- Hong Kong

- /

- Capital Markets

- /

- SEHK:8313

Increases to ZACD Group Ltd.'s (HKG:8313) CEO Compensation Might Cool off for now

Key Insights

- ZACD Group will host its Annual General Meeting on 24th of April

- Salary of S$598.0k is part of CEO Stanley Yeo's total remuneration

- The total compensation is 50% higher than the average for the industry

- ZACD Group's EPS grew by 87% over the past three years while total shareholder loss over the past three years was 50%

Shareholders of ZACD Group Ltd. (HKG:8313) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 24th of April. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

View our latest analysis for ZACD Group

Comparing ZACD Group Ltd.'s CEO Compensation With The Industry

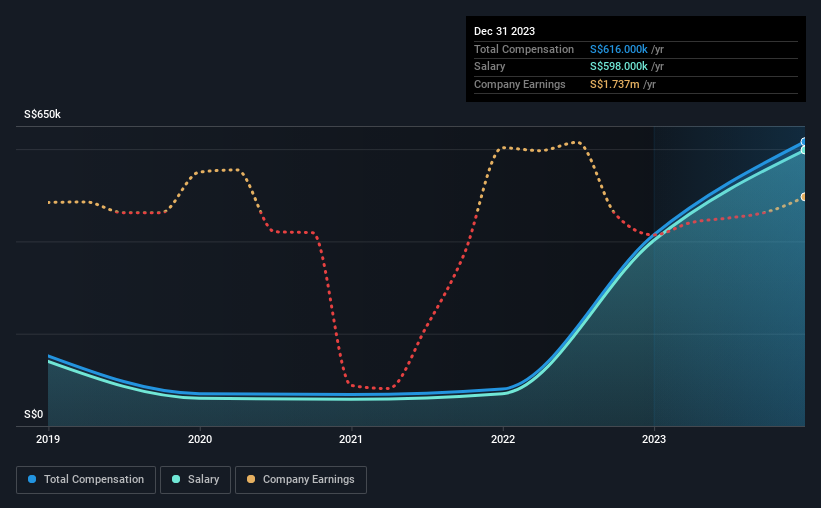

Our data indicates that ZACD Group Ltd. has a market capitalization of HK$60m, and total annual CEO compensation was reported as S$616k for the year to December 2023. That's a notable increase of 49% on last year. In particular, the salary of S$598.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Hong Kong Capital Markets industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was S$410k. This suggests that Stanley Yeo is paid more than the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | S$598k | S$402k | 97% |

| Other | S$18k | S$12k | 3% |

| Total Compensation | S$616k | S$414k | 100% |

Talking in terms of the industry, salary represented approximately 81% of total compensation out of all the companies we analyzed, while other remuneration made up 19% of the pie. ZACD Group has gone down a largely traditional route, paying Stanley Yeo a high salary, giving it preference over non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

ZACD Group Ltd.'s Growth

ZACD Group Ltd. has seen its earnings per share (EPS) increase by 87% a year over the past three years. It achieved revenue growth of 117% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has ZACD Group Ltd. Been A Good Investment?

The return of -50% over three years would not have pleased ZACD Group Ltd. shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Stanley receives almost all of their compensation through a salary. The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for ZACD Group that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if ZACD Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8313

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success