- Hong Kong

- /

- Capital Markets

- /

- SEHK:1788

What Type Of Returns Would Guotai Junan International Holdings'(HKG:1788) Shareholders Have Earned If They Purchased Their SharesFive Years Ago?

Generally speaking long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the Guotai Junan International Holdings Limited (HKG:1788) share price managed to fall 61% over five long years. That's an unpleasant experience for long term holders. There was little comfort for shareholders in the last week as the price declined a further 6.5%.

View our latest analysis for Guotai Junan International Holdings

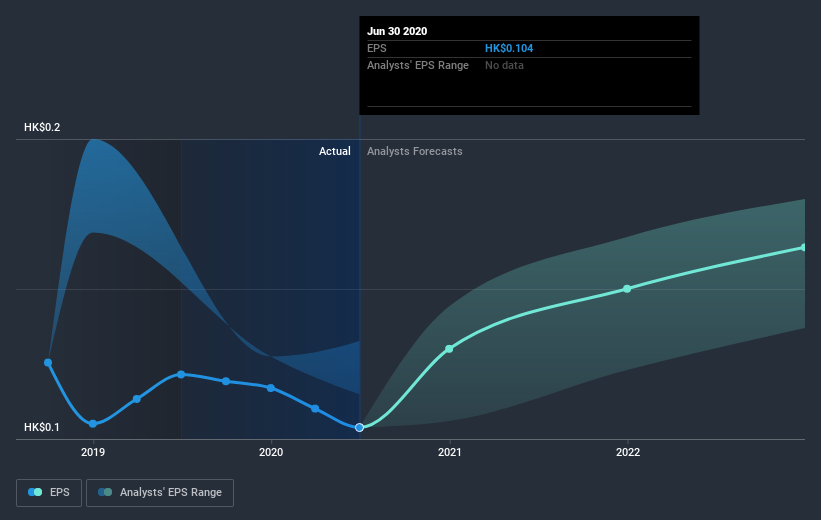

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years over which the share price declined, Guotai Junan International Holdings' earnings per share (EPS) dropped by 7.6% each year. This reduction in EPS is less than the 17% annual reduction in the share price. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 9.73.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Guotai Junan International Holdings' key metrics by checking this interactive graph of Guotai Junan International Holdings's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Guotai Junan International Holdings the TSR over the last 5 years was -53%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Guotai Junan International Holdings shareholders are down 19% for the year (even including dividends), but the market itself is up 8.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Guotai Junan International Holdings (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

We will like Guotai Junan International Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Guotai Junan International Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1788

Guotai Junan International Holdings

An investment holding company, provides brokerage, corporate finance, asset management, loans and financing, financial products, market making, and investment services in Hong Kong and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives