- Hong Kong

- /

- Capital Markets

- /

- SEHK:139

Undervalued Opportunities: 3 Penny Stocks With Market Caps As Low As US$9M

Reviewed by Simply Wall St

As global markets navigate the complexities of new political landscapes and shifting economic policies, investors are reassessing their strategies amidst fluctuating indices and sector-specific movements. Amidst this backdrop, penny stocks continue to intrigue those looking for unique opportunities outside the mainstream. While often associated with speculative investments, these smaller or newer companies can offer significant potential when backed by strong financials. This article explores three penny stocks that present compelling opportunities for investors seeking under-the-radar companies with promising prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.40 | MYR2.35B | ★★★★★☆ |

| Seafco (SET:SEAFCO) | THB1.99 | THB1.61B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$539.57M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

Click here to see the full list of 5,805 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Glycorex Transplantation (NGM:GTAB B)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Glycorex Transplantation AB (publ) is a medical technology company focused on developing, producing, and selling products for organ transplantation, with a market cap of SEK107.83 million.

Operations: The company generates revenue of SEK31.22 million from its organ transplantation segment.

Market Cap: SEK107.83M

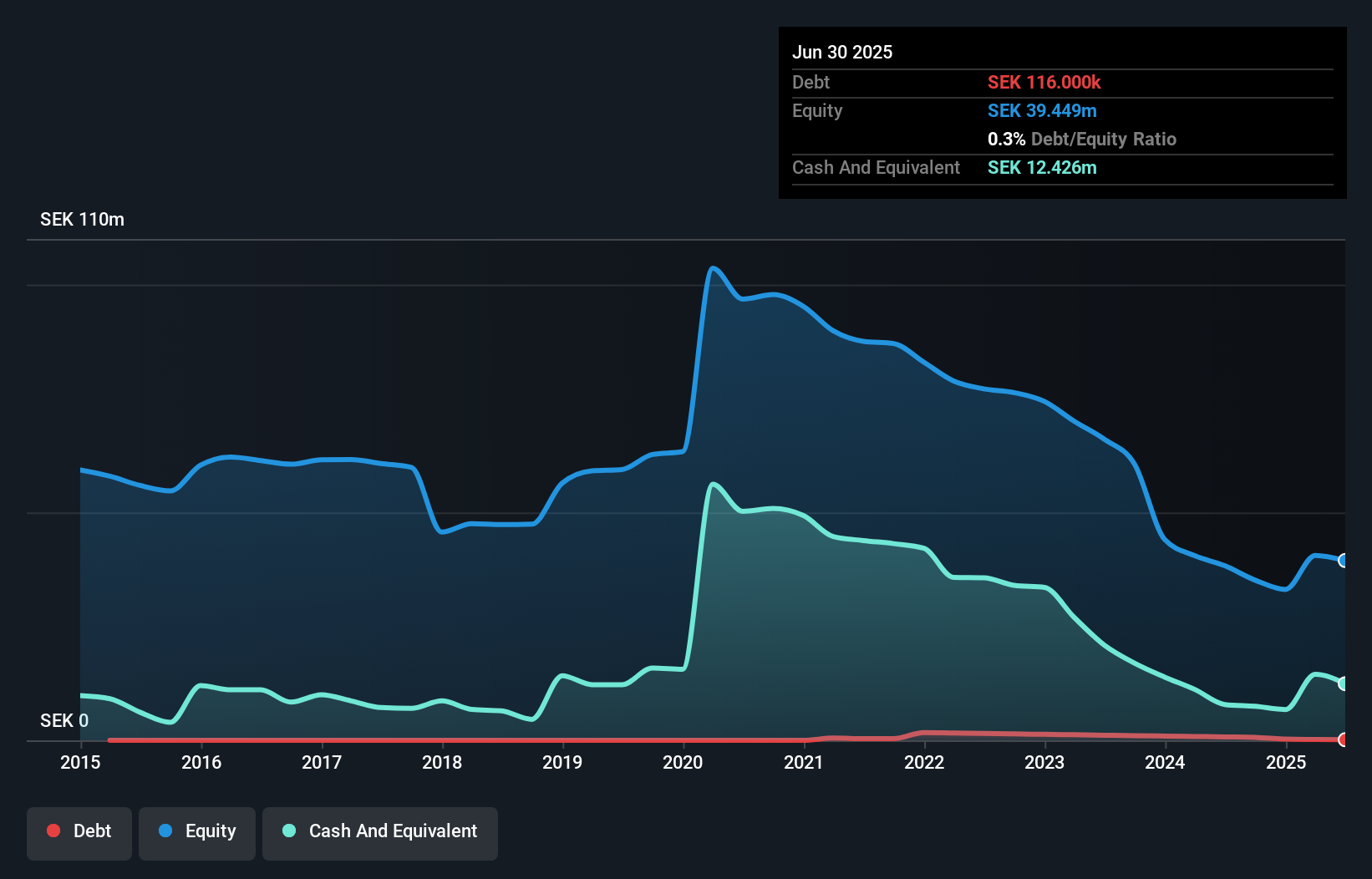

Glycorex Transplantation AB, with a market cap of SEK107.83 million, reported second-quarter revenue of SEK9.49 million and a net loss of SEK2.22 million, showing improvement from the previous year. Despite having sufficient short-term assets (SEK22.3M) to cover liabilities and more cash than debt, the company remains unprofitable with declining earnings over five years at 50.9% annually. Its cash runway is over a year if current free cash flow remains stable but less than a year if it continues to decline historically by 45.6%. The company's share price has been highly volatile recently, reflecting broader challenges in stability and profitability within the penny stock domain.

- Navigate through the intricacies of Glycorex Transplantation with our comprehensive balance sheet health report here.

- Gain insights into Glycorex Transplantation's historical outcomes by reviewing our past performance report.

Central Wealth Group Holdings (SEHK:139)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Central Wealth Group Holdings Limited is an investment holding company involved in securities and futures dealing, debt and equity investment trading, and money lending, with a market cap of HK$292.98 million.

Operations: The company generates revenue primarily from its Brokerage and Commission segment, amounting to HK$18.88 million, and Financial Investments and Services, contributing HK$25.98 million.

Market Cap: HK$292.98M

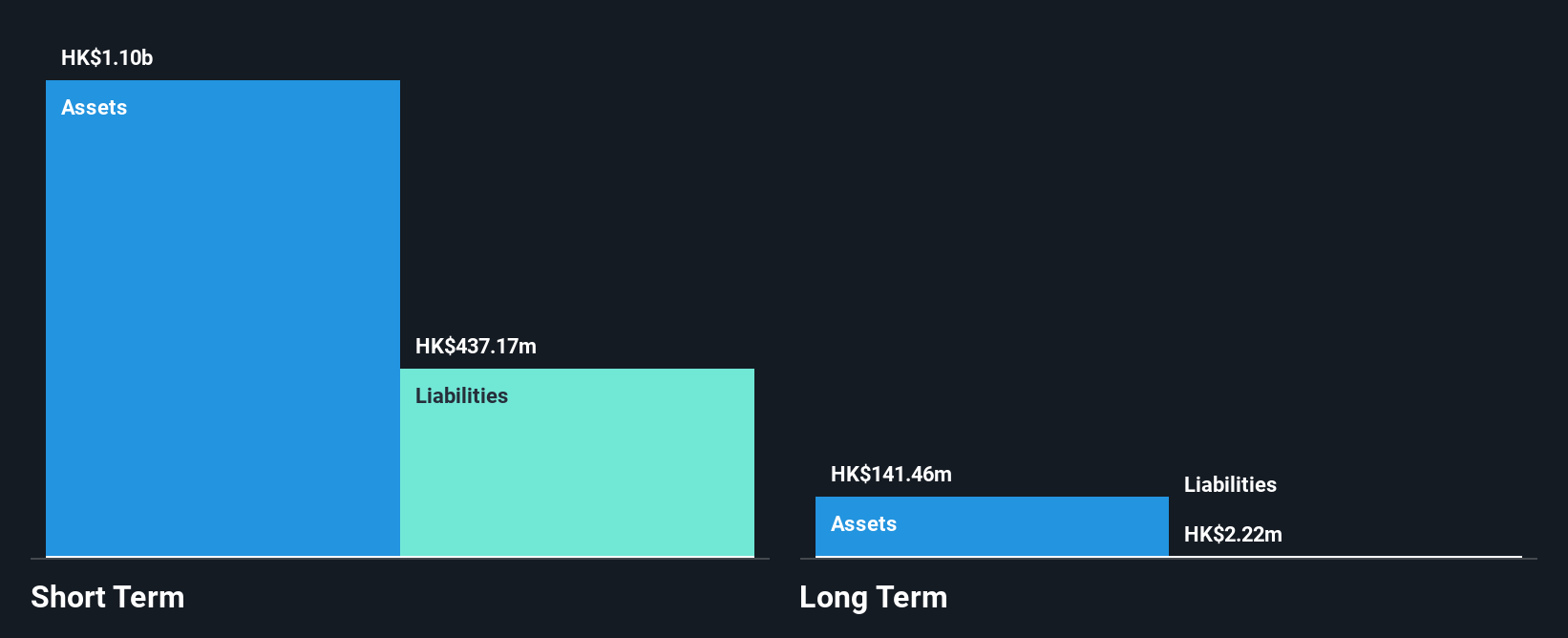

Central Wealth Group Holdings, with a market cap of HK$292.98 million, is engaged in securities and futures dealing, debt and equity investment trading, and money lending. Despite being unprofitable with a negative return on equity of -15.12%, the company has sufficient cash to cover liabilities for over three years if current free cash flow remains stable. Recent strategic alliances with Roths Investment Bank P.L.C. and Hamilton Reserve Bank aim to leverage mutual strengths for growth opportunities. However, revenue has decreased significantly from HK$81.58 million last year to HK$26.06 million this half-year, reflecting ongoing financial challenges in the penny stock sector.

- Get an in-depth perspective on Central Wealth Group Holdings' performance by reading our balance sheet health report here.

- Explore historical data to track Central Wealth Group Holdings' performance over time in our past results report.

Modern Innovative Digital Technology (SEHK:2322)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Modern Innovative Digital Technology Company Limited operates in trading, money lending and factoring, as well as finance leasing and financial services in China and Hong Kong, with a market cap of HK$3.87 billion.

Operations: The company's revenue is primarily derived from trading (HK$113.18 million), followed by money lending and factoring (HK$16.83 million), finance leasing (HK$8.94 million), and financial services (HK$6.00 million).

Market Cap: HK$3.87B

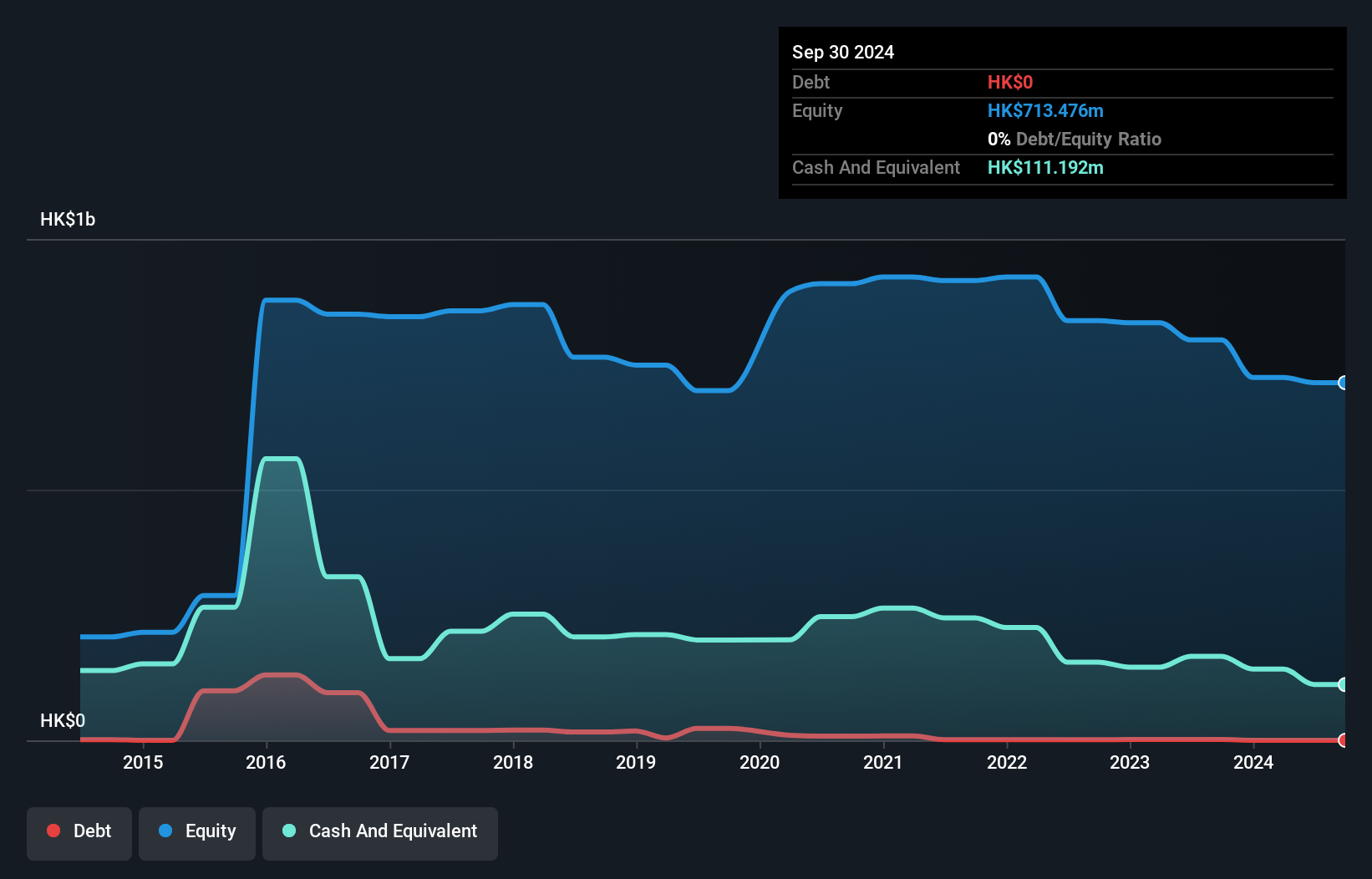

Modern Innovative Digital Technology, with a market cap of HK$3.87 billion, primarily generates revenue from trading activities in China and Hong Kong. The company has reduced its debt to equity ratio significantly over the past five years and maintains more cash than total debt, indicating a strong balance sheet position. Despite being unprofitable with increasing losses over the last five years, it boasts a sufficient cash runway for over three years based on current free cash flow trends. Recent board changes include appointing Mr. Chen Chao as an independent non-executive director, bringing expertise in artificial intelligence to the table.

- Click here to discover the nuances of Modern Innovative Digital Technology with our detailed analytical financial health report.

- Learn about Modern Innovative Digital Technology's historical performance here.

Taking Advantage

- Explore the 5,805 names from our Penny Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:139

Central Wealth Group Holdings

An investment holding company, engages in the securities and futures dealing, debts and equity investment trading, and money lending businesses.

Flawless balance sheet low.

Market Insights

Community Narratives