- Hong Kong

- /

- Hospitality

- /

- SEHK:9658

February 2025's Top Stock Picks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and competitive pressures in the technology sector, investors are keenly observing the implications for stock valuations. Amidst this volatility, identifying stocks trading below their fair value can be a prudent strategy for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$263.50 | NT$528.67 | 50.2% |

| Brookline Bancorp (NasdaqGS:BRKL) | US$12.06 | US$24.01 | 49.8% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥101.01 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK170.60 | SEK340.70 | 49.9% |

| Elekta (OM:EKTA B) | SEK64.60 | SEK128.36 | 49.7% |

| Kinaxis (TSX:KXS) | CA$171.05 | CA$340.41 | 49.8% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥25.94 | 49.7% |

| AeroEdge (TSE:7409) | ¥1771.00 | ¥3417.37 | 48.2% |

| QuinStreet (NasdaqGS:QNST) | US$23.71 | US$47.35 | 49.9% |

| Equifax (NYSE:EFX) | US$267.52 | US$531.27 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

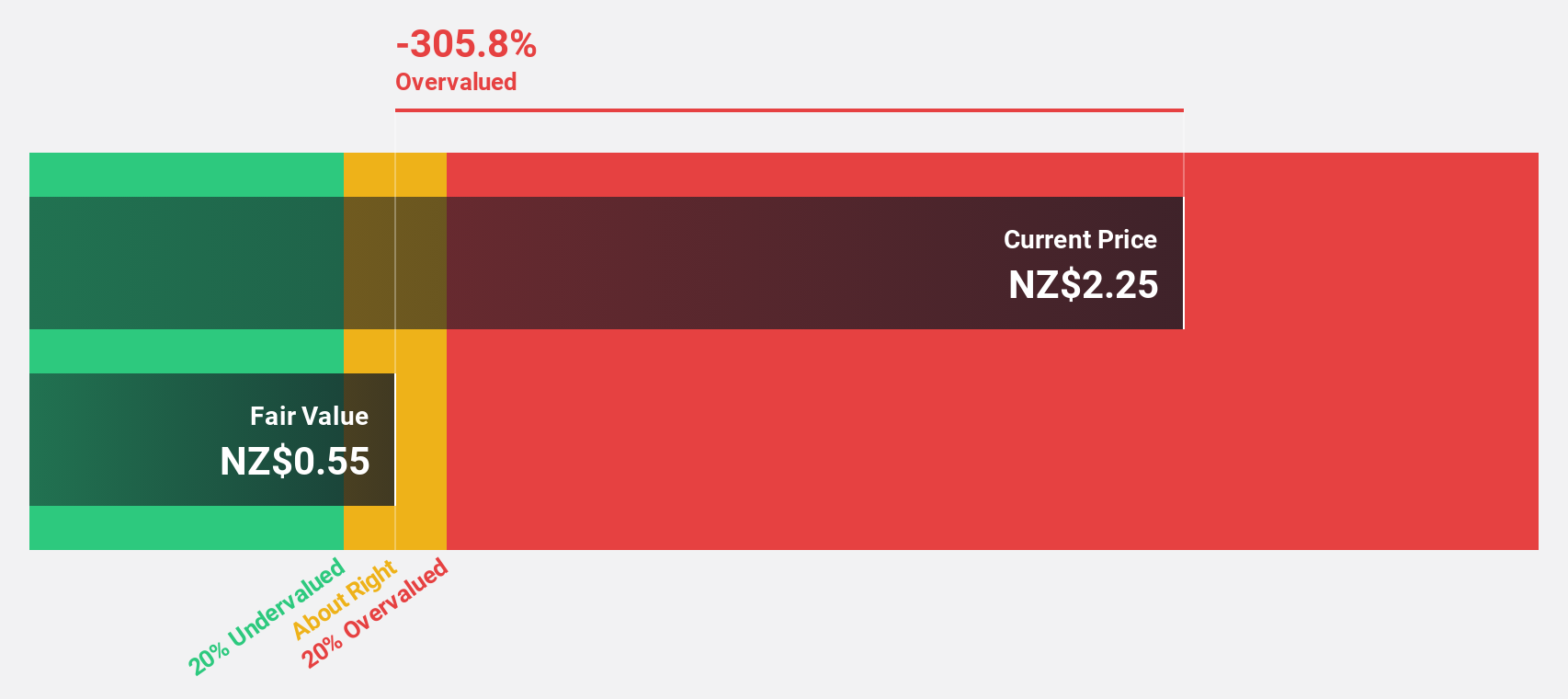

Ryman Healthcare (NZSE:RYM)

Overview: Ryman Healthcare Limited develops, owns, and operates integrated retirement villages, rest homes, and hospitals for elderly people in New Zealand and Australia, with a market cap of NZ$3 billion.

Operations: The company's revenue segment primarily consists of the provision of integrated retirement villages for older people, generating NZ$720.35 million.

Estimated Discount To Fair Value: 34.7%

Ryman Healthcare is trading at NZ$4.38, significantly below its estimated fair value of NZ$6.7, indicating undervaluation based on discounted cash flow analysis. Despite a high debt level and a forecasted low return on equity of 5.9% in three years, revenue is expected to grow at 9.2% annually, outpacing the broader New Zealand market growth rate of 4.6%. Analysts forecast profitability within three years with substantial earnings growth potential.

- Our growth report here indicates Ryman Healthcare may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Ryman Healthcare's balance sheet health report.

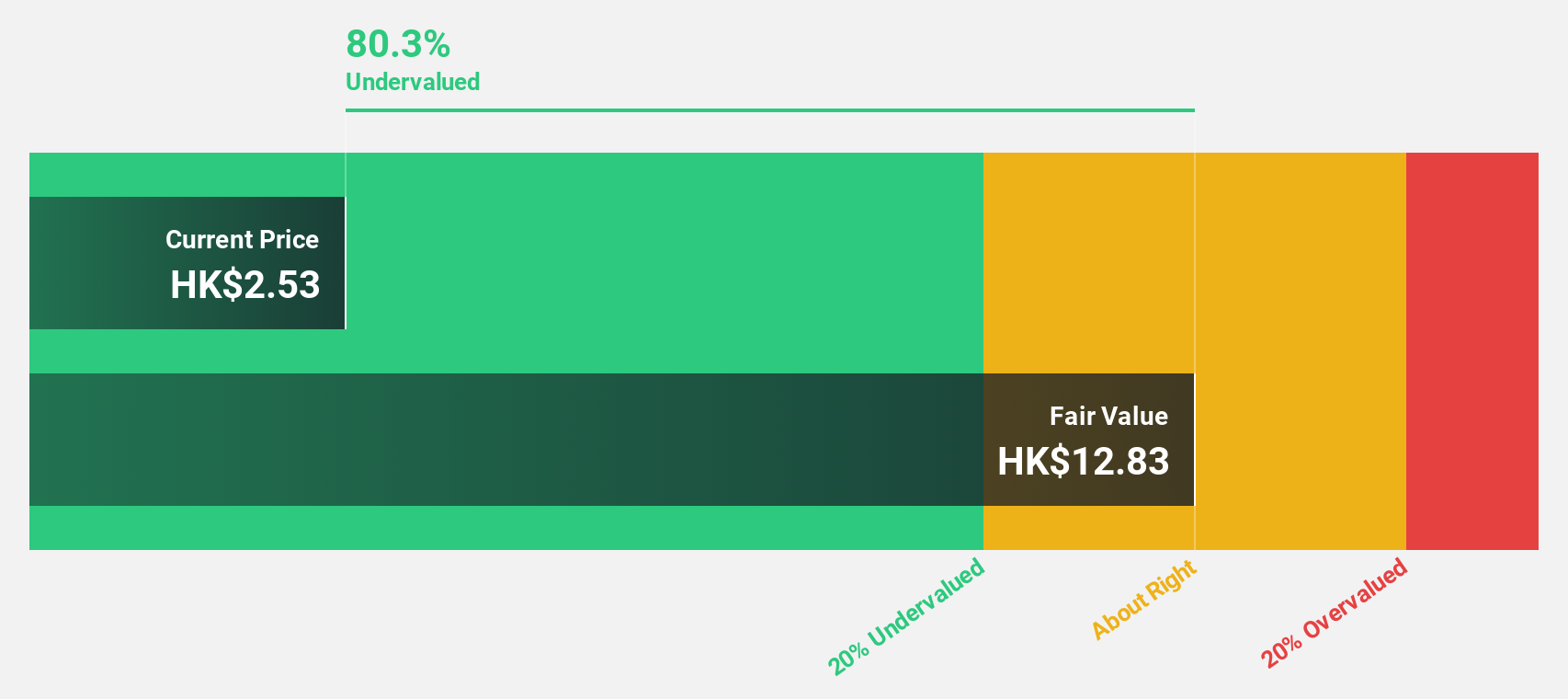

CGN Mining (SEHK:1164)

Overview: CGN Mining Company Limited focuses on the development and trading of natural uranium resources for nuclear power plants, with a market capitalization of HK$12.31 billion.

Operations: The company generates revenue primarily from its natural uranium trading segment, which amounts to HK$8.50 billion.

Estimated Discount To Fair Value: 47%

CGN Mining is trading at HK$1.62, well below its estimated fair value of HK$3.05, highlighting potential undervaluation based on cash flows. Despite low profit margins and debt not being well covered by operating cash flow, the company has shown strong earnings growth of 26.8% last year and is forecast to grow earnings by 39.2% annually, significantly outpacing the Hong Kong market's growth rate of 11.3%.

- The analysis detailed in our CGN Mining growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of CGN Mining.

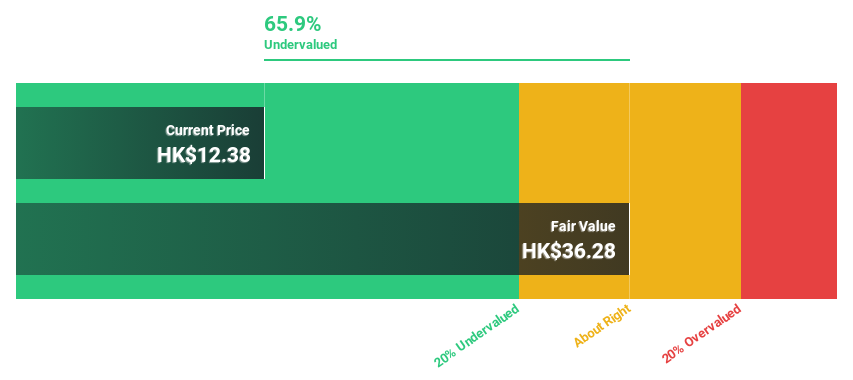

Super Hi International Holding (SEHK:9658)

Overview: Super Hi International Holding Ltd. is an investment holding company that operates Haidilao branded Chinese cuisine restaurants across Asia, North America, and internationally, with a market cap of HK$12.41 billion.

Operations: The company's revenue is primarily generated from its Haidilao branded Chinese cuisine restaurants, amounting to $759.89 million.

Estimated Discount To Fair Value: 11%

Super Hi International Holding, trading at HK$19.08, is undervalued relative to its estimated fair value of HK$21.43 based on cash flows. The company reported significant earnings growth with a net income of US$37.72 million for Q3 2024, reversing a loss from the previous year. Earnings are forecast to grow significantly over the next three years, outpacing both revenue growth and the broader Hong Kong market's earnings growth rate.

- Insights from our recent growth report point to a promising forecast for Super Hi International Holding's business outlook.

- Navigate through the intricacies of Super Hi International Holding with our comprehensive financial health report here.

Taking Advantage

- Access the full spectrum of 913 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9658

Super Hi International Holding

An investment holding company, operates Haidilao branded Chinese cuisine restaurants in Asia, North America, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives