- Hong Kong

- /

- Hospitality

- /

- SEHK:8308

Gudou Holdings'(HKG:8308) Share Price Is Down 73% Over The Past Three Years.

Every investor on earth makes bad calls sometimes. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Gudou Holdings Limited (HKG:8308); the share price is down a whopping 73% in the last three years. That would certainly shake our confidence in the decision to own the stock. And the ride hasn't got any smoother in recent times over the last year, with the price 26% lower in that time. Shareholders have had an even rougher run lately, with the share price down 32% in the last 90 days.

Check out our latest analysis for Gudou Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Gudou Holdings became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

Arguably the revenue decline of 10% per year has people thinking Gudou Holdings is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

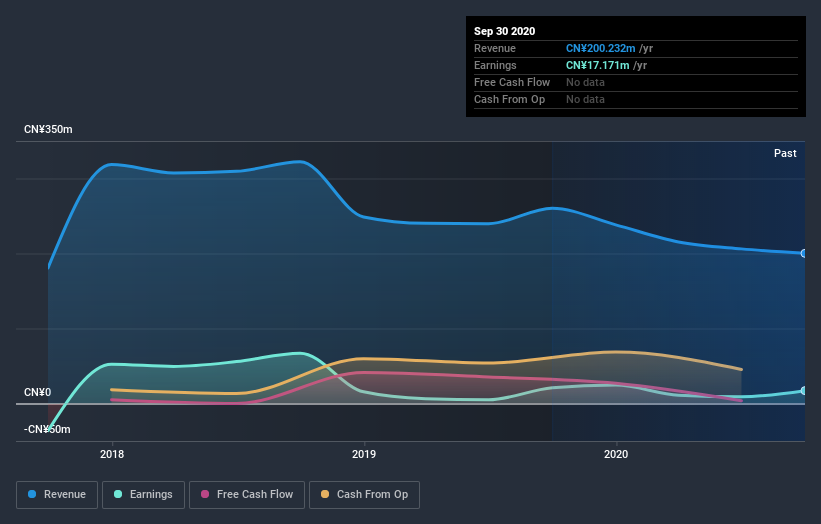

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Over the last year, Gudou Holdings shareholders took a loss of 26%. In contrast the market gained about 26%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. However, the loss over the last year isn't as bad as the 20% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Gudou Holdings better, we need to consider many other factors. For instance, we've identified 4 warning signs for Gudou Holdings (1 is potentially serious) that you should be aware of.

We will like Gudou Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Gudou Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8308

Gudou Holdings

An investment holding company, operates and manages hot spring resort and hotel facilities in the People’s Republic of China.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives