SEHK Stocks Possibly Priced Below Intrinsic Value In October 2024

Reviewed by Simply Wall St

As global markets experience varied economic shifts, the Hong Kong stock market has seen significant fluctuations, with the Hang Seng Index recently facing a notable decline amidst broader concerns about China's economic stimulus measures. In this context of volatility and potential undervaluation, identifying stocks that may be priced below their intrinsic value can offer investors opportunities to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$33.00 | HK$63.72 | 48.2% |

| Giant Biogene Holding (SEHK:2367) | HK$52.30 | HK$97.23 | 46.2% |

| Kuaishou Technology (SEHK:1024) | HK$50.85 | HK$89.29 | 43.1% |

| MicroPort NeuroScientific (SEHK:2172) | HK$10.50 | HK$19.00 | 44.7% |

| Yadea Group Holdings (SEHK:1585) | HK$13.28 | HK$23.40 | 43.2% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$30.00 | HK$56.22 | 46.6% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$11.02 | HK$19.66 | 43.9% |

| CSC Financial (SEHK:6066) | HK$9.75 | HK$17.76 | 45.1% |

| Digital China Holdings (SEHK:861) | HK$2.97 | HK$5.84 | 49.2% |

| DPC Dash (SEHK:1405) | HK$77.40 | HK$134.39 | 42.4% |

We're going to check out a few of the best picks from our screener tool.

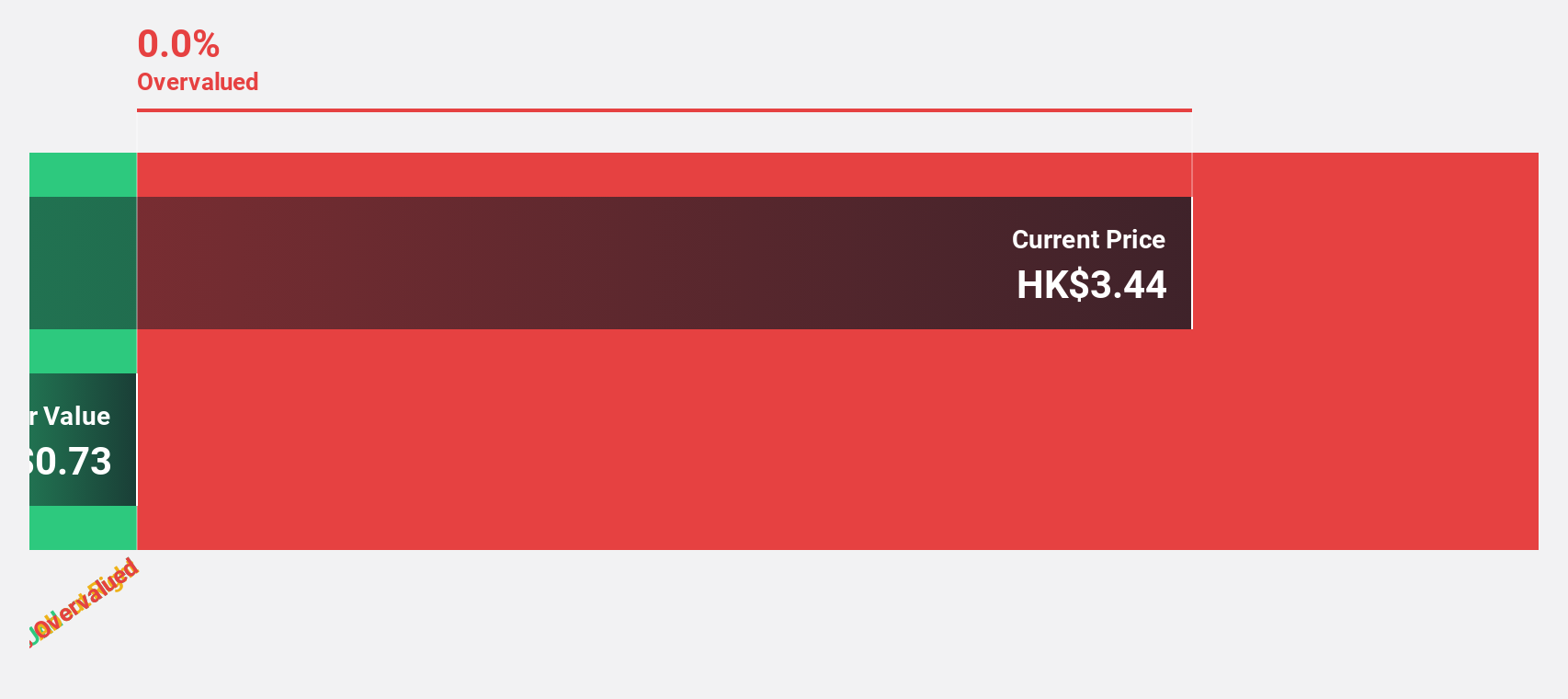

Shenzhou International Group Holdings (SEHK:2313)

Overview: Shenzhou International Group Holdings Limited is an investment holding company involved in the manufacture, printing, and sale of knitwear products across Mainland China, the European Union, the United States, Japan, and other international markets with a market cap of HK$99.14 billion.

Operations: The company's revenue from the manufacture and sale of knitwear products is CN¥26.38 billion.

Estimated Discount To Fair Value: 31.5%

Shenzhou International Group Holdings appears undervalued based on cash flows, trading at HK$65.95, below its estimated fair value of HK$96.32. Recent earnings growth of 24% and forecasted annual profit growth of 12.9% suggest strong financial health, supported by a reported net income increase to CNY 2.93 billion for the first half of 2024. However, dividend sustainability remains uncertain despite a recent HKD 1.25 per share payout announcement for June 2024.

- According our earnings growth report, there's an indication that Shenzhou International Group Holdings might be ready to expand.

- Take a closer look at Shenzhou International Group Holdings' balance sheet health here in our report.

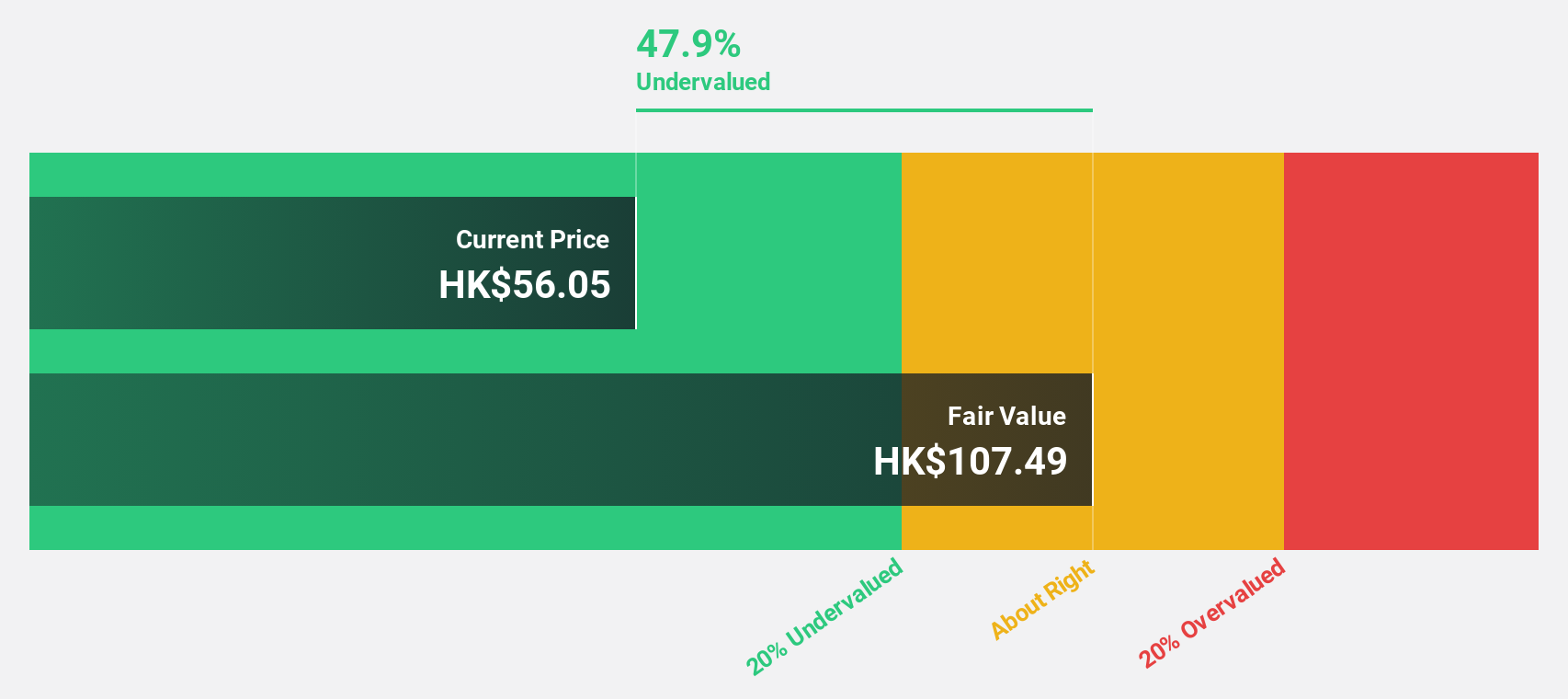

Vobile Group (SEHK:3738)

Overview: Vobile Group Limited is an investment holding company offering software as a service for digital content asset protection and transaction across the United States, Japan, Mainland China, and internationally, with a market cap of HK$5.20 billion.

Operations: The company's revenue is primarily generated from its software as a service offerings, amounting to HK$2.18 billion.

Estimated Discount To Fair Value: 14.9%

Vobile Group trades at HK$2.29, below its estimated fair value of HK$2.69, reflecting potential undervaluation based on cash flows. Despite recent shareholder dilution and volatile share prices, the company reported increased sales of HK$1.18 billion for H1 2024 and net income growth to HK$41.47 million. The ongoing share buyback program could enhance earnings per share, while projected annual earnings growth of 68.5% outpaces the Hong Kong market's average growth rate.

