- Hong Kong

- /

- Capital Markets

- /

- SEHK:6066

3 Stocks That Might Be Trading Below Fair Value By Up To 34.9%

Reviewed by Simply Wall St

Global markets have recently experienced significant movements, with U.S. stocks reaching record highs fueled by China's robust stimulus measures and optimism around artificial intelligence. Despite these gains, some sectors remain underappreciated, presenting potential opportunities for discerning investors. In such a dynamic market environment, identifying undervalued stocks can be crucial for long-term investment success. This article explores three stocks that might currently be trading below their fair value by up to 34.9%, offering a potentially attractive entry point for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Associated Banc-Corp (NYSE:ASB) | US$20.65 | US$41.24 | 49.9% |

| Pilot (TSE:7846) | ¥4452.00 | ¥8866.91 | 49.8% |

| Zhejiang Great Shengda PackagingLtd (SHSE:603687) | CN¥7.11 | CN¥14.16 | 49.8% |

| T'Way Air (KOSE:A091810) | ₩2855.00 | ₩5697.59 | 49.9% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7430.00 | ₩14860.00 | 50% |

| Ta-Yuan Cogeneration (TPEX:8931) | NT$49.20 | NT$98.22 | 49.9% |

| ChromaDex (NasdaqCM:CDXC) | US$3.56 | US$7.10 | 49.9% |

| Videndum (LSE:VID) | £2.50 | £4.98 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €3.19 | €6.36 | 49.9% |

| Distribuidora Internacional de Alimentación (BME:DIA) | €0.0128 | €0.026 | 50% |

Here's a peek at a few of the choices from the screener.

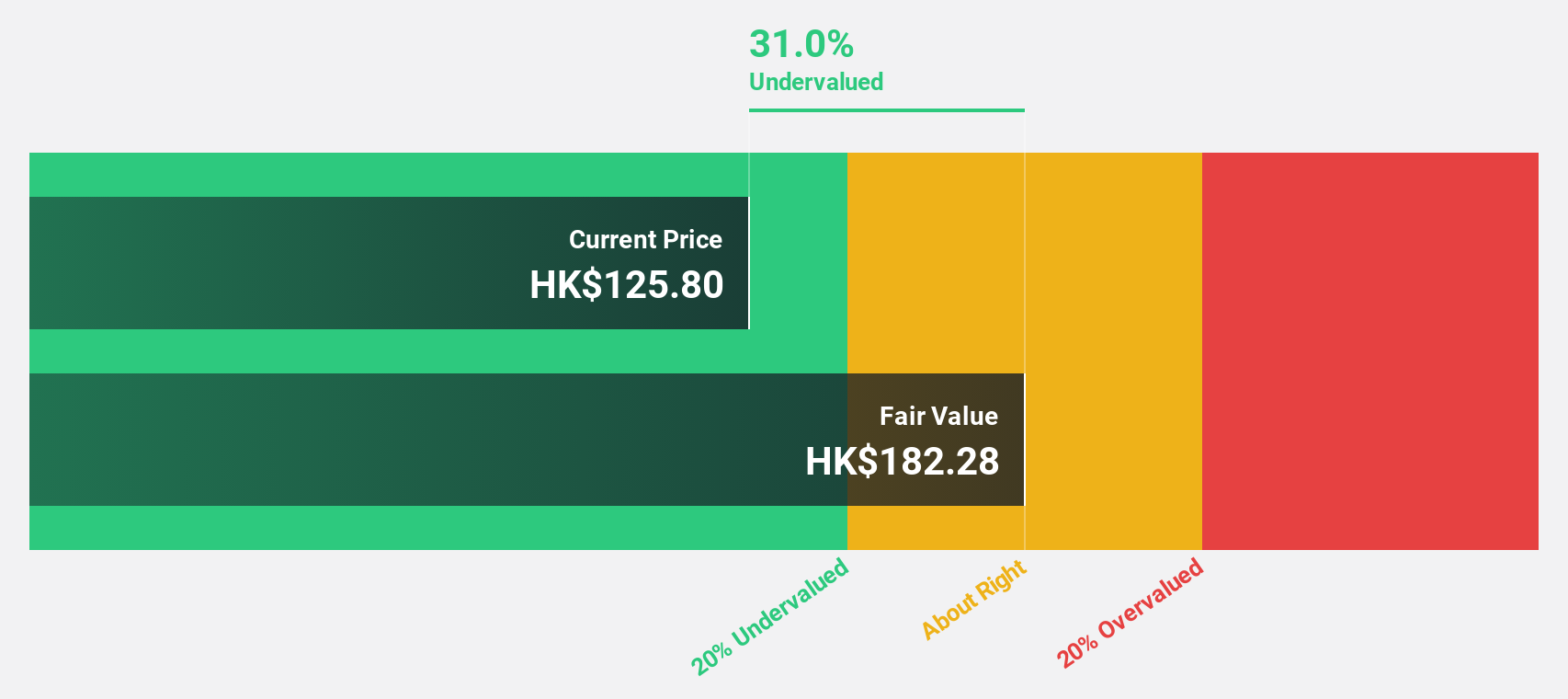

BYD (SEHK:1211)

Overview: BYD Company Limited, with a market cap of HK$925.89 billion, operates in the automobiles and batteries sectors across China, Hong Kong, Macau, Taiwan, and internationally.

Operations: BYD's revenue segments include CN¥507.52 billion from Automobiles and Related Products and CN¥154.49 billion from Mobile Handset Components, Assembly Service, and Other Products.

Estimated Discount To Fair Value: 34.9%

BYD is trading at 34.9% below its estimated fair value of HK$459.67, suggesting it may be undervalued based on cash flows. Recent earnings grew by 36.2%, with a forecasted annual profit growth of 15.47%, outpacing the Hong Kong market's 12.2%. The company reported significant production and sales increases year-to-date, alongside strategic partnerships and expansions, enhancing its revenue potential and reinforcing its strong financial position.

- Insights from our recent growth report point to a promising forecast for BYD's business outlook.

- Delve into the full analysis health report here for a deeper understanding of BYD.

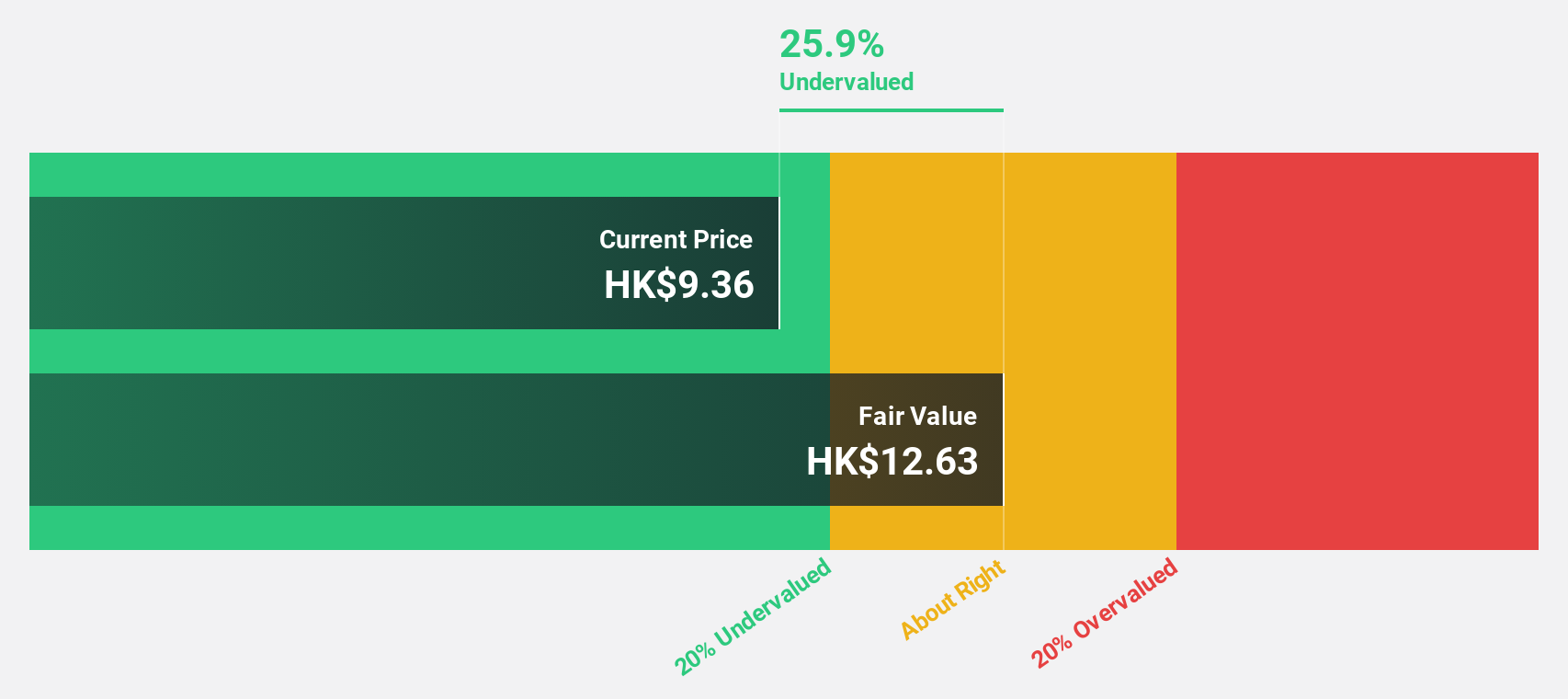

CSC Financial (SEHK:6066)

Overview: CSC Financial Co., Ltd. and its subsidiaries offer investment banking services both in Mainland China and internationally, with a market cap of HK$204.10 billion.

Operations: CSC Financial's revenue segments include Wealth Management (CN¥7.56 billion), Investment Banking (CN¥3.41 billion), Asset Management Business (CN¥1.37 billion), and Transaction and Institutional Customer Service (CN¥6.84 billion).

Estimated Discount To Fair Value: 26.9%

CSC Financial is trading at HK$13.08, significantly below its estimated fair value of HK$17.9, indicating potential undervaluation based on cash flows. Despite a recent decline in revenue and net income for the first half of 2024, earnings are forecast to grow 30.69% annually over the next three years, outpacing the Hong Kong market's 12.2%. However, return on equity remains low at a projected 9.6% in three years' time.

- The growth report we've compiled suggests that CSC Financial's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of CSC Financial.

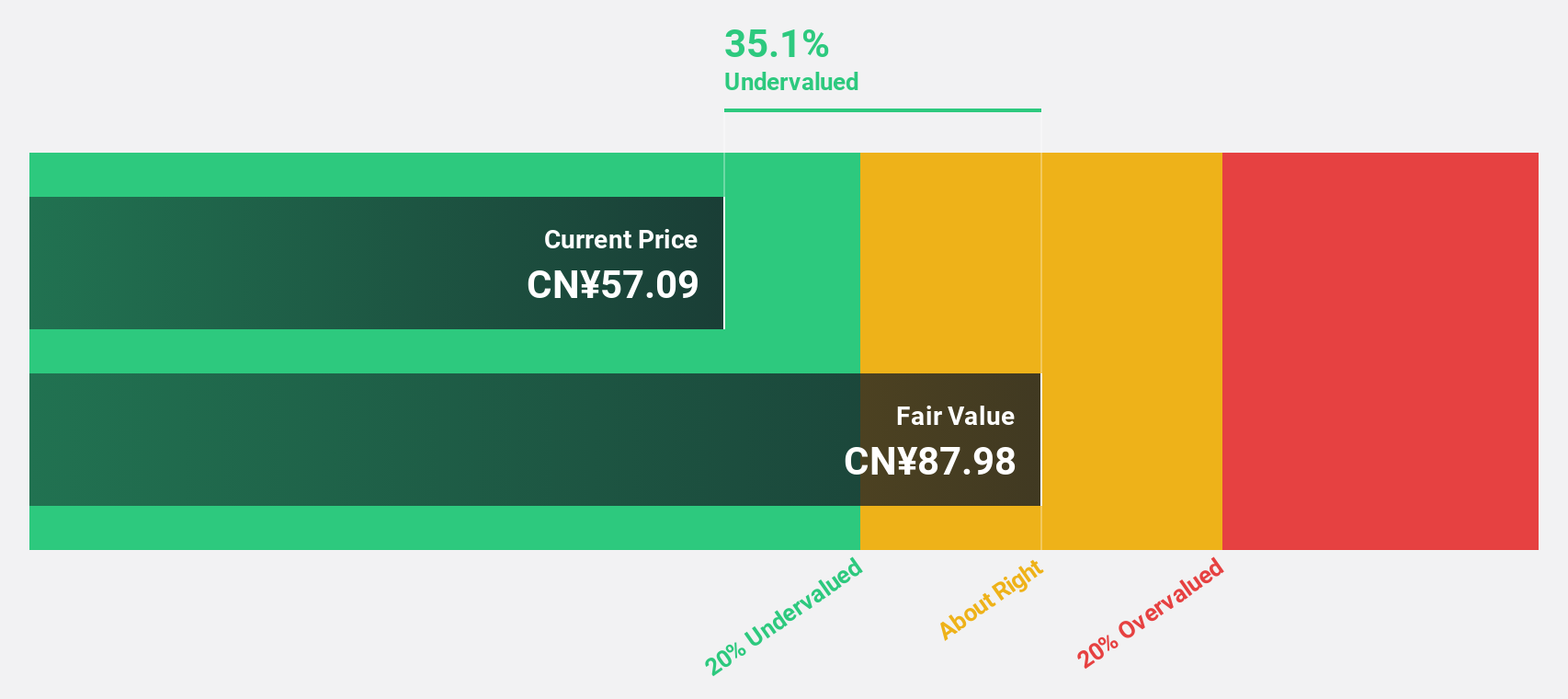

Ningbo Deye Technology Group (SHSE:605117)

Overview: Ningbo Deye Technology Group Co., Ltd. produces and sells heat exchangers, inverters, and dehumidifiers across various international markets with a market cap of CN¥65.54 billion.

Operations: The company generates revenue from the production and sales of heat exchangers, inverters, and dehumidifiers across China, the United Kingdom, the United States, Germany, India, and other international markets.

Estimated Discount To Fair Value: 21.7%

Ningbo Deye Technology Group, trading at CNY 101.68, is undervalued by over 20% based on discounted cash flow analysis. Despite a slight dip in recent earnings and revenue, the company is poised for robust growth with forecasted annual revenue and earnings increases of 31.8% and 31.1%, respectively, outpacing the broader Chinese market. However, its dividend yield of 1.48% is not well covered by free cash flows, and shareholders have experienced dilution over the past year.

- Our expertly prepared growth report on Ningbo Deye Technology Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Ningbo Deye Technology Group's balance sheet health report.

Seize The Opportunity

- Dive into all 950 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6066

CSC Financial

Provides investment banking services in Mainland China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives