- Hong Kong

- /

- Capital Markets

- /

- SEHK:8295

Kingwisoft Technology Group Company Limited (HKG:8295) Might Not Be As Mispriced As It Looks After Plunging 29%

The Kingwisoft Technology Group Company Limited (HKG:8295) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. For any long-term shareholders, the last month ends a year to forget by locking in a 62% share price decline.

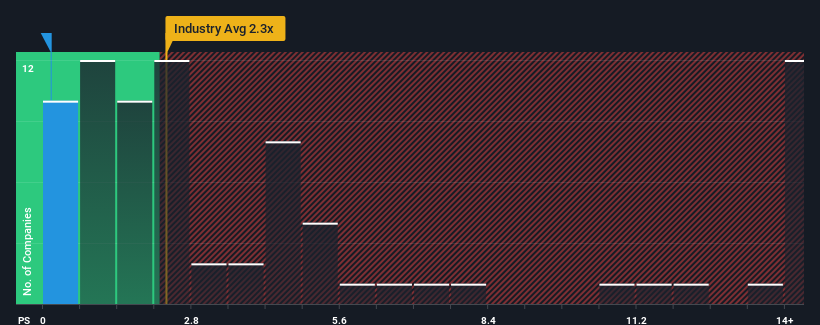

Since its price has dipped substantially, Kingwisoft Technology Group may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Capital Markets industry in Hong Kong have P/S ratios greater than 2.3x and even P/S higher than 13x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Kingwisoft Technology Group

How Has Kingwisoft Technology Group Performed Recently?

Recent times have been quite advantageous for Kingwisoft Technology Group as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Kingwisoft Technology Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kingwisoft Technology Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

Kingwisoft Technology Group's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an exceptional 45% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 39% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Kingwisoft Technology Group's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Kingwisoft Technology Group's P/S?

Shares in Kingwisoft Technology Group have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Kingwisoft Technology Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Kingwisoft Technology Group (1 can't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on Kingwisoft Technology Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kingwisoft Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8295

Kingwisoft Technology Group

An investment holding company, provides back-office, marketing, agency, and data center services in China.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026