- Hong Kong

- /

- Energy Services

- /

- SEHK:1080

Shengli Oil & Gas Pipe Holdings (HKG:1080) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Shengli Oil & Gas Pipe Holdings Limited (HKG:1080) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Shengli Oil & Gas Pipe Holdings

What Is Shengli Oil & Gas Pipe Holdings's Net Debt?

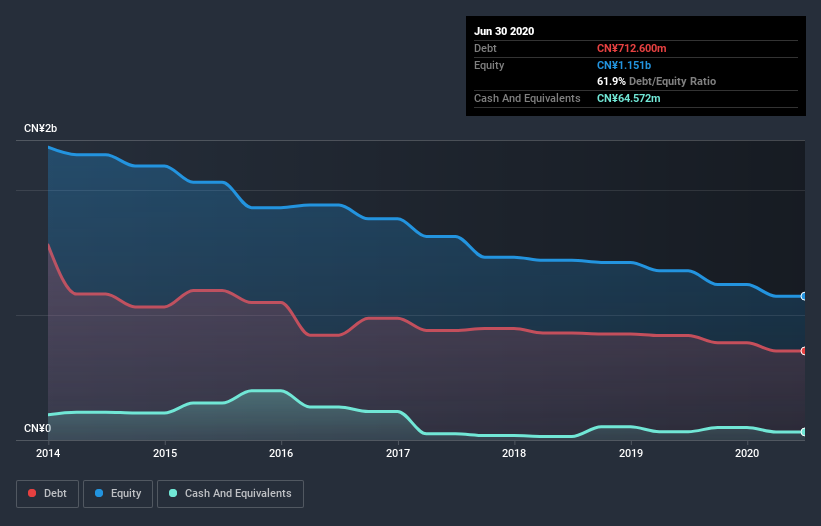

You can click the graphic below for the historical numbers, but it shows that Shengli Oil & Gas Pipe Holdings had CN¥712.6m of debt in June 2020, down from CN¥835.4m, one year before. However, because it has a cash reserve of CN¥64.6m, its net debt is less, at about CN¥648.0m.

How Healthy Is Shengli Oil & Gas Pipe Holdings's Balance Sheet?

According to the last reported balance sheet, Shengli Oil & Gas Pipe Holdings had liabilities of CN¥1.30b due within 12 months, and liabilities of CN¥7.61m due beyond 12 months. Offsetting this, it had CN¥64.6m in cash and CN¥230.0m in receivables that were due within 12 months. So its liabilities total CN¥1.01b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥231.8m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Shengli Oil & Gas Pipe Holdings would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Shengli Oil & Gas Pipe Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Shengli Oil & Gas Pipe Holdings made a loss at the EBIT level, and saw its revenue drop to CN¥662m, which is a fall of 30%. That makes us nervous, to say the least.

Caveat Emptor

While Shengli Oil & Gas Pipe Holdings's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping CN¥165m. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely since it is low on liquid assets, and made a loss of CN¥158m in the last year. So we think this stock is quite risky. We'd prefer to pass. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Shengli Oil & Gas Pipe Holdings you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Shengli Oil & Gas Pipe Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1080

Shengli Oil & Gas Pipe Holdings

An investment holding company, engages in the design, process, manufacture, and sale of welded pipes for oil and gas pipeline in Mainland China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives