- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1393

Hidili Industry International Development Limited (HKG:1393) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Hidili Industry International Development Limited (HKG:1393) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

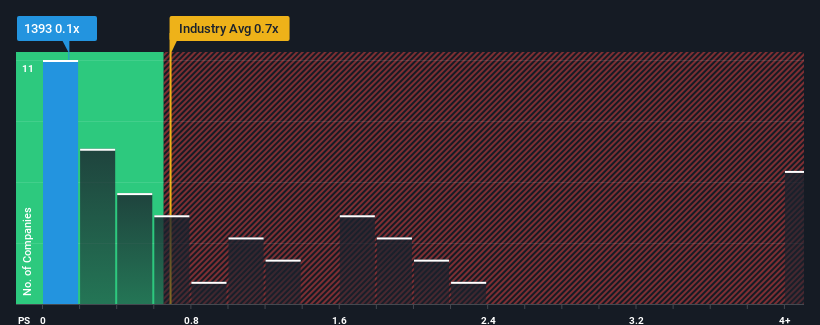

Since its price has dipped substantially, given about half the companies operating in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") above 0.7x, you may consider Hidili Industry International Development as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Hidili Industry International Development

How Hidili Industry International Development Has Been Performing

As an illustration, revenue has deteriorated at Hidili Industry International Development over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Hidili Industry International Development will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Hidili Industry International Development, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Hidili Industry International Development's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 44%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 1.9% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Hidili Industry International Development's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Key Takeaway

The southerly movements of Hidili Industry International Development's shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Hidili Industry International Development revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

It is also worth noting that we have found 3 warning signs for Hidili Industry International Development (1 is potentially serious!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hidili Industry International Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1393

Hidili Industry International Development

An investment holding company engages in the mining, manufacturing, and sale of raw and clean coal in the People’s Republic of China.

Slightly overvalued very low.