- Hong Kong

- /

- Consumer Finance

- /

- SEHK:2051

51 Credit Card Inc.'s (HKG:2051) 26% Share Price Surge Not Quite Adding Up

Those holding 51 Credit Card Inc. (HKG:2051) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 144% following the latest surge, making investors sit up and take notice.

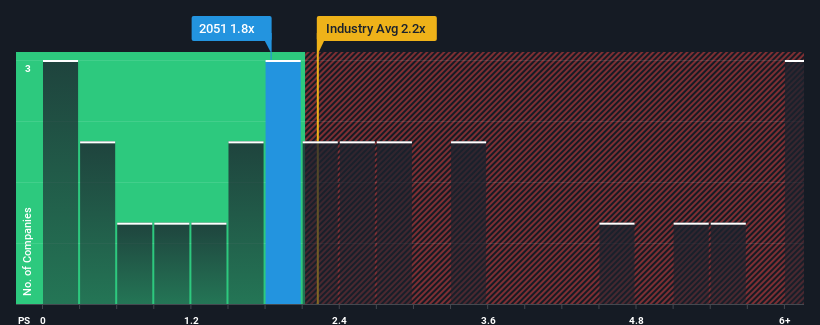

In spite of the firm bounce in price, there still wouldn't be many who think 51 Credit Card's price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in Hong Kong's Consumer Finance industry is similar at about 2.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for 51 Credit Card

What Does 51 Credit Card's Recent Performance Look Like?

For instance, 51 Credit Card's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on 51 Credit Card will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For 51 Credit Card?

In order to justify its P/S ratio, 51 Credit Card would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 39% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 35% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that 51 Credit Card's P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Key Takeaway

51 Credit Card's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at 51 Credit Card revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for 51 Credit Card you should know about.

If these risks are making you reconsider your opinion on 51 Credit Card, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2051

Vala

An investment holding company, operates 51 Credit Card Manager, an online credit card management platform in the People’s Republic of China.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives