- Hong Kong

- /

- Diversified Financial

- /

- SEHK:1905

The Market Doesn't Like What It Sees From Haitong Unitrust International Financial Leasing Co.,Ltd.'s (HKG:1905) Earnings Yet

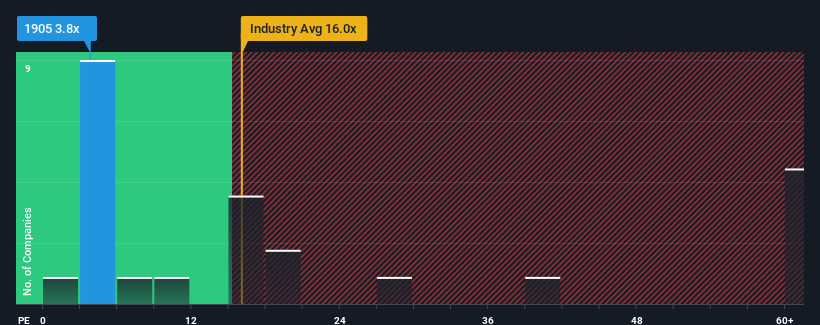

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may consider Haitong Unitrust International Financial Leasing Co.,Ltd. (HKG:1905) as a highly attractive investment with its 3.8x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Haitong Unitrust International Financial LeasingLtd's financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Haitong Unitrust International Financial LeasingLtd

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Haitong Unitrust International Financial LeasingLtd's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 38% overall rise in EPS, in spite of its uninspiring short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Haitong Unitrust International Financial LeasingLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Haitong Unitrust International Financial LeasingLtd's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Haitong Unitrust International Financial LeasingLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Haitong Unitrust International Financial LeasingLtd you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Haitong Unitrust International Financial Leasing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1905

Haitong Unitrust International Financial Leasing

Through its subsidiaries, operates as a financial leasing company in the People’s Republic of China.

Good value average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026