Spotlight On 3 High-Ownership Growth Stocks Backed By Insiders

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration, investors are closely monitoring policy implications that could impact various sectors, from financials to energy. Amidst this backdrop of fluctuating indices and economic shifts, identifying growth companies with high insider ownership can offer insights into stocks where those closest to the business have significant confidence in its future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.5% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's dive into some prime choices out of the screener.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers a range of cloud services, including public and private cloud solutions, shared hosting, and dedicated servers globally, with a market capitalization of approximately €1.60 billion.

Operations: The company's revenue is primarily derived from its Private Cloud segment at €623.53 million, followed by Public Cloud at €182.82 million, and Web Cloud & Other services contributing €186.71 million.

Insider Ownership: 10.3%

OVH Groupe is experiencing a strategic boost with its integration into Digital Realty's ServiceFabric platform, enhancing its cloud offerings. Despite reporting a net loss of €10.3 million for the year ending August 2024, OVH's earnings are improving compared to last year's €40.32 million loss. Forecasts indicate profitability within three years and revenue growth outpacing the French market at 10.1% annually, though still below high-growth benchmarks. The stock trades significantly below estimated fair value, highlighting potential investment interest despite low forecasted Return on Equity.

- Click to explore a detailed breakdown of our findings in OVH Groupe's earnings growth report.

- In light of our recent valuation report, it seems possible that OVH Groupe is trading behind its estimated value.

Laopu Gold (SEHK:6181)

Simply Wall St Growth Rating: ★★★★★★

Overview: Laopu Gold Co., Ltd. designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau with a market cap of HK$31.47 billion.

Operations: The company's revenue primarily comes from its Jewelry & Watches segment, which generated CN¥5.28 billion.

