- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1138

COSCO SHIPPING Energy Transportation's (HKG:1138) Upcoming Dividend Will Be Larger Than Last Year's

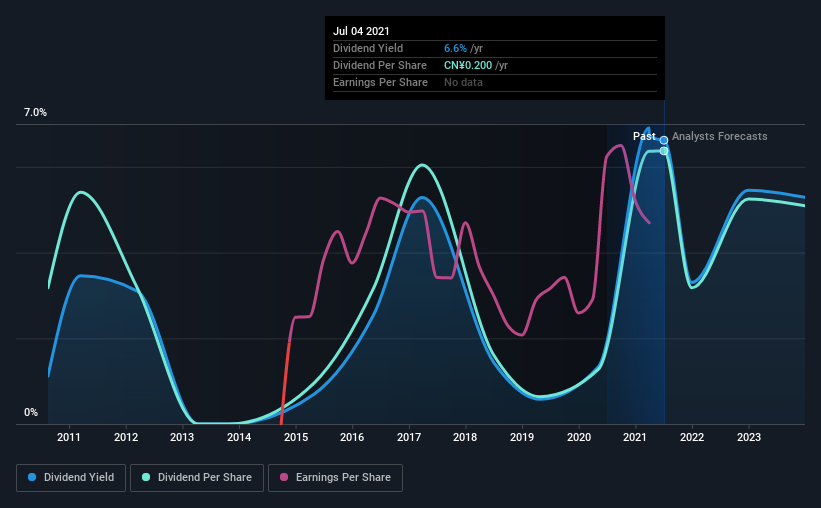

COSCO SHIPPING Energy Transportation Co., Ltd. (HKG:1138) will increase its dividend on the 27th of August to HK$0.24. This takes the annual payment to 6.6% of the current stock price, which is about average for the industry.

View our latest analysis for COSCO SHIPPING Energy Transportation

COSCO SHIPPING Energy Transportation's Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Prior to this announcement, COSCO SHIPPING Energy Transportation's dividend was only 46% of earnings, however it was paying out 119% of free cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Over the next year, EPS is forecast to fall by 0.09%. If the dividend continues along recent trends, we estimate the payout ratio could be 56%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2011, the first annual payment was CN¥0.10, compared to the most recent full-year payment of CN¥0.20. This means that it has been growing its distributions at 7.2% per annum over that time. It's good to see the dividend growing at a decent rate, but the dividend has been cut at least once in the past. COSCO SHIPPING Energy Transportation might have put its house in order since then, but we remain cautious.

COSCO SHIPPING Energy Transportation May Find It Hard To Grow The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Although it's important to note that COSCO SHIPPING Energy Transportation's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. Growth of 1.7% may indicate that the company has limited investment opportunity so it is returning its earnings to shareholders instead. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

Our Thoughts On COSCO SHIPPING Energy Transportation's Dividend

In summary, while it's always good to see the dividend being raised, we don't think COSCO SHIPPING Energy Transportation's payments are rock solid. While COSCO SHIPPING Energy Transportation is earning enough to cover the payments, the cash flows are lacking. We would be a touch cautious of relying on this stock primarily for the dividend income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 3 warning signs for COSCO SHIPPING Energy Transportation that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1138

COSCO SHIPPING Energy Transportation

An investment holding company, engages in the shipment of oil, liquefied natural gas (LNG), and chemicals along the coast of the People’s Republic of China and internationally.

Adequate balance sheet and fair value.