- Hong Kong

- /

- Diversified Financial

- /

- SEHK:818

Hi Sun Technology (China) Leads These 3 Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have experienced a volatile week, with U.S. stocks mostly lower due to AI competition fears and mixed corporate earnings, while European indices reached record highs following strong earnings and interest rate cuts by the ECB. Amid these fluctuations, investors often seek opportunities in various market segments, including penny stocks—an investment area that remains relevant despite its somewhat outdated terminology. These stocks typically represent smaller or newer companies and can offer significant growth potential when backed by robust financial health.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.23B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.86 | £471.38M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.39 | MYR1.09B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$141.28M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.12 | HK$710.96M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.22 | £154.81M | ★★★★★☆ |

Click here to see the full list of 5,714 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Hi Sun Technology (China) (SEHK:818)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hi Sun Technology (China) Limited is an investment holding company that offers payment and digital solutions, platform operations, and financial services in Hong Kong and internationally, with a market cap of HK$868.83 million.

Operations: The company's revenue is primarily derived from Payment and Digital Services (HK$1.86 billion), Financial Solutions (HK$330.39 million), Fintech Services (HK$131.51 million), and Platform Operation Solutions (HK$164 million).

Market Cap: HK$868.83M

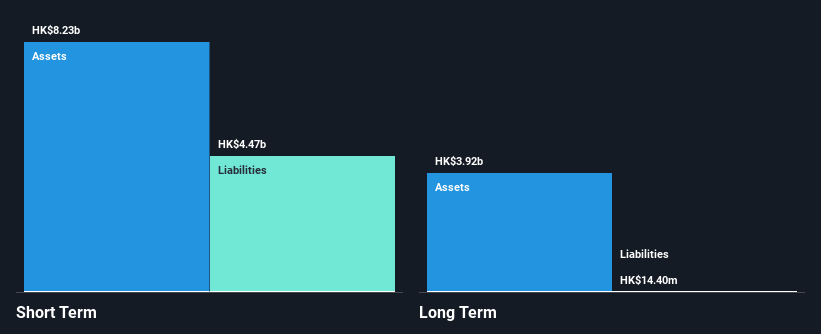

Hi Sun Technology (China) Limited faces challenges with a significant 86% decrease in operating profit for the eleven months ending November 2024, primarily due to reduced interest income and lower digital payment handling fees. Despite this, the company maintains strong liquidity with HK$8.2 billion in short-term assets surpassing its liabilities and has more cash than total debt, indicating financial resilience. The board's extensive experience supports strategic decisions during this transition phase. However, declining earnings over five years and a low return on equity of 2.4% highlight ongoing profitability concerns amidst its digital transformation efforts.

- Click here to discover the nuances of Hi Sun Technology (China) with our detailed analytical financial health report.

- Evaluate Hi Sun Technology (China)'s historical performance by accessing our past performance report.

Beisen Holding (SEHK:9669)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beisen Holding Limited is an investment holding company that offers cloud-based human capital management solutions for enterprises in China, with a market cap of HK$3.32 billion.

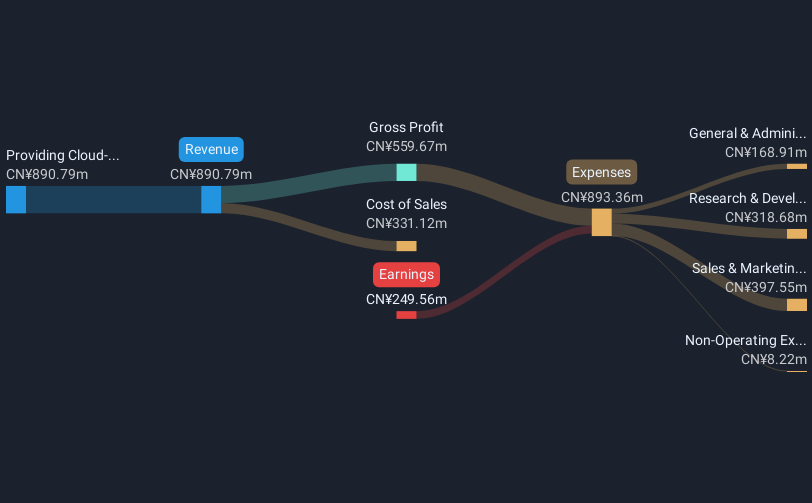

Operations: The company's revenue is derived from providing cloud-based HCM solutions and related professional services, totaling CN¥890.79 million.