- The analysis detailed in our Vobile Group growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Vobile Group.

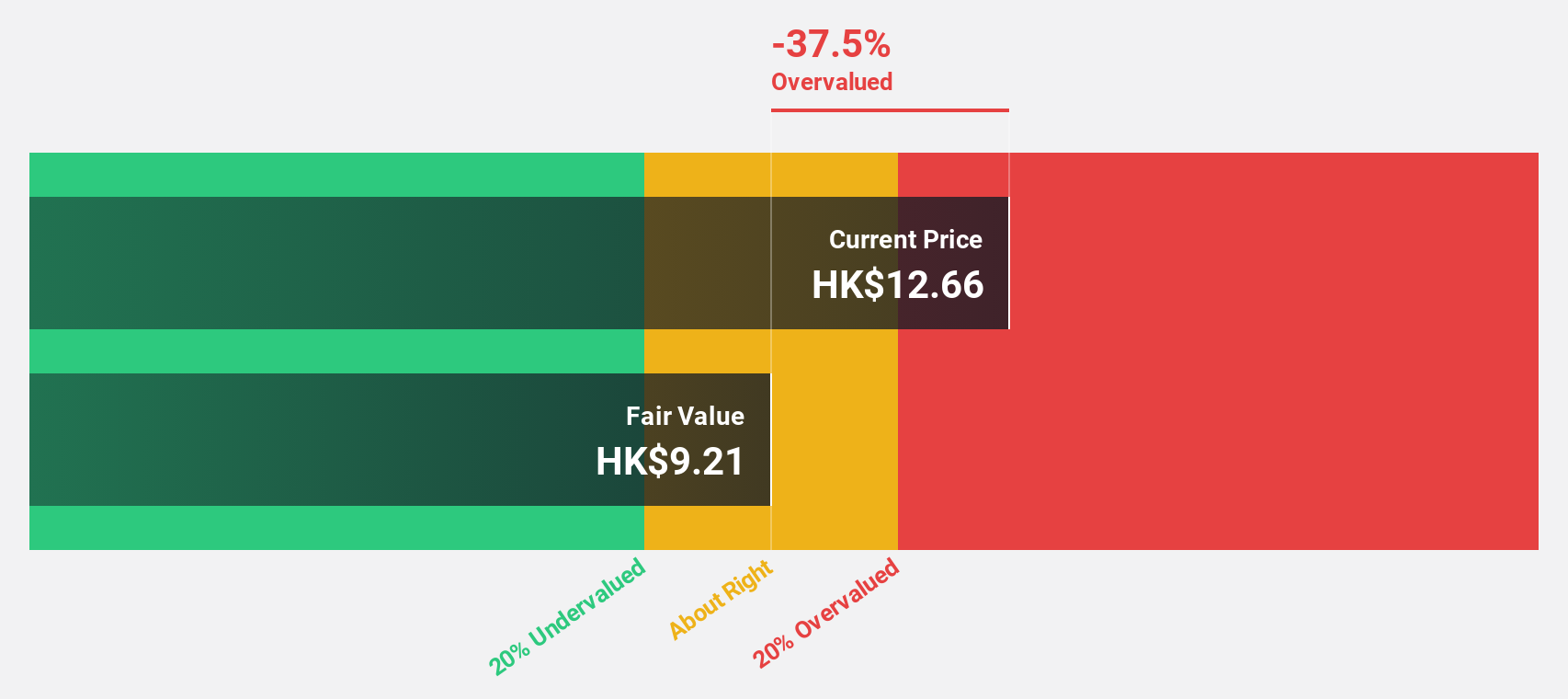

Yeahka (SEHK:9923)

Overview: Yeahka Limited is an investment holding company that offers payment and business services to merchants and consumers in the People’s Republic of China, with a market cap of HK$5.13 billion.

Operations: The company generates revenue from its business services segment, amounting to CN¥3.47 billion.

Estimated Discount To Fair Value: 12.5%

Yeahka Limited is trading at HK$11.98, slightly below its estimated fair value of HK$13.68, suggesting potential undervaluation based on cash flows. Despite a decline in profit margins from 2.9% to 0.3% year-on-year, earnings are forecasted to grow significantly at 39.23% annually over the next three years, surpassing the Hong Kong market average growth rate of 12.1%. Recent executive changes and stable earnings per share indicate operational resilience amidst evolving business dynamics.

- The growth report we've compiled suggests that Yeahka's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Yeahka stock in this financial health report.

Summing It All Up

- Unlock more gems! Our Undervalued SEHK Stocks Based On Cash Flows screener has unearthed 33 more companies for you to explore.Click here to unveil our expertly curated list of 36 Undervalued SEHK Stocks Based On Cash Flows.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3738

Vobile Group

An investment holding company, provides software as a service for digital content asset protection and transaction in the United States, Mainland China, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives