- Hong Kong

- /

- Diversified Financial

- /

- SEHK:629

With EPS Growth And More, Yue Da International Holdings (HKG:629) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Yue Da International Holdings (HKG:629), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Yue Da International Holdings with the means to add long-term value to shareholders.

See our latest analysis for Yue Da International Holdings

How Fast Is Yue Da International Holdings Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Yue Da International Holdings grew its EPS from CN¥0.0086 to CN¥0.031, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

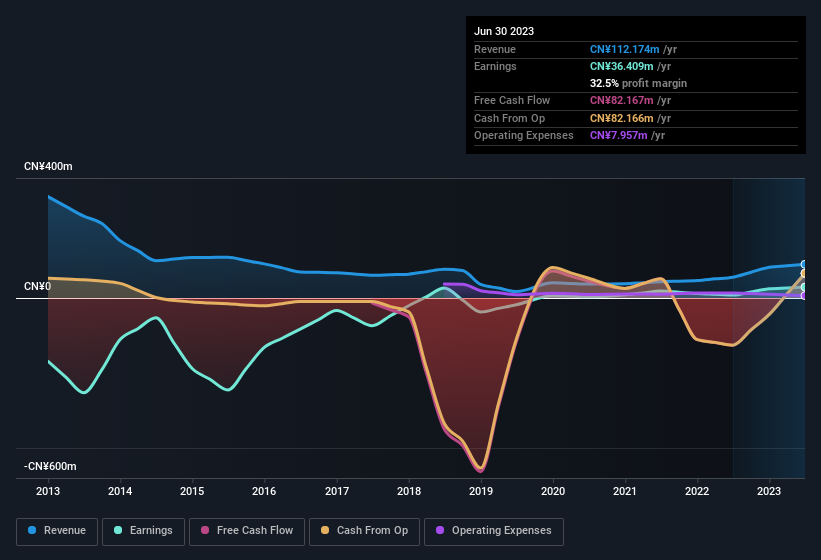

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Yue Da International Holdings' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The music to the ears of Yue Da International Holdings shareholders is that EBIT margins have grown from 38% to 55% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Yue Da International Holdings isn't a huge company, given its market capitalisation of HK$134m. That makes it extra important to check on its balance sheet strength.

Are Yue Da International Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Yue Da International Holdings shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Huaimin Hu, the Non-Executive Vice Chairman of the company, paid CN¥110k for shares at around CN¥0.085 each. It seems that at least one insider is prepared to show the market there is potential within Yue Da International Holdings.

Recent insider purchases of Yue Da International Holdings stock is not the only way management has kept the interests of the general public shareholders in mind. Namely, Yue Da International Holdings has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like Yue Da International Holdings with market caps under CN¥1.5b is about CN¥1.7m.

Yue Da International Holdings' CEO only received compensation totalling CN¥77k in the year to December 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Yue Da International Holdings To Your Watchlist?

Yue Da International Holdings' earnings per share growth have been climbing higher at an appreciable rate. Better yet, we can observe insider buying and the chief executive pay looks reasonable. It could be that Yue Da International Holdings is at an inflection point, given the EPS growth. For those attracted to fast growth, we'd suggest this stock merits monitoring. We should say that we've discovered 3 warning signs for Yue Da International Holdings (1 is potentially serious!) that you should be aware of before investing here.

The good news is that Yue Da International Holdings is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Yue Da International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:629

Yue Da International Holdings

An investment holding company, engages in the traditional factoring and communications factoring businesses in the People’s Republic of China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives