- Hong Kong

- /

- Diversified Financial

- /

- SEHK:8223

We Think Some Shareholders May Hesitate To Increase Ziyuanyuan Holdings Group Limited's (HKG:8223) CEO Compensation

Key Insights

- Ziyuanyuan Holdings Group will host its Annual General Meeting on 31st of May

- CEO Junshen Zhang's total compensation includes salary of CN¥497.0k

- The overall pay is 43% above the industry average

- Ziyuanyuan Holdings Group's EPS grew by 1.4% over the past three years while total shareholder return over the past three years was 9.5%

Performance at Ziyuanyuan Holdings Group Limited (HKG:8223) has been reasonably good and CEO Junshen Zhang has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 31st of May. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for Ziyuanyuan Holdings Group

Comparing Ziyuanyuan Holdings Group Limited's CEO Compensation With The Industry

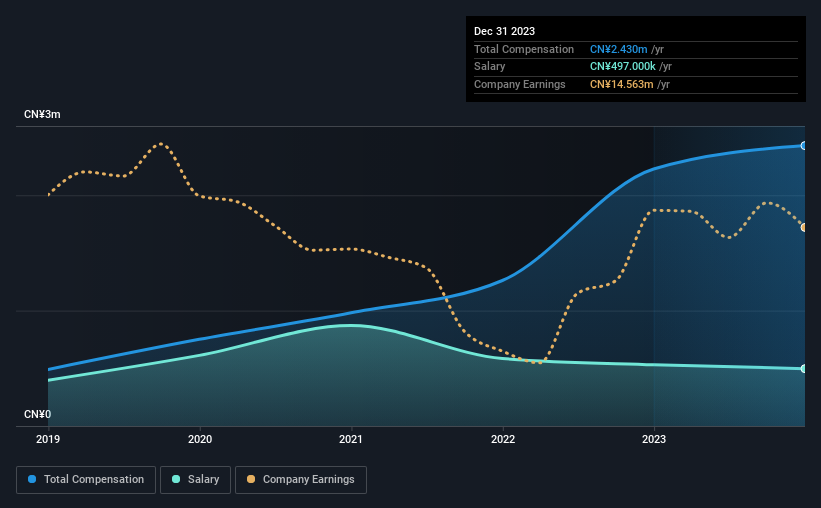

At the time of writing, our data shows that Ziyuanyuan Holdings Group Limited has a market capitalization of HK$555m, and reported total annual CEO compensation of CN¥2.4m for the year to December 2023. We note that's an increase of 9.1% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CN¥497k.

In comparison with other companies in the Hong Kong Diversified Financial industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥1.7m. Accordingly, our analysis reveals that Ziyuanyuan Holdings Group Limited pays Junshen Zhang north of the industry median. Furthermore, Junshen Zhang directly owns HK$284m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥497k | CN¥530k | 20% |

| Other | CN¥1.9m | CN¥1.7m | 80% |

| Total Compensation | CN¥2.4m | CN¥2.2m | 100% |

On an industry level, roughly 66% of total compensation represents salary and 34% is other remuneration. It's interesting to note that Ziyuanyuan Holdings Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Ziyuanyuan Holdings Group Limited's Growth

Over the past three years, Ziyuanyuan Holdings Group Limited has seen its earnings per share (EPS) grow by 1.4% per year. Its revenue is up 57% over the last year.

It's hard to interpret the strong revenue growth as anything other than a positive. Combined with modest EPS growth, we get a good impression of the company. So while we'd stop short of saying growth is absolutely outstanding, there are definitely some clear positives! We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Ziyuanyuan Holdings Group Limited Been A Good Investment?

With a total shareholder return of 9.5% over three years, Ziyuanyuan Holdings Group Limited has done okay by shareholders, but there's always room for improvement. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 5 warning signs for Ziyuanyuan Holdings Group you should be aware of, and 1 of them is significant.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Ziyuanyuan Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8223

Ziyuanyuan Holdings Group

An investment holding company, provides medical equipment finance leasing services in the People's Republic of China.

Slight with acceptable track record.