- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1164

Why Investors Shouldn't Be Surprised By CGN Mining Company Limited's (HKG:1164) 31% Share Price Surge

CGN Mining Company Limited (HKG:1164) shares have had a really impressive month, gaining 31% after a shaky period beforehand. The annual gain comes to 137% following the latest surge, making investors sit up and take notice.

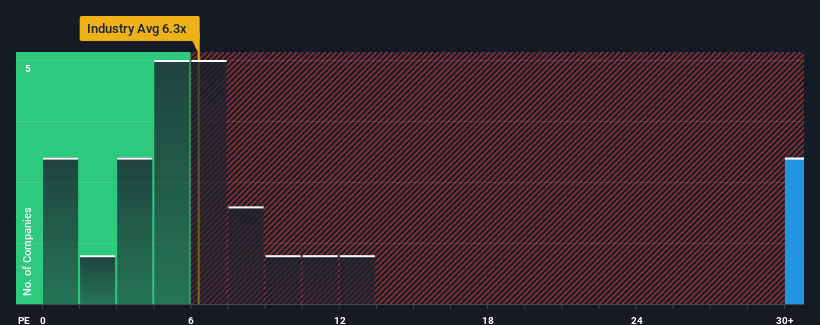

Since its price has surged higher, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider CGN Mining as a stock to avoid entirely with its 31.5x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

CGN Mining could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for CGN Mining

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as CGN Mining's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 8.9% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 178% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 43% each year as estimated by the eight analysts watching the company. With the market only predicted to deliver 15% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that CGN Mining's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On CGN Mining's P/E

CGN Mining's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of CGN Mining's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for CGN Mining that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1164

CGN Mining

Engages in the development and trading of natural uranium resources to nuclear power plants.

High growth potential and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026