Market Cap: HK$3.32B

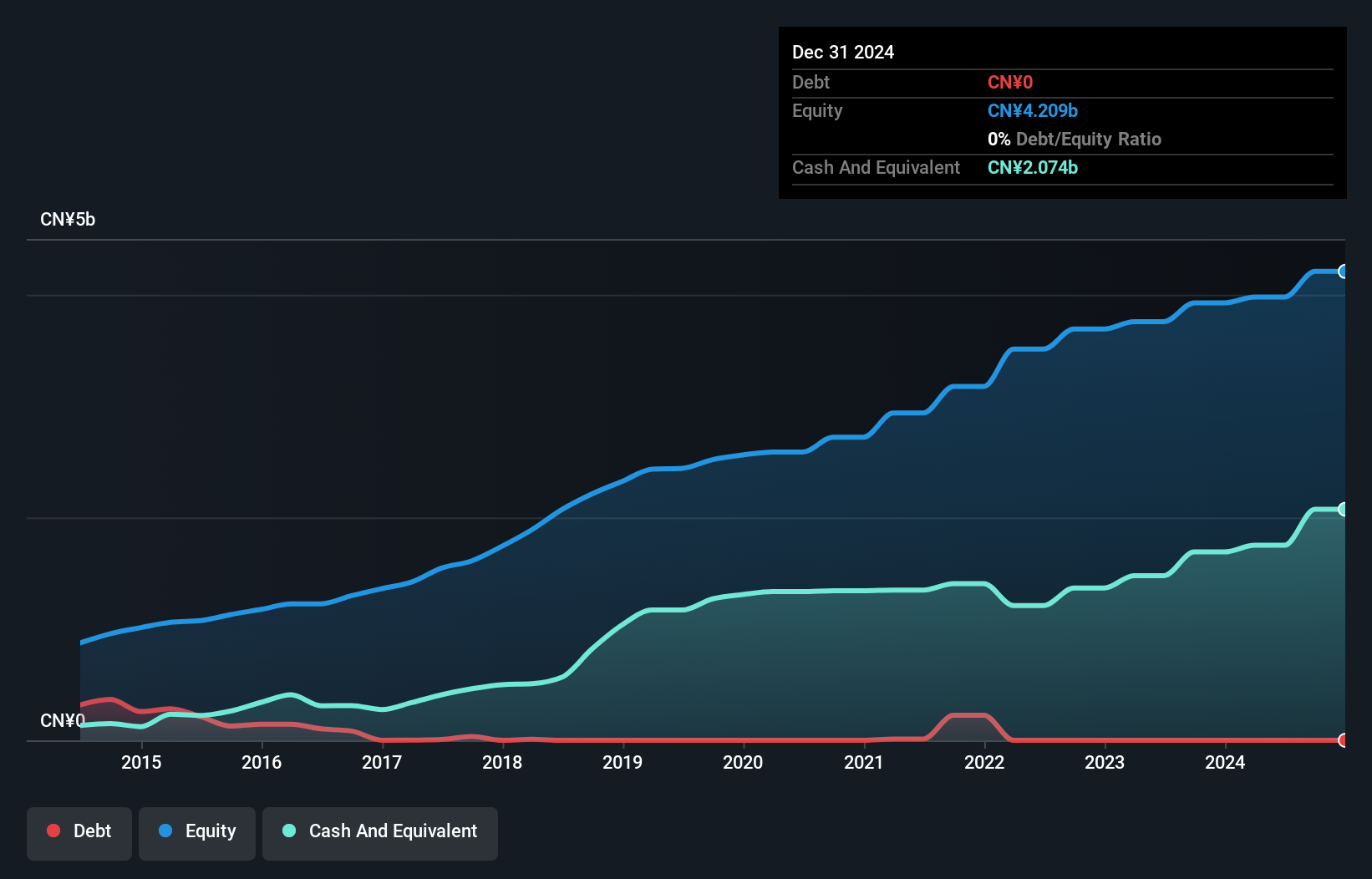

Beisen Holding Limited, with a market cap of HK$3.32 billion, has shown improved financial stability by reducing its net loss significantly from CN¥3.06 billion to CN¥99.04 million year-over-year for the half-year ending September 2024. The company completed a share buyback of HK$90.05 million, reflecting confidence in its valuation despite ongoing unprofitability and expected earnings decline by 19.2% annually over the next three years. While revenue is projected to grow at 15% per annum, challenges remain due to significant insider selling and an inexperienced board with an average tenure of 2.5 years amidst strategic transitions in China's cloud-based HCM market.

- Unlock comprehensive insights into our analysis of Beisen Holding stock in this financial health report.

- Learn about Beisen Holding's future growth trajectory here.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market capitalization of SGD424.26 million.

Operations: The company's revenue is primarily derived from its Rubber Chemicals segment, which generated CN¥4.39 billion, along with contributions from Heating Power at CN¥203 million and Waste Treatment at CN¥25.06 million.

Market Cap: SGD424.26M

China Sunsine Chemical Holdings Ltd., with a market cap of SGD424.26 million, is navigating strategic expansions and management changes amidst fluctuating profit margins. The company maintains strong financial health, with CN¥3.3 billion in short-term assets exceeding CN¥415.7 million in liabilities and no long-term debt concerns. Recent executive appointments aim to enhance operational efficiency and product management as the company completes its 20,000-tonne MBT project trial run and progresses on a 30,000-tonne IS project by year-end 2024. Despite stable earnings quality, challenges include lower net profit margins compared to last year and an inexperienced board of directors.

- Dive into the specifics of China Sunsine Chemical Holdings here with our thorough balance sheet health report.

- Examine China Sunsine Chemical Holdings' earnings growth report to understand how analysts expect it to perform.

Where To Now?

- Investigate our full lineup of 5,714 Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hi Sun Technology (China) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:818

Hi Sun Technology (China)

An investment holding company, provides payment and digital, platform operation, and financial solutions in Hong Kong and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives