- Hong Kong

- /

- Energy Services

- /

- SEHK:1623

Here's Why We Think Hilong Holding (HKG:1623) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hilong Holding (HKG:1623). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Hilong Holding

Hilong Holding's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that Hilong Holding's EPS went from CN¥0.034 to CN¥0.14 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

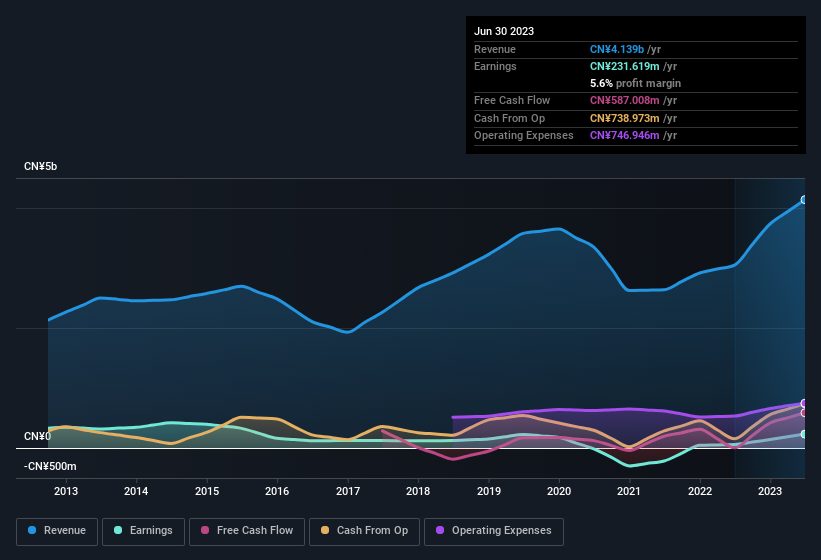

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Hilong Holding maintained stable EBIT margins over the last year, all while growing revenue 36% to CN¥4.1b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Hilong Holding is no giant, with a market capitalisation of HK$458m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Hilong Holding Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Our analysis into Hilong Holding has shown that insiders have sold CN¥91k worth of shares over the last 12 months. But that doesn't beat the large CN¥581k share acquisition by Executive Chairman of the Board Jun Zhang. Overall, that is something good to take away.

On top of the insider buying, we can also see that Hilong Holding insiders own a large chunk of the company. Owning 47% of the company, insiders have plenty riding on the performance of the the share price. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. With that sort of holding, insiders have about CN¥217m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Tao Wang, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Hilong Holding with market caps under CN¥1.5b is about CN¥1.7m.

Hilong Holding offered total compensation worth CN¥1.4m to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Hilong Holding To Your Watchlist?

Hilong Holding's earnings per share have been soaring, with growth rates sky high. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Hilong Holding deserves timely attention. It is worth noting though that we have found 4 warning signs for Hilong Holding (2 don't sit too well with us!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Hilong Holding, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hilong Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1623

Hilong Holding

An investment holding company, operates as an oil field equipment and services provider in the People’s Republic of China, Hong Kong, Russia, Central Asia and Europe, the Middle East, North and South America, South Asia, Southeast Asia, and Africa.

Good value with adequate balance sheet.

Market Insights

Community Narratives