As of July 2025, Asian markets are exhibiting mixed performance amid ongoing global trade negotiations and economic data releases. While Japan faces challenges from stalled U.S.-Japan trade talks, China's stock markets show resilience with modest gains despite mixed economic indicators. In this context, identifying undervalued stocks in Asia requires a keen understanding of intrinsic value and the ability to navigate fluctuating market conditions effectively.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2574.50 | ¥5115.01 | 49.7% |

| Polaris Holdings (TSE:3010) | ¥219.00 | ¥436.36 | 49.8% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥23.12 | CN¥46.19 | 49.9% |

| JRCLtd (TSE:6224) | ¥1160.00 | ¥2306.76 | 49.7% |

| HL Holdings (KOSE:A060980) | ₩41650.00 | ₩82347.91 | 49.4% |

| Hibino (TSE:2469) | ¥2394.00 | ¥4731.64 | 49.4% |

| Dive (TSE:151A) | ¥935.00 | ¥1858.95 | 49.7% |

| cottaLTD (TSE:3359) | ¥431.00 | ¥857.05 | 49.7% |

| Bloks Group (SEHK:325) | HK$146.60 | HK$292.82 | 49.9% |

| APAC Realty (SGX:CLN) | SGD0.475 | SGD0.95 | 49.9% |

Here's a peek at a few of the choices from the screener.

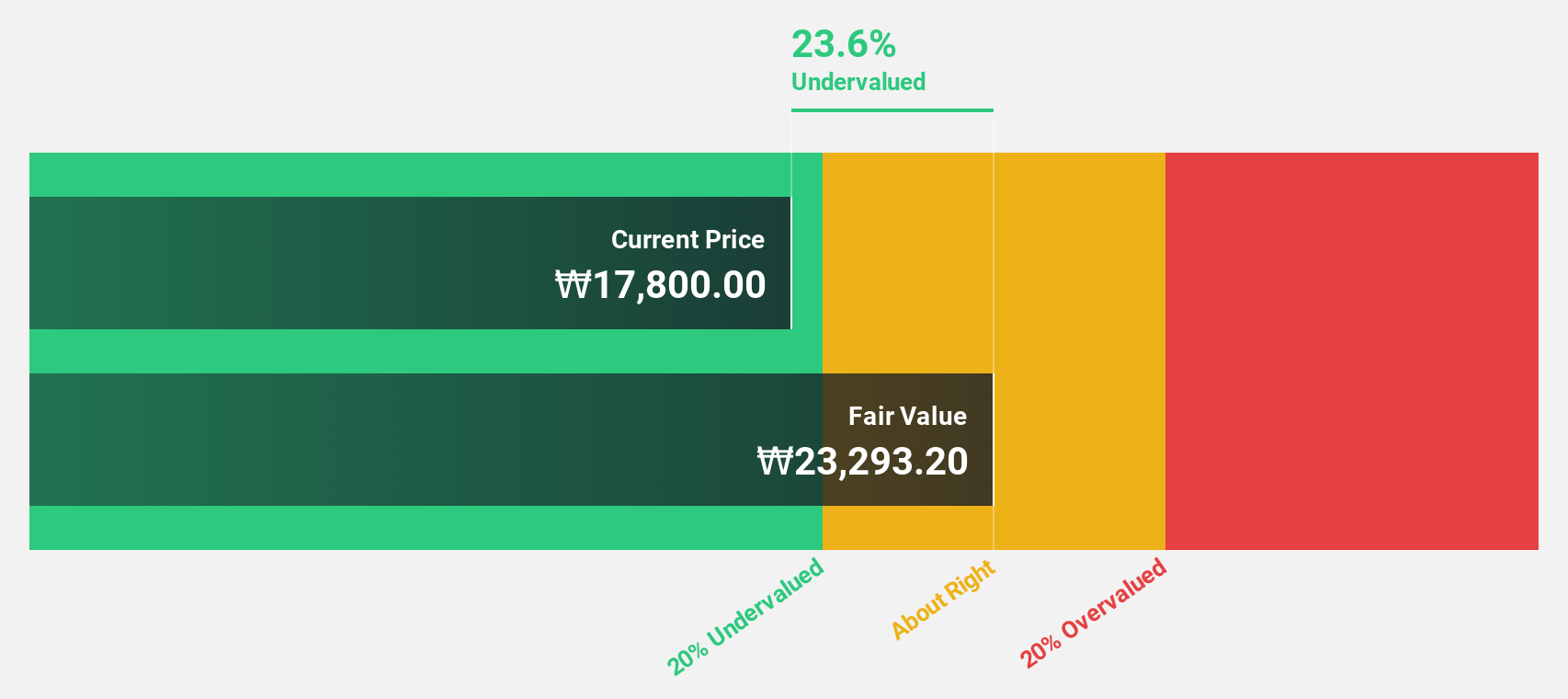

Samsung Heavy Industries (KOSE:A010140)

Overview: Samsung Heavy Industries Co., Ltd. operates in the shipbuilding, offshore, and energy and infrastructure sectors globally, with a market cap of ₩14.79 trillion.

Operations: The company's revenue segments include Shipbuilding & Marine Engineering at ₩9.50 trillion and Construction at ₩752.33 million.

Estimated Discount To Fair Value: 39.3%

Samsung Heavy Industries is trading at 39.3% below its estimated fair value, with a share price of ₩17,320 compared to a fair value estimate of ₩28,528.35. The company became profitable this year and its earnings are forecasted to grow significantly at 51% annually over the next three years, outpacing the Korean market's growth rate. Recent Q1 2025 results showed strong performance with net income soaring to ₩92 billion from ₩9.95 billion last year.

- Our earnings growth report unveils the potential for significant increases in Samsung Heavy Industries' future results.

- Navigate through the intricacies of Samsung Heavy Industries with our comprehensive financial health report here.

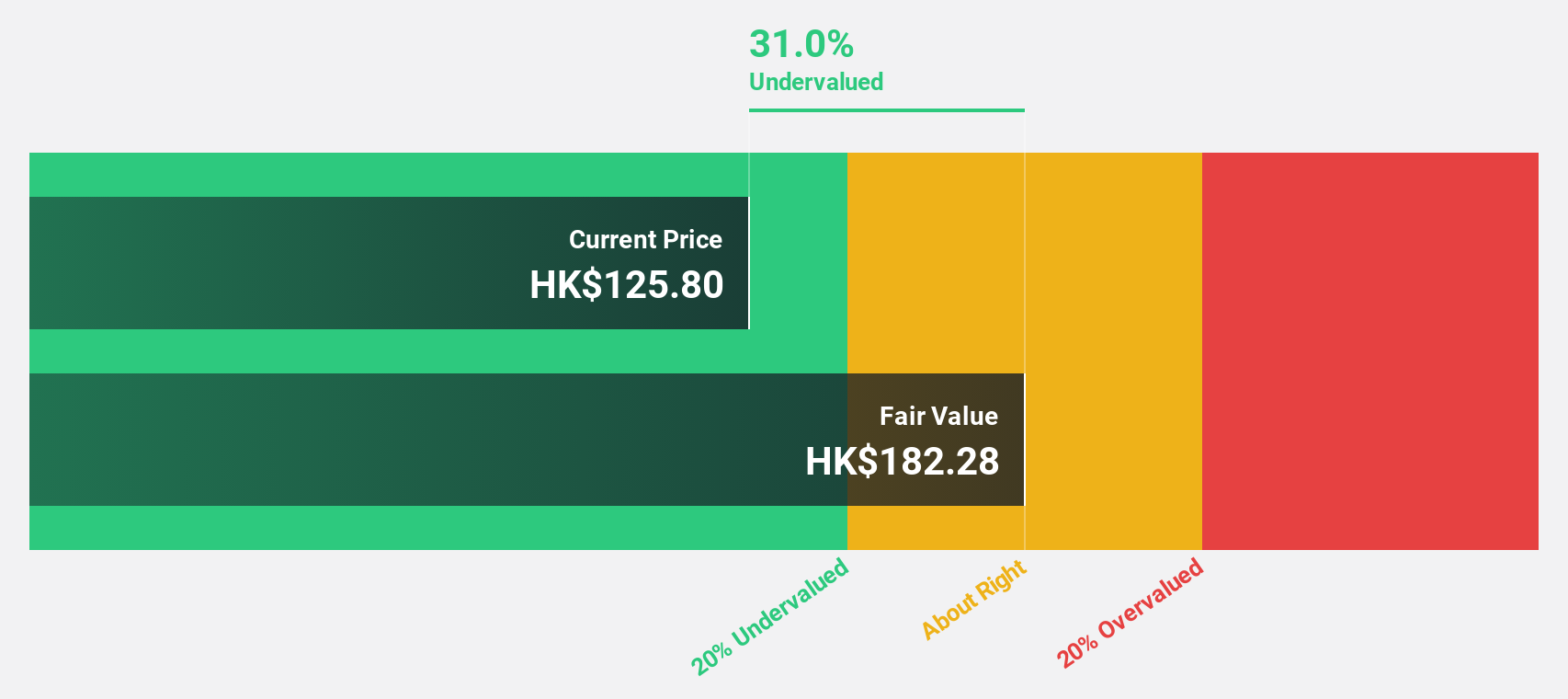

BYD (SEHK:1211)

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally with a market cap of approximately HK$1.10 trillion.

Operations: BYD generates revenue primarily from its operations in the automobile and battery sectors across various regions, including China, Hong Kong, Macau, Taiwan, and international markets.

Estimated Discount To Fair Value: 41.2%

BYD is trading at 41.2% below its estimated fair value of HK$208.83, with current share price at HK$122.7, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow faster than the Hong Kong market at 15.8% annually, supported by a recent strategic shift in Sweden and expansion plans in Europe including a new R&D center in Hungary to enhance its European footprint and production capabilities.

- In light of our recent growth report, it seems possible that BYD's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of BYD.

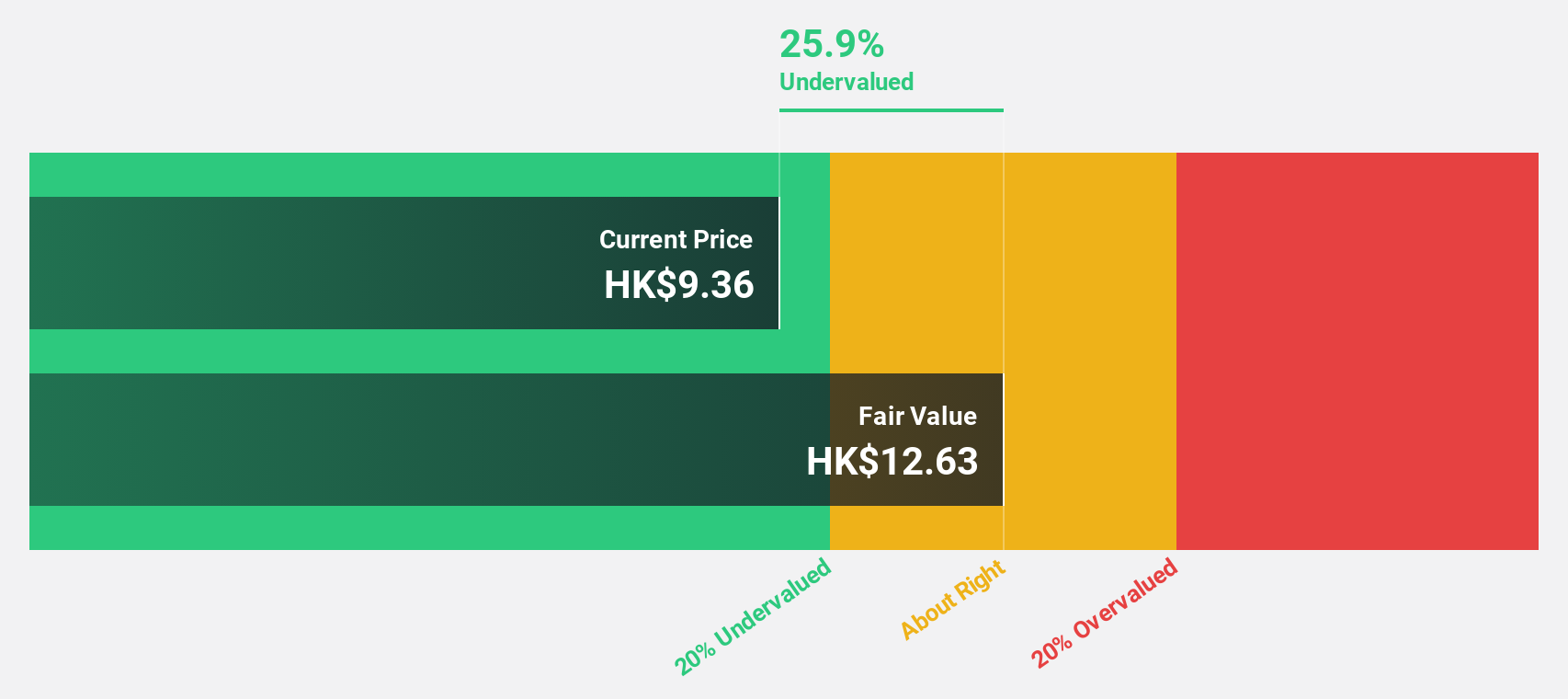

CSC Financial (SEHK:6066)

Overview: CSC Financial Co., Ltd. operates as an investment banking service provider in Mainland China and internationally, with a market cap of HK$185.33 billion.

Operations: The company's revenue segments include investment banking services, wealth management, and trading and institutional client services.

Estimated Discount To Fair Value: 13.7%

CSC Financial is trading at 13.7% below its estimated fair value of HK$12.38, with a current share price of HK$10.68, suggesting potential undervaluation based on cash flows. Despite an unstable dividend track record, earnings are projected to grow significantly at 22.8% annually over the next three years, surpassing market expectations in Hong Kong. Recent first-quarter results showed strong revenue and net income growth, while the company continues to focus on cost reduction and efficiency improvements.

- Our comprehensive growth report raises the possibility that CSC Financial is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of CSC Financial stock in this financial health report.

Summing It All Up

- Unlock our comprehensive list of 271 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives