- Hong Kong

- /

- Consumer Finance

- /

- SEHK:6878

With EPS Growth And More, Differ Group Auto (HKG:6878) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Differ Group Auto (HKG:6878), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Differ Group Auto

How Fast Is Differ Group Auto Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Differ Group Auto grew its EPS by 8.7% per year. That growth rate is fairly good, assuming the company can keep it up.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Differ Group Auto's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While Differ Group Auto may have maintained EBIT margins over the last year, revenue has fallen. While this may raise concerns, investors should investigate the reasoning behind this.

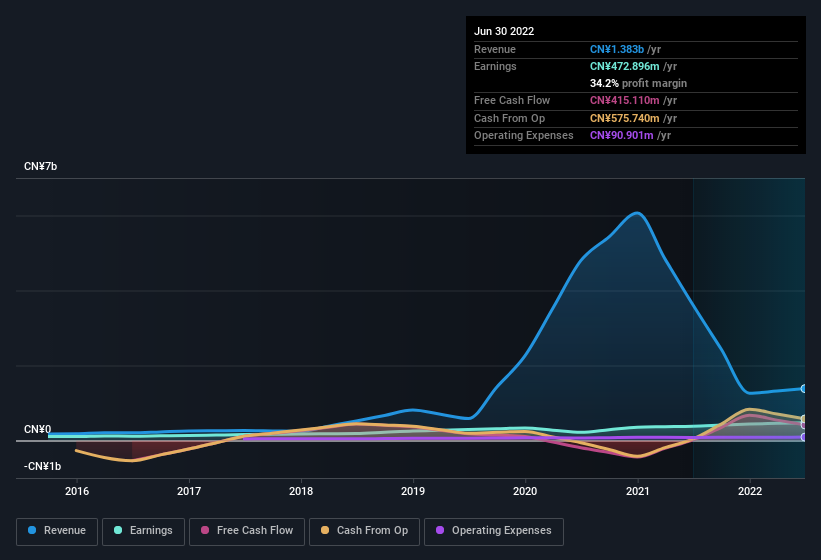

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Differ Group Auto's forecast profits?

Are Differ Group Auto Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While there was some insider selling, that pales in comparison to the CN¥8.6m that the CEO & Executive Chairman, Chi Chung Ng spent acquiring shares. The average price of which was CN¥1.96 per share. Insider buying like this is a rare occurrence and should stoke the interest of the market and shareholders alike.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Differ Group Auto insiders own more than a third of the company. To be exact, company insiders hold 58% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. This insider holding amounts to This is an incredible endorsement from them.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Chi Chung Ng is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Differ Group Auto, with market caps between CN¥7.1b and CN¥23b, is around CN¥2.6m.

Differ Group Auto's CEO took home a total compensation package of CN¥525k in the year prior to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Differ Group Auto Worth Keeping An Eye On?

One important encouraging feature of Differ Group Auto is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Differ Group Auto , and understanding them should be part of your investment process.

The good news is that Differ Group Auto is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6878

Differ Group Auto

An investment holding company, provides various financial services in the People’s Republic of China.

Slight and slightly overvalued.

Market Insights

Community Narratives