- Hong Kong

- /

- Diversified Financial

- /

- SEHK:3877

The one-year underlying earnings growth at CSSC (Hong Kong) Shipping (HKG:3877) is promising, but the shareholders are still in the red over that time

It's understandable if you feel frustrated when a stock you own sees a lower share price. But in the short term the market is a voting machine, and the share price movements may not reflect the underlying business performance. The CSSC (Hong Kong) Shipping Company Limited (HKG:3877) is down 17% over a year, but the total shareholder return is -12% once you include the dividend. And that total return actually beats the market decline of 31%. CSSC (Hong Kong) Shipping may have better days ahead, of course; we've only looked at a one year period. The last month has also been disappointing, with the stock slipping a further 20%. However, we note the price may have been impacted by the broader market, which is down 23% in the same time period.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for CSSC (Hong Kong) Shipping

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the CSSC (Hong Kong) Shipping share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

The fact that the dividend has fallen is probably weighing on the share price, as it implies some form of business stress.

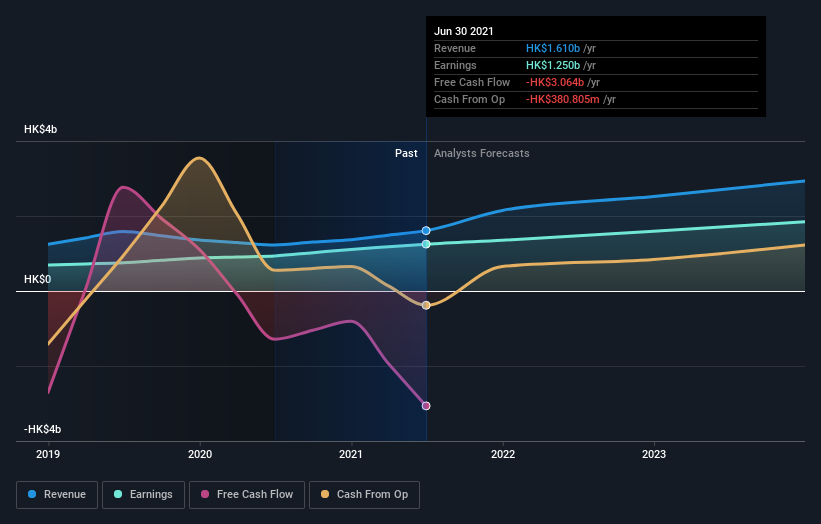

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that CSSC (Hong Kong) Shipping has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling CSSC (Hong Kong) Shipping stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for CSSC (Hong Kong) Shipping the TSR over the last 1 year was -12%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While they no doubt would have preferred make a profit, at least CSSC (Hong Kong) Shipping shareholders didn't do too badly in the last year. Their loss of 12%, including dividends, actually beat the broader market, which lost around 31%. The falls have continued up until the last quarter, with the share price down 11% in that time. Momentum traders would generally avoid a stock if the share price is in a downtrend. We prefer keep an eye on the trends in business metrics like revenue or EPS. It's always interesting to track share price performance over the longer term. But to understand CSSC (Hong Kong) Shipping better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with CSSC (Hong Kong) Shipping (including 1 which is a bit unpleasant) .

Of course CSSC (Hong Kong) Shipping may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3877

CSSC (Hong Kong) Shipping

Operates as a shipyard-affiliated leasing company in People Republic of China, Asia, the United States, and Europe.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.