- Hong Kong

- /

- Diversified Financial

- /

- SEHK:629

If EPS Growth Is Important To You, Yue Da International Holdings (HKG:629) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Yue Da International Holdings (HKG:629). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Yue Da International Holdings

Yue Da International Holdings' Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Yue Da International Holdings' EPS went from CN¥0.0086 to CN¥0.031 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Yue Da International Holdings' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The good news is that Yue Da International Holdings is growing revenues, and EBIT margins improved by 16.7 percentage points to 55%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

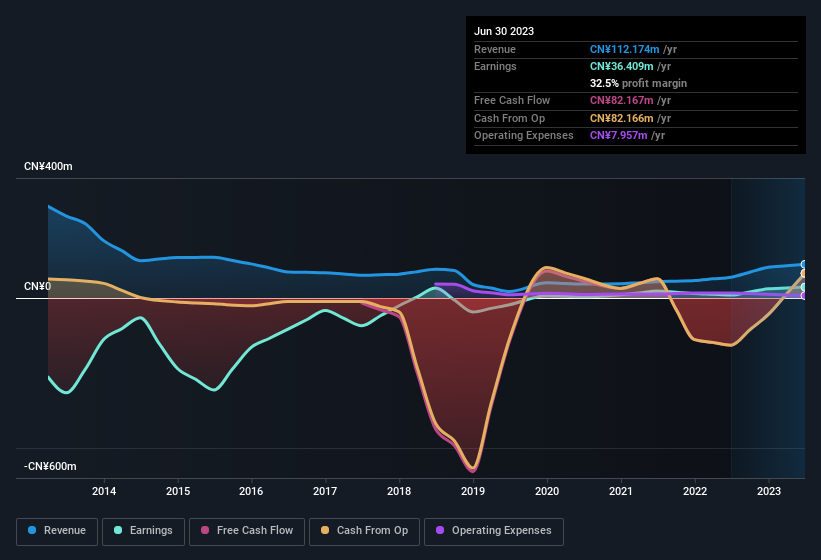

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Yue Da International Holdings is no giant, with a market capitalisation of HK$276m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Yue Da International Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Yue Da International Holdings shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Huaimin Hu, the Non-Executive Vice Chairman of the company, paid CN¥110k for shares at around CN¥0.085 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

It's reassuring that Yue Da International Holdings insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Namely, Yue Da International Holdings has a very reasonable level of CEO pay. The median total compensation for CEOs of companies similar in size to Yue Da International Holdings, with market caps under CN¥1.4b is around CN¥1.7m.

The Yue Da International Holdings CEO received total compensation of only CN¥77k in the year to December 2022. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Yue Da International Holdings Deserve A Spot On Your Watchlist?

Yue Da International Holdings' earnings per share growth have been climbing higher at an appreciable rate. Not to mention the company's insiders have been adding to their portfolios and the CEO's remuneration policy looks to have had shareholders in mind seeing as it's quite modest for the company size. It could be that Yue Da International Holdings is at an inflection point, given the EPS growth. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for Yue Da International Holdings (of which 1 is concerning!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Yue Da International Holdings, you'll probably love this curated collection of companies in HK that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Yue Da International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:629

Yue Da International Holdings

An investment holding company, engages in the traditional factoring and communications factoring businesses in the People’s Republic of China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives