- Hong Kong

- /

- Hospitality

- /

- SEHK:8371

Taste Gourmet Group (HKG:8371) Has Announced That Its Dividend Will Be Reduced To HK$0.016

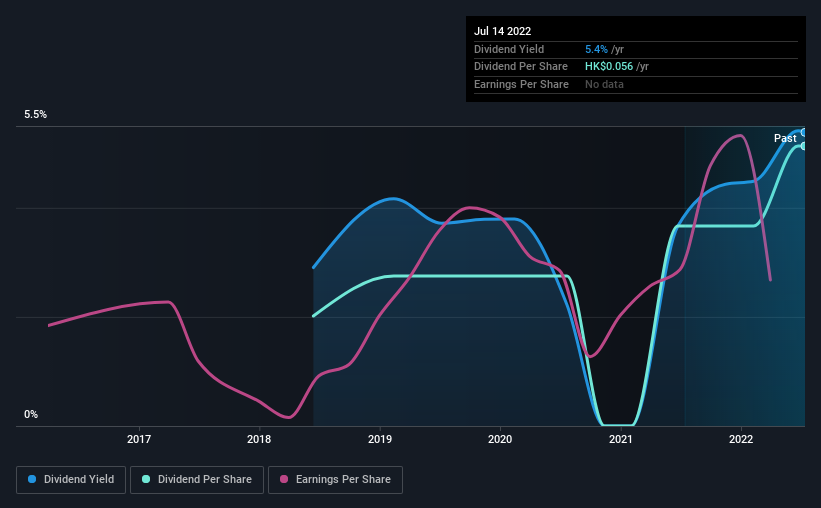

Taste Gourmet Group Limited's (HKG:8371) dividend is being reduced from last year's payment covering the same period to HK$0.016 on the 25th of August. However, the dividend yield of 5.4% is still a decent boost to shareholder returns.

View our latest analysis for Taste Gourmet Group

Taste Gourmet Group Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. The last payment made up 82% of earnings, but cash flows were much higher. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

EPS is set to grow by 3.3% over the next year if recent trends continue. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 99% over the next year.

Taste Gourmet Group's Dividend Has Lacked Consistency

Looking back, the company hasn't been paying the most consistent dividend, but with such a short dividend history it could be too early to draw solid conclusions. The dividend has gone from an annual total of HK$0.022 in 2018 to the most recent total annual payment of HK$0.056. This means that it has been growing its distributions at 26% per annum over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. However, Taste Gourmet Group has only grown its earnings per share at 3.3% per annum over the past five years. Taste Gourmet Group's earnings per share has barely grown, which is not ideal - perhaps this is why the company pays out the majority of its earnings to shareholders. That's fine as far as it goes, but we're less enthusiastic as this often signals that the dividend is likely to grow slower in the future.

In Summary

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Taste Gourmet Group is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 3 warning signs for Taste Gourmet Group that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Taste Gourmet Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8371

Taste Gourmet Group

An investment holding company, operates full-service restaurants and kiosks in Hong Kong and China.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives