- Hong Kong

- /

- Capital Markets

- /

- SEHK:3908

A Look at China International Capital (SEHK:3908) Valuation Following Major Governance Restructuring Proposal

Reviewed by Simply Wall St

China International Capital (SEHK:3908) has proposed a vote to eliminate its Supervisory Committee and amend its Articles of Association at the upcoming annual meeting on October 31, 2025. This move signals a shift in the corporate governance structure.

See our latest analysis for China International Capital.

Investors seem upbeat about China International Capital’s bold governance overhaul, with the share price up 78% year-to-date and a standout three-year total shareholder return of 110%. This momentum, combined with recent structural changes, signals shifting optimism and confidence in the company’s growth potential.

If this kind of positive turnaround has you searching for more breakthroughs, consider expanding your investing radar with fast growing stocks with high insider ownership.

With shares climbing so quickly, the key question now is whether China International Capital’s strong returns are undervalued by the market or if future growth is already reflected in today’s share price. Is there still a buying opportunity?

Price-to-Earnings of 13.7x: Is it justified?

China International Capital is currently trading at a price-to-earnings (P/E) ratio of 13.7x, a level that stands well below similar firms in the Hong Kong capital markets sector. Based on this metric, the stock looks inexpensive when compared with both its industry and peers.

The price-to-earnings ratio reflects how much investors are willing to pay for each unit of the company’s current earnings. For a financial services company like China International Capital, the P/E is especially relevant as a gauge of market expectations about future earnings power and the stability of profit generation in a cyclical sector.

This relatively modest multiple may signal that the market is underestimating the company’s recent turnaround in profitability and forecasted growth. China International Capital’s P/E sits not only beneath the sector average of 22.1x, but also trails the peer group average of 24.9x. In addition, it is below the estimated fair price-to-earnings ratio of 16.2x, suggesting further room for price appreciation should sentiment or fundamentals improve.

Explore the SWS fair ratio for China International Capital

Result: Price-to-Earnings of 13.7x (UNDERVALUED)

However, if revenue or net income growth slows, or if share price momentum reverses, current optimism around China International Capital could quickly be tempered.

Find out about the key risks to this China International Capital narrative.

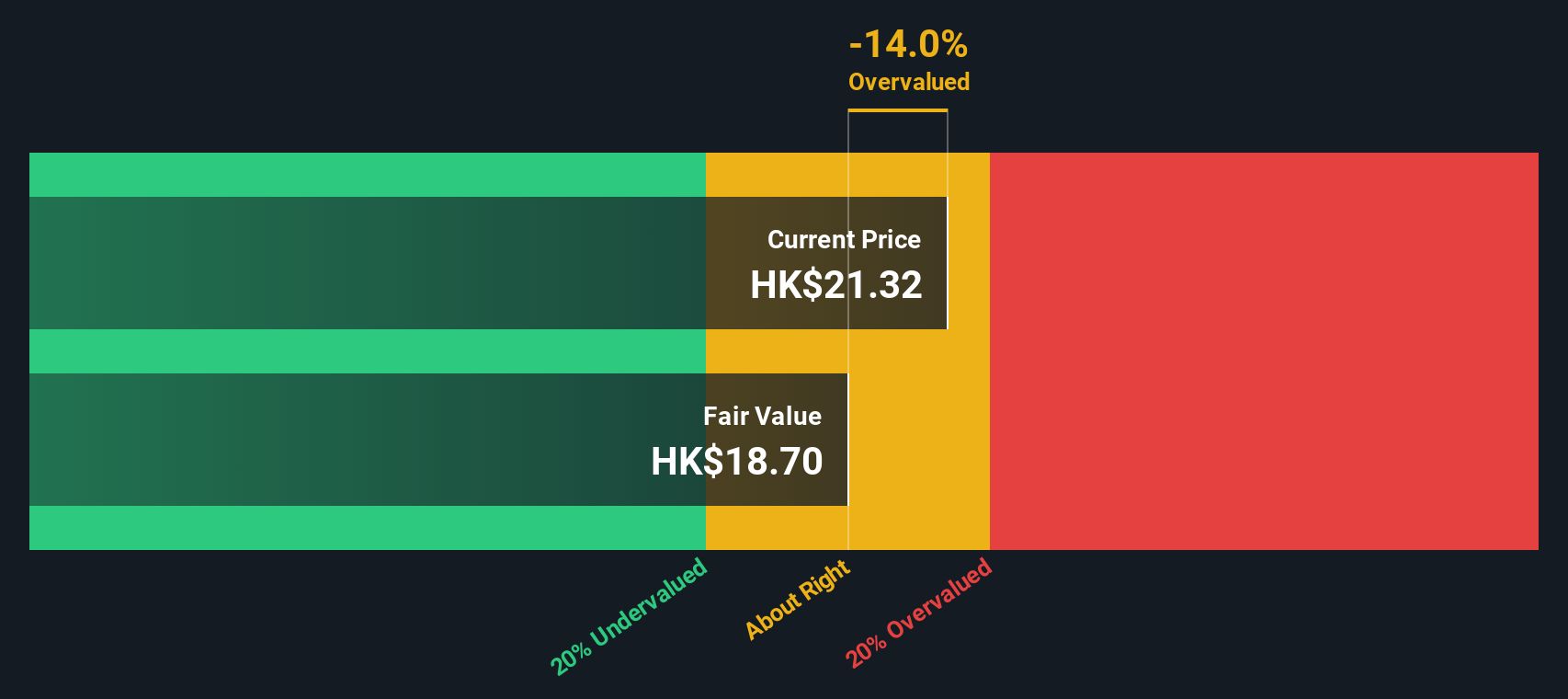

Another View: SWS DCF Model Offers a Different Angle

While the price-to-earnings ratio paints China International Capital as undervalued versus peers and industry, our SWS DCF model comes to a different conclusion. According to this approach, the shares are actually trading above their estimated fair value, which suggests that future returns might be less compelling than recent momentum indicates. Could the current optimism be ahead of the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China International Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China International Capital Narrative

If you think a different story could be told, or want to dig into the numbers yourself, it’s easy to craft your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding China International Capital.

Looking for more investment ideas?

Don’t miss out on smart opportunities across the markets, from promising small-caps to innovative trends. Take your investing game to the next level today.

- Explore unmatched potential and invest early by checking out these 3587 penny stocks with strong financials set to transform their industries.

- Boost your portfolio's future-readiness when you browse these 33 healthcare AI stocks targeting breakthroughs in medical technology.

- Tap into reliable income streams with these 17 dividend stocks with yields > 3% featuring companies committed to strong yields and financial resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3908

China International Capital

Provides financial services in Mainland China and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives