- Singapore

- /

- Construction

- /

- SGX:E3B

December 2024's Top Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainty, investors are increasingly seeking opportunities that balance risk with potential reward. Penny stocks, often associated with smaller or newer companies, remain an intriguing segment for those looking to uncover hidden value. Despite the term's outdated connotations, penny stocks can still offer significant opportunities when backed by strong financials and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR420.07M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.15B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,850 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

OCI International Holdings (SEHK:329)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OCI International Holdings Limited is an investment holding company offering asset management services in Hong Kong and the People's Republic of China, with a market cap of HK$502.42 million.

Operations: The company's revenue is primarily derived from trading of wines and beverages (HK$64.64 million), asset management (HK$27.19 million), and investment and financial advisory services (HK$0.53 million), while securities trading and investments contributed negatively (-HK$11.05 million).

Market Cap: HK$502.42M

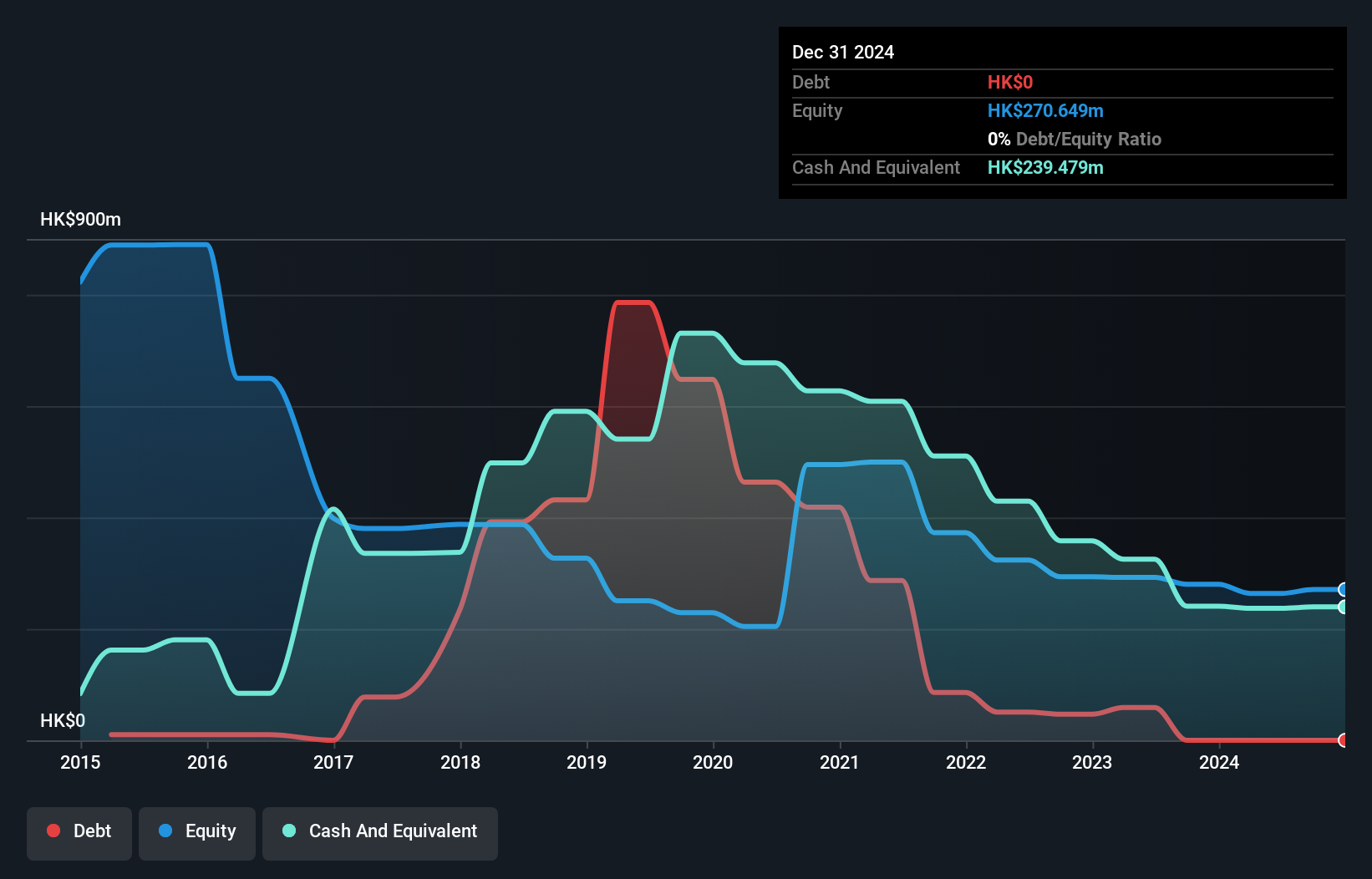

OCI International Holdings Limited, with a market cap of HK$502.42 million, has shown resilience despite being unprofitable by reducing losses over the past five years and maintaining a positive cash flow. Its short-term assets significantly exceed both short and long-term liabilities, indicating solid liquidity. The company is debt-free, having reduced its debt from a high ratio five years ago. However, its share price remains highly volatile. Recent board changes include the appointment of Ms. Guo Ting Ting as a non-executive director, bringing her extensive entrepreneurial experience to bolster governance amidst these financial challenges.

- Take a closer look at OCI International Holdings' potential here in our financial health report.

- Review our historical performance report to gain insights into OCI International Holdings' track record.

Xikang Cloud Hospital Holdings (SEHK:9686)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xikang Cloud Hospital Holdings Inc. is an investment holding company that primarily offers cloud hospital platform services in the People's Republic of China, with a market cap of HK$892.39 million.

Operations: The company generates revenue from Health Management Services amounting to CN¥217.21 million.

Market Cap: HK$892.39M

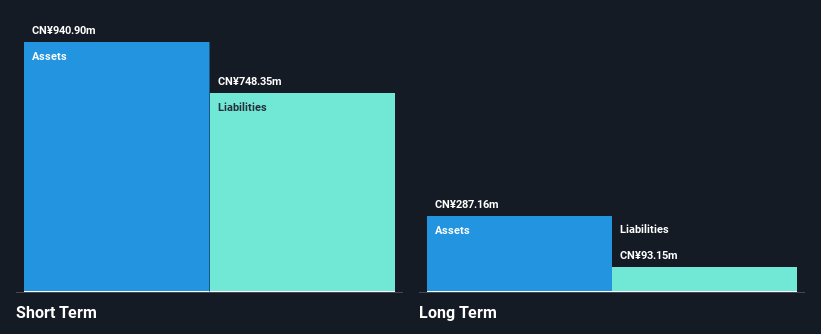

Xikang Cloud Hospital Holdings Inc., with a market cap of HK$892.39 million, demonstrates financial stability through its short-term assets (CN¥940.9M) exceeding both short and long-term liabilities, showcasing solid liquidity. Despite being unprofitable with a negative return on equity of -31.14%, the company has reduced losses over the past five years at 17.8% annually and maintains a sufficient cash runway for over three years based on current free cash flow trends. The management team is experienced, although board members are relatively new, averaging two years in tenure, which may impact strategic continuity.

- Navigate through the intricacies of Xikang Cloud Hospital Holdings with our comprehensive balance sheet health report here.

- Understand Xikang Cloud Hospital Holdings' track record by examining our performance history report.

Wee Hur Holdings (SGX:E3B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wee Hur Holdings Ltd., with a market cap of SGD381.49 million, is an investment holding company involved in general building and civil engineering construction in Singapore and Australia.

Operations: The company's revenue segments include Building Construction (SGD121.19 million), Workers Dormitory (SGD76.45 million), Property Development in Singapore (SGD50.76 million), Fund Management (SGD5.81 million), PBSA Operations (SGD1.84 million), Corporate Segment (SGD2.20 million), and Property Development in Australia (SGD0.81 million).

