- Hong Kong

- /

- Energy Services

- /

- SEHK:1921

Dalipal Holdings (HKG:1921) investors are up 4.2% in the past week, but earnings have declined over the last five years

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. To wit, the Dalipal Holdings Limited (HKG:1921) share price has soared 539% over five years. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 154% over the last quarter. We love happy stories like this one. The company should be really proud of that performance!

The past week has proven to be lucrative for Dalipal Holdings investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Dalipal Holdings

While Dalipal Holdings made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

For the last half decade, Dalipal Holdings can boast revenue growth at a rate of 9.8% per year. That's a fairly respectable growth rate. Arguably it's more than reflected in the very strong share price gain of 45% a year over a half a decade. We usually like strong growth stocks but it does seem the market already appreciates this one quite well!

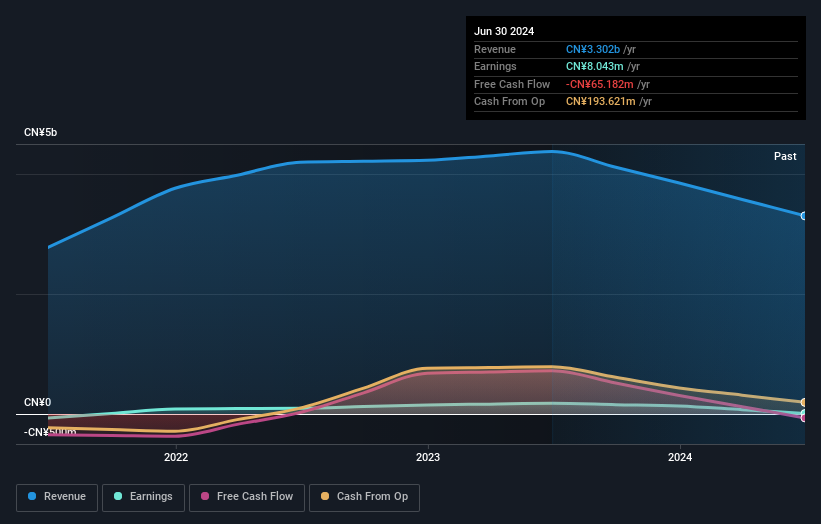

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Dalipal Holdings' earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Dalipal Holdings, it has a TSR of 624% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Dalipal Holdings has rewarded shareholders with a total shareholder return of 120% in the last twelve months. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 49%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Dalipal Holdings better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Dalipal Holdings you should be aware of, and 3 of them are potentially serious.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1921

Dalipal Holdings

An investment holding company, supplies application equipment for energy development in the People’s Republic of China and internationally.

Slight with imperfect balance sheet.