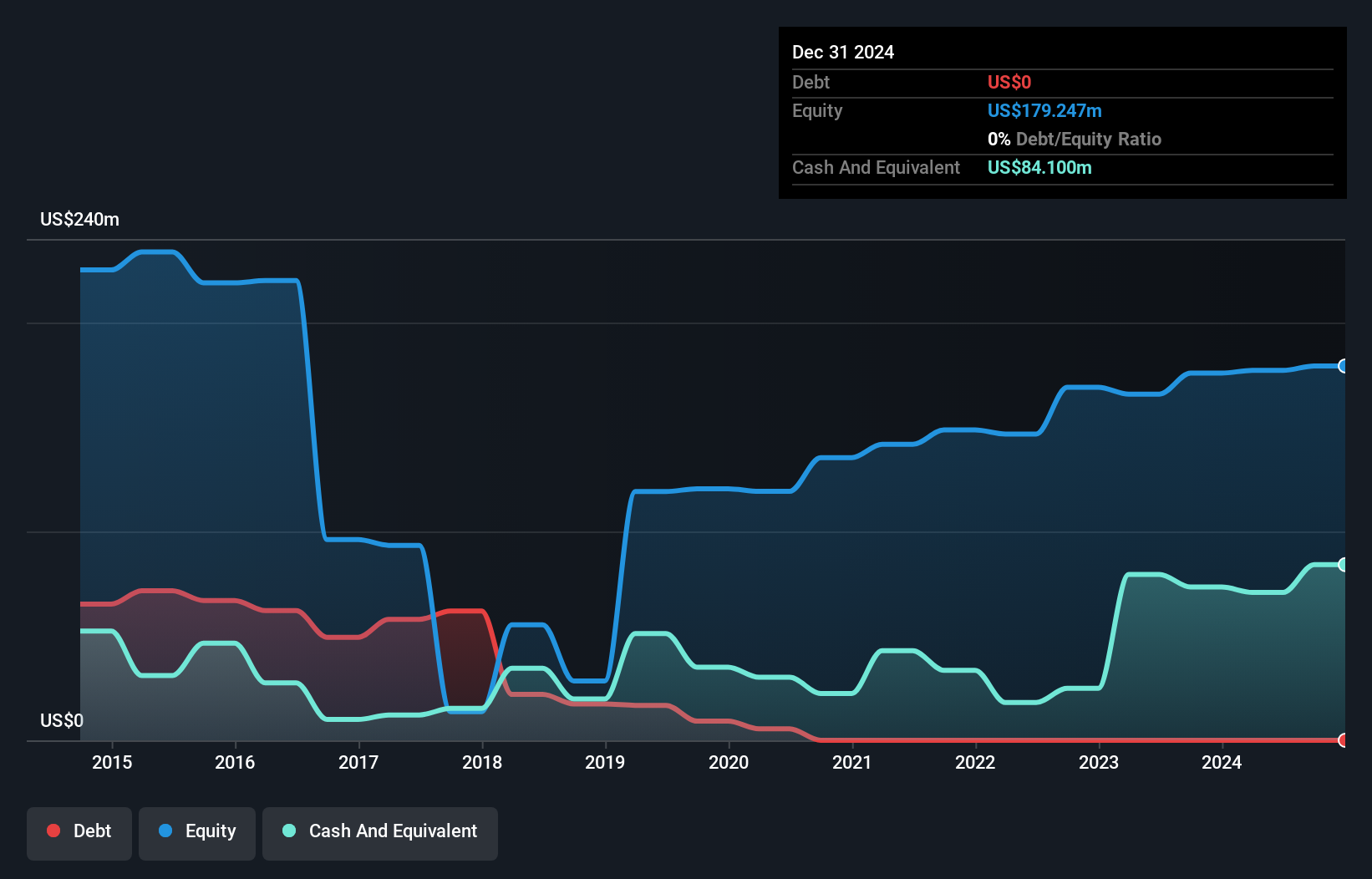

CM Energy Tech Co., Ltd. presents a complex picture for potential investors. The company is debt-free, which reduces financial risk, and its short-term assets of US$234.7 million comfortably cover both short- and long-term liabilities. However, recent earnings show a decline in sales to US$77.6 million for the first half of 2024, with stagnant net income at US$4.79 million year-on-year, highlighting challenges in revenue growth amidst negative earnings growth over the past year. While the management team is experienced with an average tenure of 5.3 years, the board's shorter tenure suggests recent changes at higher levels.

- Click here and access our complete financial health analysis report to understand the dynamics of CM Energy Tech.

- Evaluate CM Energy Tech's historical performance by accessing our past performance report.

Lee's Pharmaceutical Holdings (SEHK:950)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lee's Pharmaceutical Holdings Limited is an investment holding company that develops, manufactures, markets, and sells pharmaceutical products primarily in the People's Republic of China, with a market cap of HK$753.71 million.

Operations: The company's revenue is derived from Licensed-In Products, contributing HK$483.06 million, and Proprietary and Generic Products, generating HK$716.01 million.

Market Cap: HK$753.71M

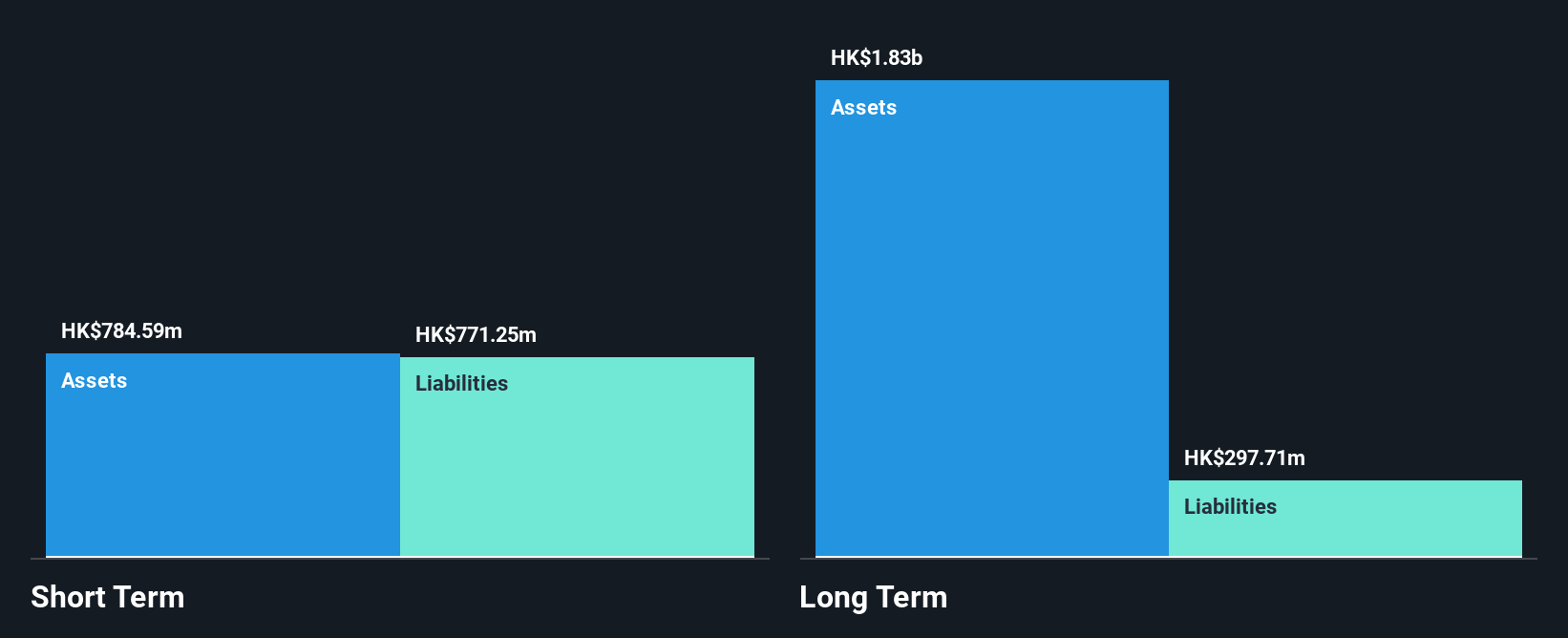

Lee's Pharmaceutical Holdings has demonstrated significant earnings growth of 61.9% over the past year, surpassing industry averages. The company's revenue for the first half of 2024 increased to HK$658.35 million, with net income rising to HK$62.48 million, reflecting improved profit margins from 3.6% to 5.3%. While short-term assets exceed both short- and long-term liabilities, indicating strong liquidity, the board's average tenure of 2.8 years suggests recent changes that could impact strategic direction. Despite an increase in debt-to-equity ratio over five years, interest coverage remains robust at 6.5 times EBIT, supported by satisfactory operating cash flow coverage of debt at 56.2%.

- Unlock comprehensive insights into our analysis of Lee's Pharmaceutical Holdings stock in this financial health report.

- Gain insights into Lee's Pharmaceutical Holdings' past trends and performance with our report on the company's historical track record.

Boustead Singapore (SGX:F9D)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boustead Singapore Limited is an investment holding company that offers energy engineering, real estate, geospatial, and healthcare technology solutions across various regions globally, with a market cap of SGD511.29 million.

Operations: No specific revenue segments are reported for this company.

Market Cap: SGD511.29M

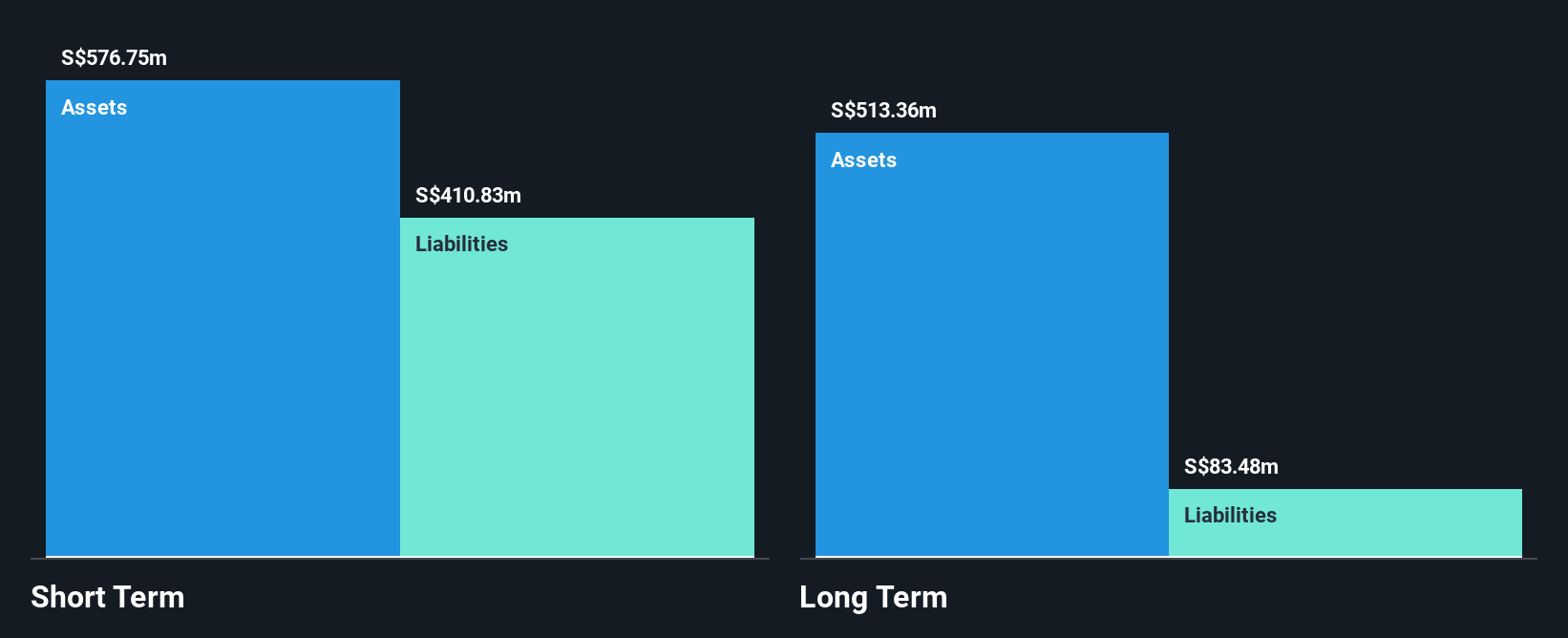

Boustead Singapore Limited's recent earnings report for the half year ended September 30, 2024, reveals a decline in sales to SGD 295.21 million from SGD 367.93 million the previous year, yet net income increased to SGD 35.98 million from SGD 26.85 million due to improved profit margins of 10.6%. The company exhibits strong financial health with short-term assets significantly exceeding both short- and long-term liabilities and more cash than total debt. Despite shareholder dilution over the past year, Boustead maintains a low price-to-earnings ratio of 7x compared to the SG market average of 11.2x, suggesting potential value opportunities amidst its stable weekly volatility at 2%.

- Take a closer look at Boustead Singapore's potential here in our financial health report.

- Assess Boustead Singapore's previous results with our detailed historical performance reports.

Where To Now?

- Investigate our full lineup of 5,781 Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:206

CM Energy Tech

An investment holding company, engages in the design, manufacture, installation, and commissioning of land and offshore drilling rigs and equipment worldwide.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives