- Hong Kong

- /

- Consumer Finance

- /

- SEHK:2051

Insider Buying: Shen Guojun Just Spent CN¥148m On 51 Credit Card Inc. (HKG:2051) Shares

Those following along with 51 Credit Card Inc. (HKG:2051) will no doubt be intrigued by the recent purchase of shares by insider Shen Guojun, who spent a stonking HK$148m on stock at an average price of HK$2.12. That purchase boosted their holding by 59%, which makes us wonder if the move was inspired by quietly confident deeply-felt optimism.

Check out our latest analysis for 51 Credit Card

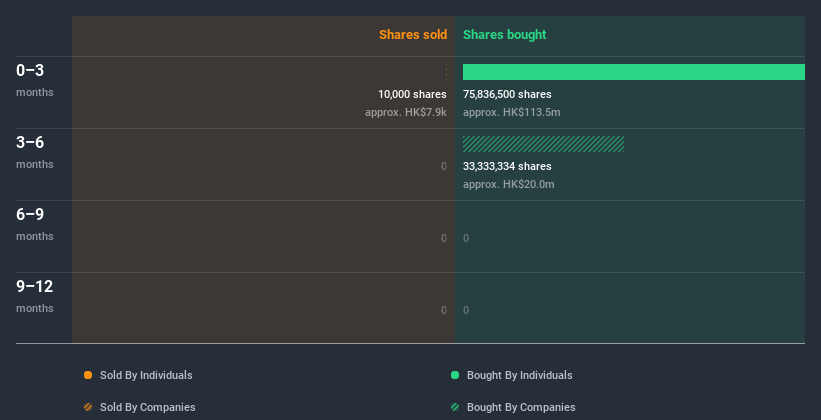

The Last 12 Months Of Insider Transactions At 51 Credit Card

In fact, the recent purchase by Shen Guojun was the biggest purchase of 51 Credit Card shares made by an insider individual in the last twelve months, according to our records. That means that an insider was happy to buy shares at above the current price of HK$1.47. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We always take careful note of the price insiders pay when purchasing shares. As a general rule, we feel more positive about a stock when an insider has bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price. The only individual insider to buy over the last year was Shen Guojun.

Shen Guojun bought 75.84m shares over the last 12 months at an average price of HK$2.02. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. 51 Credit Card insiders own about HK$320m worth of shares. That equates to 17% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Do The 51 Credit Card Insider Transactions Indicate?

The recent insider purchase is heartening. We also take confidence from the longer term picture of insider transactions. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. Once you factor in the high insider ownership, it certainly seems like insiders are positive about 51 Credit Card. That's what I like to see! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing 51 Credit Card. To assist with this, we've discovered 2 warning signs that you should run your eye over to get a better picture of 51 Credit Card.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade 51 Credit Card, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2051

Vala

An investment holding company, operates 51 Credit Card Manager, an online credit card management platform in the People’s Republic of China.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success