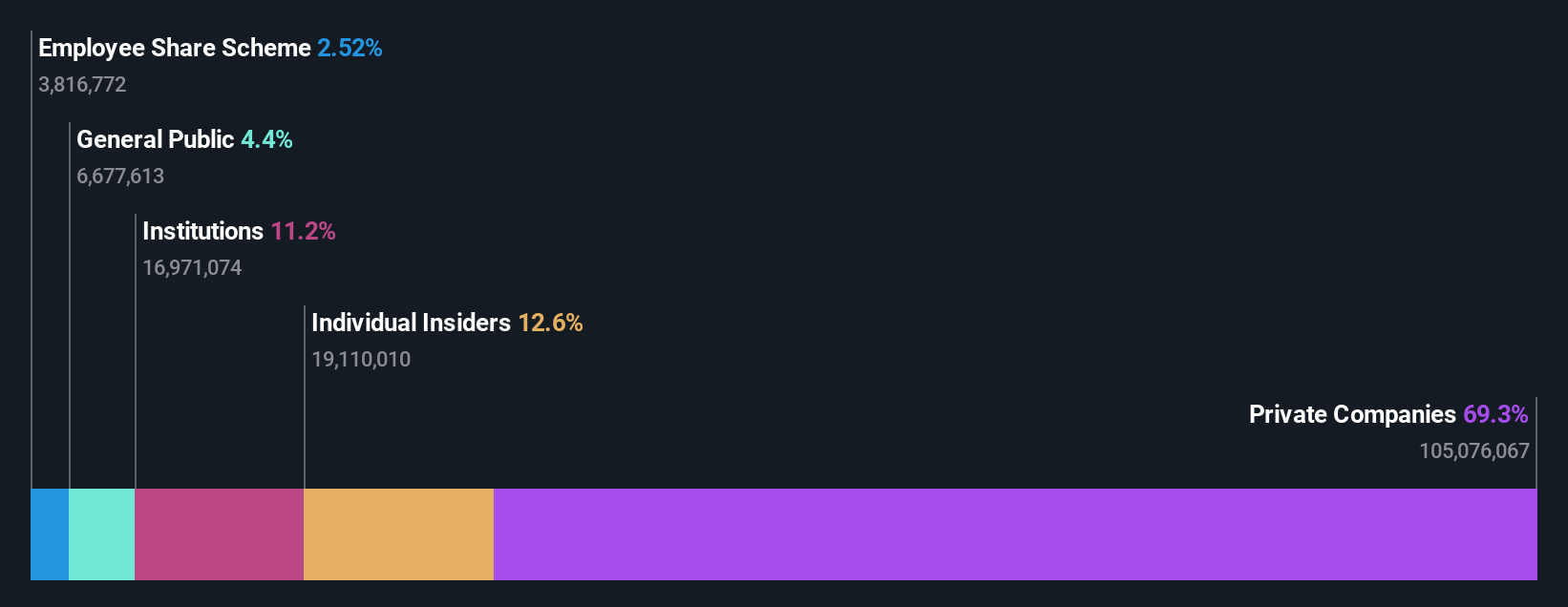

Insider Ownership: 36.4%

Laopu Gold's revenue is projected to grow at 24.5% annually, outpacing the Hong Kong market. Earnings surged by 217.7% in the past year, with forecasts indicating continued significant growth over the next three years. The company reported a net income of CNY 587.81 million for H1 2024, up from CNY 196.75 million a year ago, reflecting robust operational performance despite no substantial insider trading activity recently and trading below estimated fair value by 36.6%.

- Unlock comprehensive insights into our analysis of Laopu Gold stock in this growth report.

- According our valuation report, there's an indication that Laopu Gold's share price might be on the expensive side.

Bairong (SEHK:6608)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bairong Inc. is a cloud-based AI turnkey services provider in China with a market cap of approximately HK$4.21 billion.

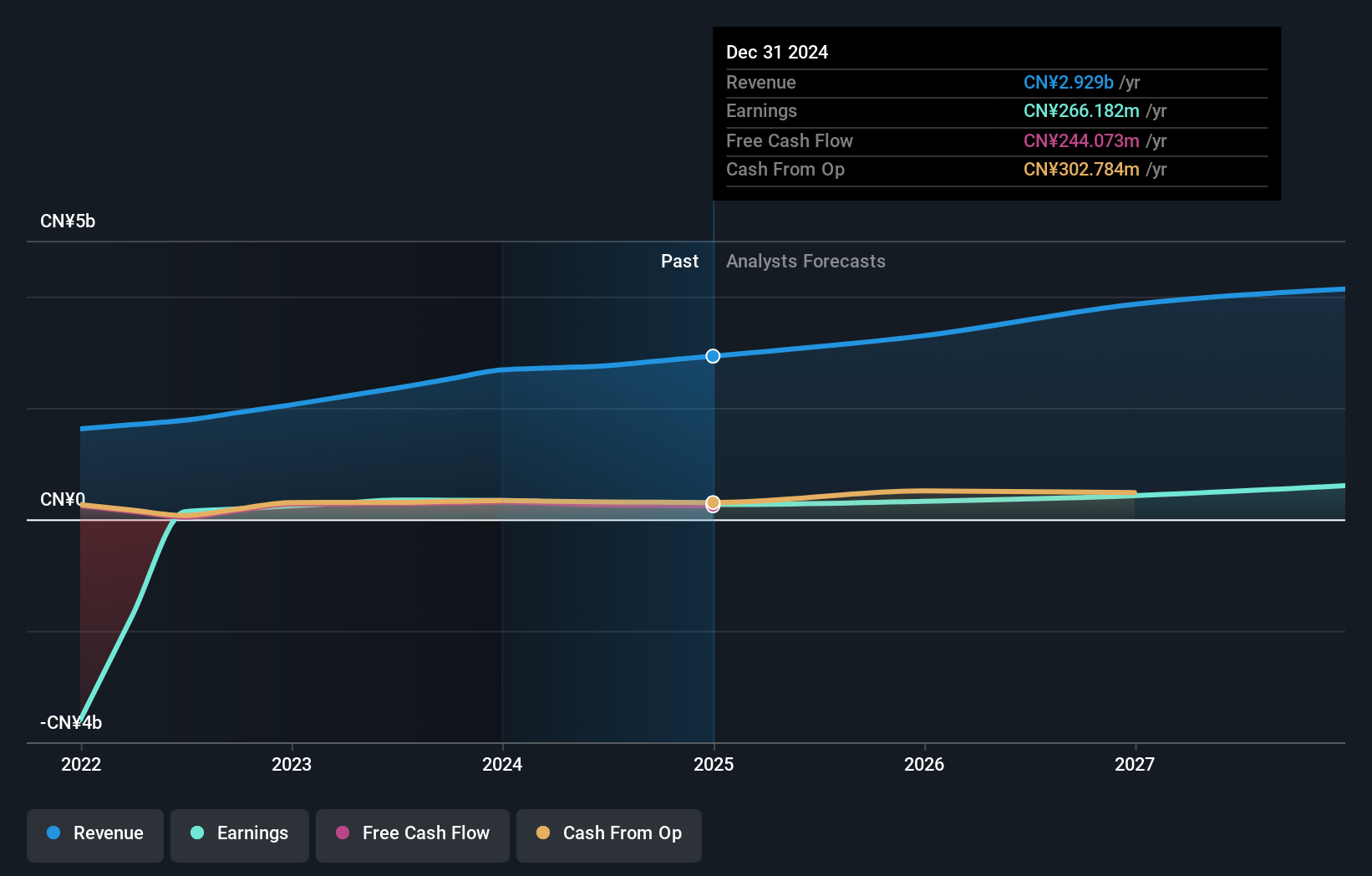

Operations: The company's revenue segment includes Data Processing, generating CN¥2.76 billion.

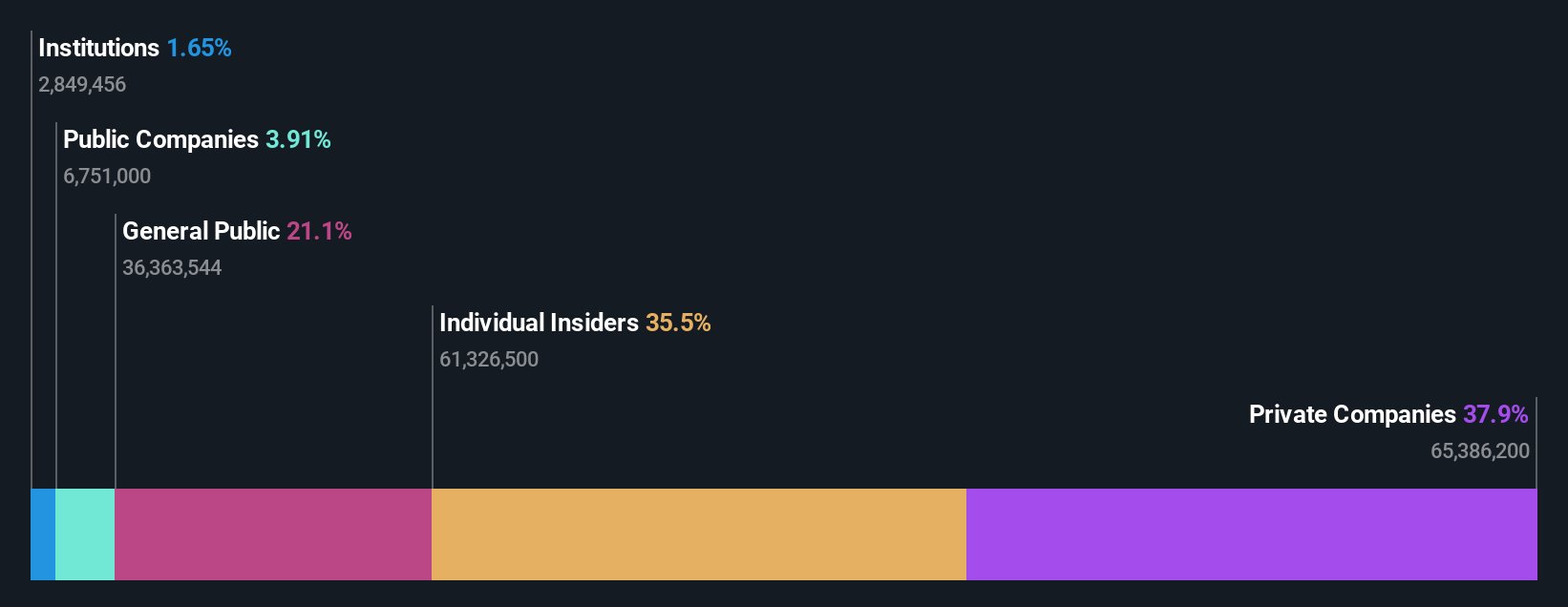

Insider Ownership: 19.5%

Bairong is trading 42.5% below its estimated fair value and analysts expect a 47.7% stock price increase, highlighting potential undervaluation. Despite a forecasted annual earnings growth of 29.6%, profit margins have decreased to 10% from last year's 14.7%. Revenue is expected to grow at 13.5%, faster than the Hong Kong market but below significant growth levels. Recent earnings show sales increased to CNY 1,321.35 million, though net income declined to CNY 139.96 million year-over-year.

- Click here to discover the nuances of Bairong with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Bairong's current price could be quite moderate.

Next Steps

- Click this link to deep-dive into the 1538 companies within our Fast Growing Companies With High Insider Ownership screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6181

Laopu Gold

Designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives