- Hong Kong

- /

- Capital Markets

- /

- SEHK:8017

Here's Why We Think TradeGo FinTech (HKG:8017) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like TradeGo FinTech (HKG:8017). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for TradeGo FinTech

TradeGo FinTech's Improving Profits

Over the last three years, TradeGo FinTech has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. TradeGo FinTech boosted its trailing twelve month EPS from HK$0.031 to HK$0.038, in the last year. That's a 22% gain; respectable growth in the broader scheme of things.

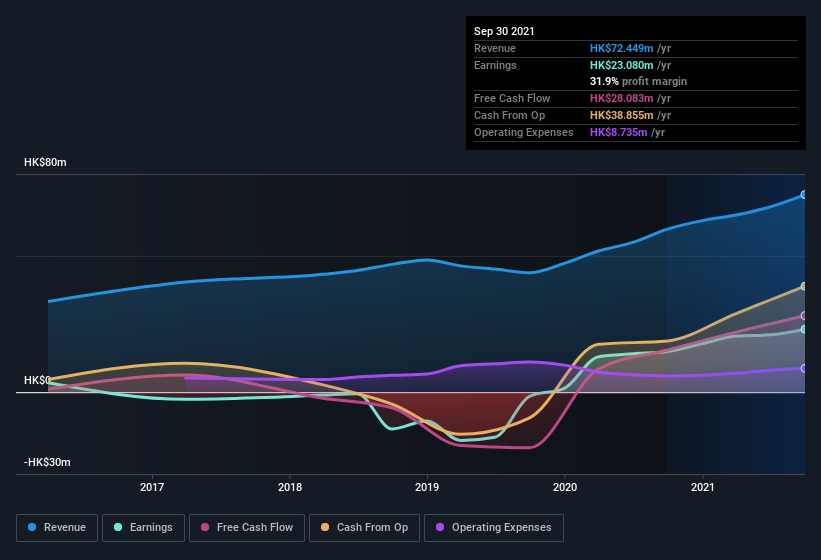

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. TradeGo FinTech shareholders can take confidence from the fact that EBIT margins are up from 23% to 33%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since TradeGo FinTech is no giant, with a market capitalization of HK$546m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are TradeGo FinTech Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own TradeGo FinTech shares worth a considerable sum. Indeed, they hold HK$140m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 26% of the company, demonstrating a degree of high-level alignment with shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations under HK$1.6b, like TradeGo FinTech, the median CEO pay is around HK$1.8m.

The TradeGo FinTech CEO received HK$927k in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add TradeGo FinTech To Your Watchlist?

One important encouraging feature of TradeGo FinTech is that it is growing profits. The fact that EPS is growing is a genuine positive for TradeGo FinTech, but the pretty picture gets better than that. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. However, before you get too excited we've discovered 2 warning signs for TradeGo FinTech that you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TradeGo FinTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8017

TradeGo FinTech

An investment holding company, provides integrated securities trading platform services to brokerage firms and their clients in Hong Kong and the People’s Republic of China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.