- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1478

Q Technology (Group)'s (HKG:1478) earnings trajectory could turn positive as the stock spikes 10% this past week

Q Technology (Group) Company Limited (HKG:1478) shareholders should be happy to see the share price up 11% in the last month. But that is little comfort to those holding over the last half decade, sitting on a big loss. In fact, the share price has declined rather badly, down some 54% in that time. Some might say the recent bounce is to be expected after such a bad drop. But it could be that the fall was overdone.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Q Technology (Group)

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

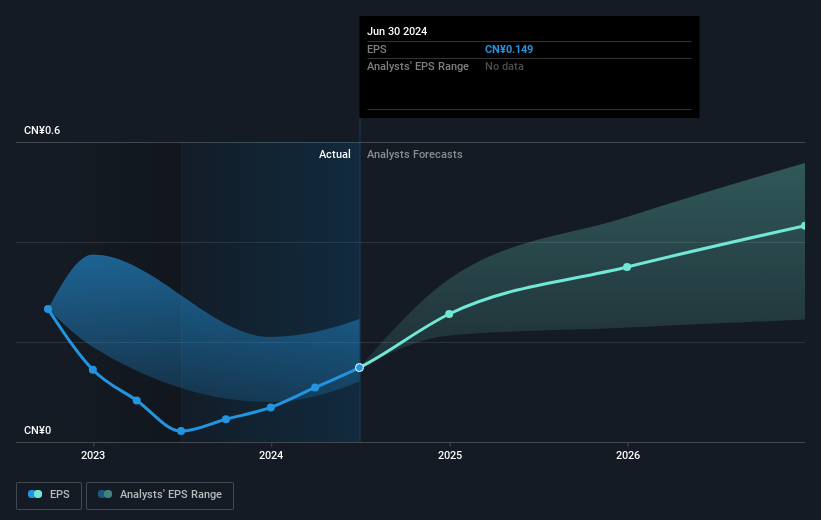

During the five years over which the share price declined, Q Technology (Group)'s earnings per share (EPS) dropped by 7.3% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 14% per year, over the period. This implies that the market is more cautious about the business these days.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Q Technology (Group)'s earnings, revenue and cash flow.

A Different Perspective

Q Technology (Group) shareholders have received returns of 17% over twelve months, which isn't far from the general market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 9% over the last five years. While 'turnarounds seldom turn' there are green shoots for Q Technology (Group). Before deciding if you like the current share price, check how Q Technology (Group) scores on these 3 valuation metrics.

Of course Q Technology (Group) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Q Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1478

Q Technology (Group)

An investment holding company, engages in the design, research and development, manufacturing, and sale of camera and fingerprint recognition modules in the Mainland of China, Hong Kong, India, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives