- Hong Kong

- /

- Capital Markets

- /

- SEHK:717

Emperor Capital Group's(HKG:717) Share Price Is Down 81% Over The Past Five Years.

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held Emperor Capital Group Limited (HKG:717) for five whole years - as the share price tanked 81%. And it's not just long term holders hurting, because the stock is down 29% in the last year. Unhappily, the share price slid 2.3% in the last week.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Emperor Capital Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

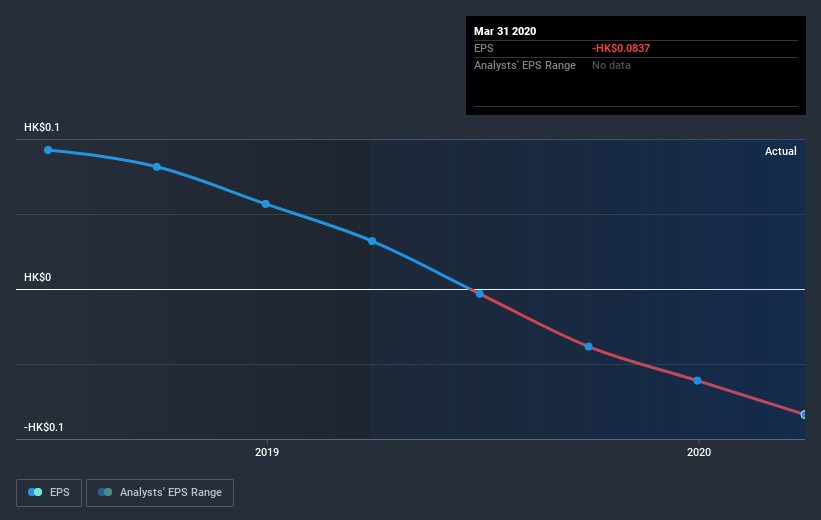

Over five years Emperor Capital Group's earnings per share dropped significantly, falling to a loss, with the share price also lower. At present it's hard to make valid comparisons between EPS and the share price. However, we can say we'd expect to see a falling share price in this scenario.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Emperor Capital Group's key metrics by checking this interactive graph of Emperor Capital Group's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Emperor Capital Group's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Emperor Capital Group's TSR, which was a 77% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Investors in Emperor Capital Group had a tough year, with a total loss of 29%, against a market gain of about 8.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Emperor Capital Group better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Emperor Capital Group you should be aware of, and 1 of them doesn't sit too well with us.

Of course Emperor Capital Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Emperor Capital Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Emperor Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:717

Emperor Capital Group

An investment holding company, provides various financial services in Hong Kong, the United States, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives