- Hong Kong

- /

- Diversified Financial

- /

- SEHK:3623

Reflecting on China Success Finance Group Holdings' (HKG:3623) Share Price Returns Over The Last Five Years

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example, after five long years the China Success Finance Group Holdings Limited (HKG:3623) share price is a whole 61% lower. We certainly feel for shareholders who bought near the top. The silver lining is that the stock is up 1.9% in about a week.

View our latest analysis for China Success Finance Group Holdings

China Success Finance Group Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, China Success Finance Group Holdings saw its revenue increase by 8.2% per year. That's a fairly respectable growth rate. The share price return isn't so respectable with an annual loss of 10% over the period. It seems probably that the business has failed to live up to initial expectations. A pessimistic market can create opportunities.

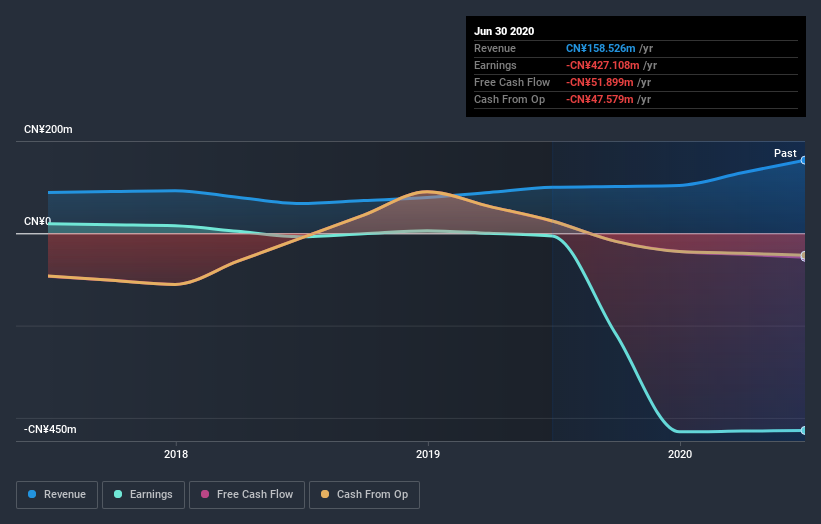

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free interactive report on China Success Finance Group Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that China Success Finance Group Holdings has rewarded shareholders with a total shareholder return of 44% in the last twelve months. That certainly beats the loss of about 10% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with China Success Finance Group Holdings (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

China Success Finance Group Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading China Success Finance Group Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3623

China Success Finance Group Holdings

An investment holding company, provides financial and non-financial guarantee, financial leasing, factoring, and financial consultancy services in the People’s Republic of China, South Africa, and Australia.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives