- Hong Kong

- /

- Hospitality

- /

- SEHK:8527

JLogo Holdings Limited's (HKG:8527) 46% Share Price Plunge Could Signal Some Risk

JLogo Holdings Limited (HKG:8527) shareholders that were waiting for something to happen have been dealt a blow with a 46% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 61% share price decline.

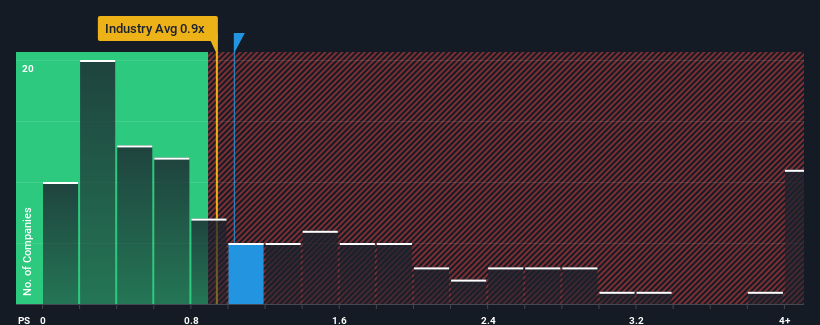

Although its price has dipped substantially, there still wouldn't be many who think JLogo Holdings' price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Hong Kong's Hospitality industry is similar at about 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for JLogo Holdings

How JLogo Holdings Has Been Performing

For instance, JLogo Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on JLogo Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like JLogo Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.3%. Regardless, revenue has managed to lift by a handy 30% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 19% shows it's noticeably less attractive.

With this in mind, we find it intriguing that JLogo Holdings' P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Following JLogo Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that JLogo Holdings' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you take the next step, you should know about the 2 warning signs for JLogo Holdings (1 shouldn't be ignored!) that we have uncovered.

If you're unsure about the strength of JLogo Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8527

JLogo Holdings

An investment holding company, owns, operates, and manages restaurants in Singapore and Malaysia.

Slight and slightly overvalued.