Market Cap: SGD381.49M

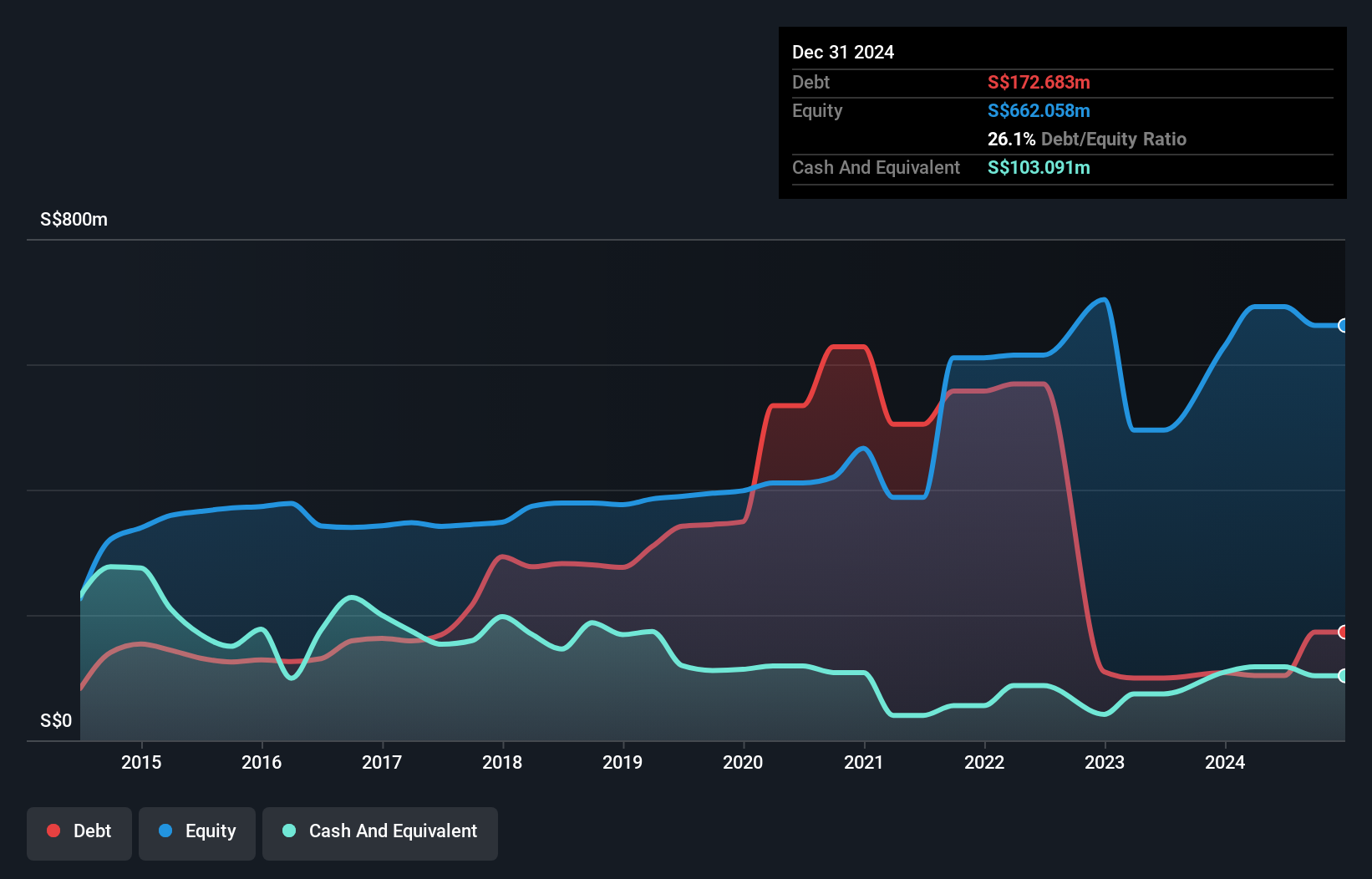

Wee Hur Holdings Ltd., with a market cap of SGD381.49 million, shows financial robustness through its high return on equity at 32.2% and substantial short-term assets (SGD343.2M) exceeding liabilities, both short-term (SGD183.5M) and long-term (SGD138.2M). The company has reduced its debt-to-equity ratio significantly over five years to 14.9%, demonstrating improved financial health. Recently, the stock experienced volatility due to speculation around potential M&A activity involving its Australian PBSA business, although no definitive agreements have been confirmed by the company amidst ongoing confidential discussions with a third party.

- Dive into the specifics of Wee Hur Holdings here with our thorough balance sheet health report.

- Explore historical data to track Wee Hur Holdings' performance over time in our past results report.

Summing It All Up

- Embark on your investment journey to our 5,850 Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wee Hur Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:E3B

Wee Hur Holdings

An investment holding company, engages in general building and civil engineering construction business in Singapore and Australia.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives