- Hong Kong

- /

- Energy Services

- /

- SEHK:1586

If You Had Bought China Leon Inspection Holding's (HKG:1586) Shares Three Years Ago You Would Be Down 18%

While it may not be enough for some shareholders, we think it is good to see the China Leon Inspection Holding Limited (HKG:1586) share price up 17% in a single quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 18% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Check out our latest analysis for China Leon Inspection Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

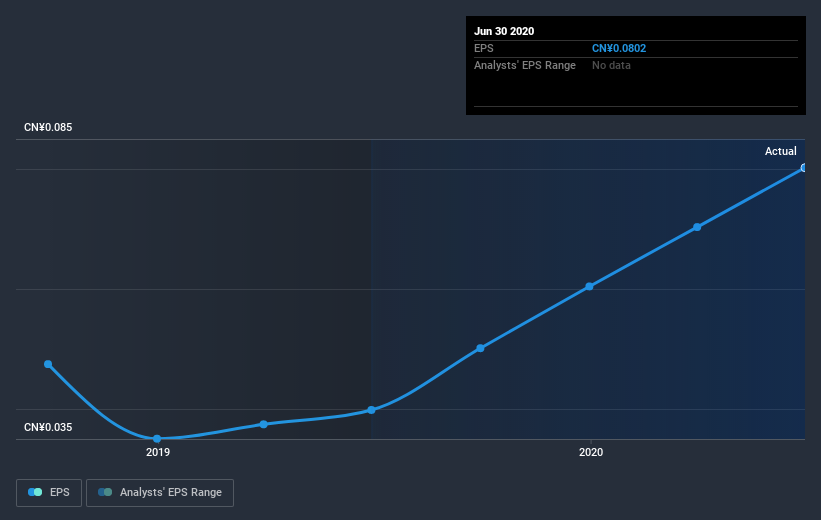

During the three years that the share price fell, China Leon Inspection Holding's earnings per share (EPS) dropped by 12% each year. In comparison the 7% compound annual share price decline isn't as bad as the EPS drop-off. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on China Leon Inspection Holding's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, China Leon Inspection Holding's TSR for the last 3 years was -13%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

China Leon Inspection Holding shareholders are up 7.0% for the year (even including dividends). Unfortunately this falls short of the market return of around 22%. The silver lining is that the recent rise is far preferable to the annual loss of 4% that shareholders have suffered over the last three years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - China Leon Inspection Holding has 3 warning signs (and 1 which is potentially serious) we think you should know about.

China Leon Inspection Holding is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade China Leon Inspection Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade China Leon Inspection Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1586

China Leon Inspection Holding

An investment holding company, provides services on inspection, testing, technical, and consulting services in Greater China, Singapore, and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives