- Hong Kong

- /

- Capital Markets

- /

- SEHK:3908

China International Capital (SEHK:3908): Is the Current Valuation Reflecting Its 2024 Performance?

Reviewed by Kshitija Bhandaru

China International Capital (SEHK:3908) is coming off a strong quarter, with its recent performance drawing attention among investors tracking Hong Kong’s financial sector. The stock’s price movement this month may prompt some to revisit its valuation strategy.

See our latest analysis for China International Capital.

China International Capital’s share price has shown steady momentum in 2024, with this month’s valuation push following a calm but persistent climb. While recent news has sparked renewed attention, the bigger picture is about long-term value. The one-year total shareholder return remains nearly flat, but the three-year total return suggests patient investors have finally begun seeing some payback from their holding.

If you want to look beyond the big names, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With shares edging closer to analyst price targets, but a history of long-term gains, is China International Capital trading at a rare discount, or is the market already factoring in all the growth ahead?

Price-to-Earnings of 13.4x: Is it justified?

China International Capital is trading at a price-to-earnings (P/E) ratio of 13.4x, a level notably below both its direct peers and the industry norm. With the last close price at HK$21.32, this multiple suggests the stock may be underappreciated by the market given current earnings.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. For a diversified financial company like China International Capital, it is a crucial benchmark to put its valuation into perspective, especially in capital markets where profitability and growth rates drive sentiment.

Right now, the company's P/E stands far beneath the peer average of 27x and the Hong Kong Capital Markets industry average of 24.1x. Compared to its estimated fair P/E of 17.1x, the current market level could represent a value gap the market may eventually close. If sentiment shifts, there is possible upside as the market revalues towards the fair ratio.

Explore the SWS fair ratio for China International Capital

Result: Price-to-Earnings of 13.4x (UNDERVALUED)

However, risks remain if earnings momentum slows, or if market sentiment towards financial stocks in Hong Kong shifts unexpectedly this quarter.

Find out about the key risks to this China International Capital narrative.

Another View: What Does the DCF Model Say?

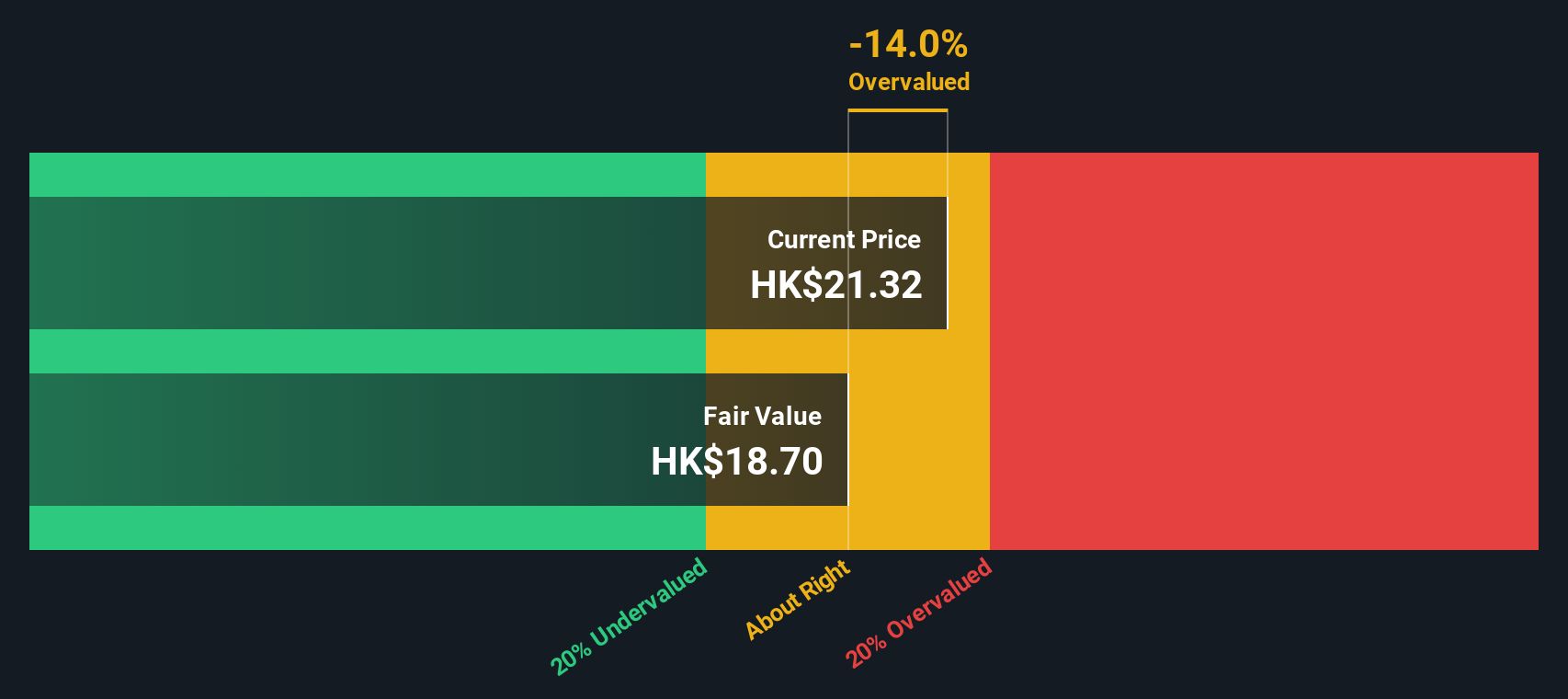

Taking a different approach, the SWS DCF model points to a fair value of HK$18.7, which is below the current price of HK$21.32. This suggests that, from a discounted cash flow perspective, the shares may be a little overvalued at today's levels. Is the market looking too far ahead, or missing hidden value in future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China International Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China International Capital Narrative

If you have a different perspective or want to dig into the numbers yourself, it's quick and easy to craft your own narrative in just a few minutes. So why not Do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding China International Capital.

Looking for More Smart Investment Ideas?

Don’t limit your potential gains. Broaden your horizons and spot tomorrow’s winners now using our market-tested, data-driven screeners.

- Target attractive income by checking out these 19 dividend stocks with yields > 3% offering above-average yields for investors seeking regular cash flow and strong fundamentals.

- Seize opportunities as technology transforms industries by following these 24 AI penny stocks, where artificial intelligence is creating new leaders and shifting market momentum.

- Capitalize on undervalued gems that the market may be missing. Start your search with these 896 undervalued stocks based on cash flows and position yourself for smart, calculated growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3908

China International Capital

Provides financial services in Mainland China and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives