- Hong Kong

- /

- Capital Markets

- /

- SEHK:388

Hong Kong Exchanges and Clearing (SEHK:388) Expands to Riyadh, Strengthening Middle East Connectivity

Reviewed by Simply Wall St

Hong Kong Exchanges and Clearing (SEHK:388) is making significant strides with plans to open a new office in Riyadh in 2025, aiming to enhance its Middle East presence and strengthen connectivity between China and the Gulf region. Despite a Return on Equity of 23.4% and innovative product offerings driving customer engagement, the company faces challenges such as a 3.1% earnings decline and operational inefficiencies. The following discussion will explore these developments, highlighting both the opportunities and challenges that lie ahead for HKEX.

Core Advantages Driving Sustained Success for Hong Kong Exchanges and Clearing

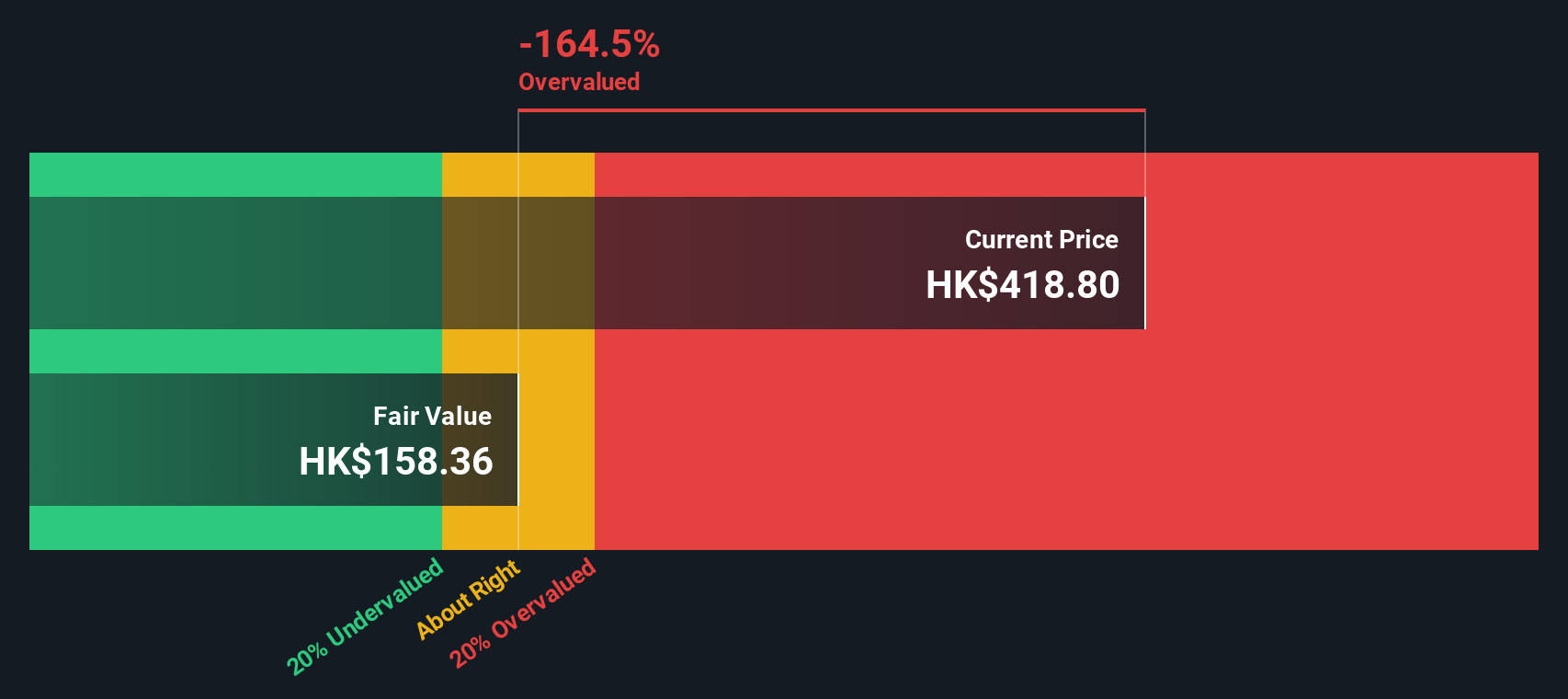

The company has demonstrated financial health with a high Return on Equity of 23.4%, surpassing industry benchmarks. This strong performance is further supported by high-quality past earnings and a substantial cash reserve that exceeds total debt, ensuring financial stability. During the latest earnings call, CEO Yiting Chan highlighted a 15% increase in revenue year-over-year, driven by strong demand in core segments, underscoring effective market positioning. Product innovation has also played a pivotal role, with new offerings exceeding expectations and enhancing customer engagement, as noted by Chief Product Officer Bik Lau. These strengths contribute to the company's current trading position, which is above its estimated fair value, indicating a strong market presence.

Critical Issues Affecting the Performance of Hong Kong Exchanges and Clearing and Areas for Growth

The company faces challenges such as a 3.1% earnings decline over the past year and a decrease in net profit margins to 57.2%. Operational inefficiencies, highlighted by a 10% rise in costs, pose a risk to profitability if not addressed. Additionally, dividend payments are not fully covered by earnings, with a high payout ratio of 136.1%, raising concerns about sustainability. The company is also dealing with competitive pressures, as acknowledged by Chan, necessitating strategic adaptations to maintain its market position.

Emerging Markets Or Trends for Hong Kong Exchanges and Clearing

Looking ahead, the company is poised to capitalize on emerging opportunities, including the planned opening of a new office in Riyadh in 2025, which aims to strengthen its Middle East presence. This expansion is part of a broader initiative to enhance connectivity between China and the Gulf region, fostering new opportunities for customers. The launch of AI-driven products and successful marketing campaigns, resulting in a 20% increase in new customer sign-ups, further highlight the company's commitment to innovation and market expansion.

External Factors Threatening Hong Kong Exchanges and Clearing

However, external threats such as economic headwinds and regulatory changes could impact growth. Chan emphasized the need for strategic flexibility in response to potential downturns, while Chief Compliance Officer Bik Lau noted preparations to adapt to regulatory shifts. Supply chain challenges also persist, affecting product availability and customer satisfaction. These factors necessitate a proactive approach to ensure resilience and sustained growth in a competitive environment.

To learn about how Hong Kong Exchanges and Clearing's valuation metrics are shaping its market position, check out our detailed analysis of Hong Kong Exchanges and Clearing's Valuation.Conclusion

Hong Kong Exchanges and Clearing has shown a commendable financial performance with a Return on Equity of 23.4%, outperforming industry norms, and a 15% revenue growth, reflecting strong market demand and effective positioning. However, challenges such as declining earnings, reduced profit margins, and high dividend payout ratios highlight areas needing strategic attention to sustain profitability. The company's current market valuation above its estimated fair value suggests investor confidence, but also implies expectations of continued growth and resilience in light of competitive pressures and external threats. The planned expansion into the Middle East and innovative product offerings signal potential for future growth, yet the company must address operational inefficiencies and adapt to economic and regulatory changes to maintain its market leadership.

Where To Now?

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Exchanges and Clearing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:388

Hong Kong Exchanges and Clearing

Owns and operates stock and futures exchanges, and related clearing houses in Hong Kong, the United Kingdom, and Mainland China.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives