- Hong Kong

- /

- Hospitality

- /

- SEHK:9869

Helens International Holdings Company Limited's (HKG:9869) 29% Share Price Plunge Could Signal Some Risk

The Helens International Holdings Company Limited (HKG:9869) share price has fared very poorly over the last month, falling by a substantial 29%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 69% loss during that time.

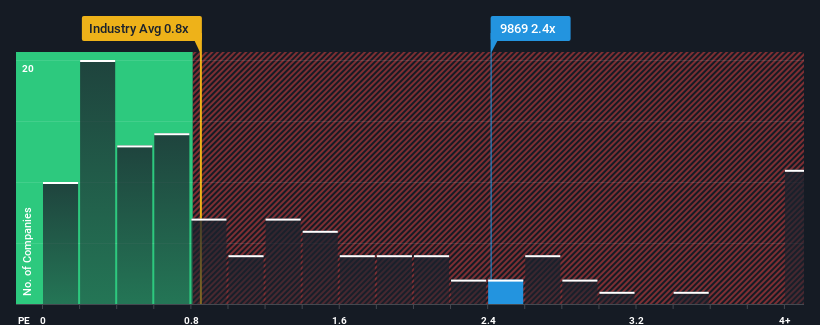

Even after such a large drop in price, when almost half of the companies in Hong Kong's Hospitality industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Helens International Holdings as a stock probably not worth researching with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Helens International Holdings

How Helens International Holdings Has Been Performing

Helens International Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Helens International Holdings will help you uncover what's on the horizon.How Is Helens International Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Helens International Holdings would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. Even so, admirably revenue has lifted 48% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 15% per year as estimated by the nine analysts watching the company. With the industry predicted to deliver 15% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Helens International Holdings' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Helens International Holdings' P/S

There's still some elevation in Helens International Holdings' P/S, even if the same can't be said for its share price recently. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given Helens International Holdings' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Helens International Holdings (1 shouldn't be ignored!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Helens International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9869

Helens International Holdings

An investment holding company, engages in the bar operations and franchise business in the People’s Republic of China (PRC) and Hong Kong.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives