David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Royal Catering Group Holdings Company Limited (HKG:8300) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Royal Catering Group Holdings

What Is Royal Catering Group Holdings's Debt?

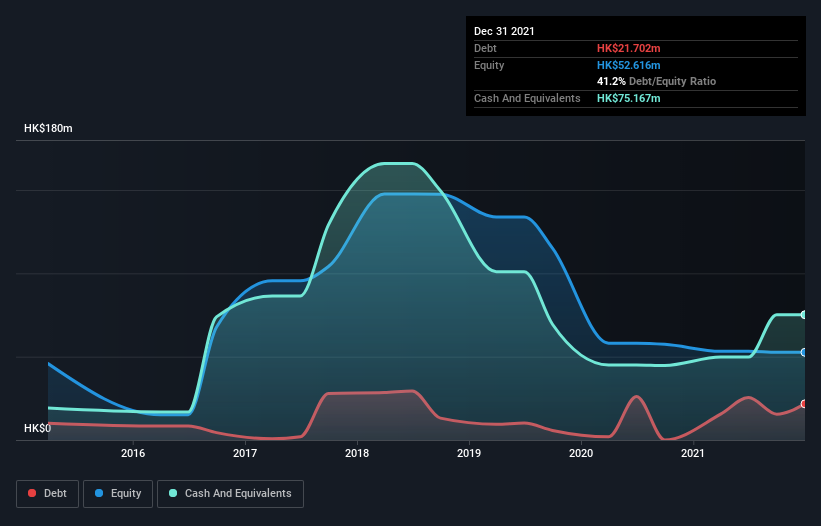

As you can see below, at the end of September 2021, Royal Catering Group Holdings had HK$21.7m of debt, up from HK$15.5m a year ago. Click the image for more detail. However, its balance sheet shows it holds HK$75.2m in cash, so it actually has HK$53.5m net cash.

A Look At Royal Catering Group Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that Royal Catering Group Holdings had liabilities of HK$32.0m due within 12 months and liabilities of HK$1.39m due beyond that. On the other hand, it had cash of HK$75.2m and HK$1.30m worth of receivables due within a year. So it can boast HK$43.1m more liquid assets than total liabilities.

This excess liquidity is a great indication that Royal Catering Group Holdings' balance sheet is almost as strong as Fort Knox. Having regard to this fact, we think its balance sheet is as strong as an ox. Simply put, the fact that Royal Catering Group Holdings has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Royal Catering Group Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Royal Catering Group Holdings had a loss before interest and tax, and actually shrunk its revenue by 4.4%, to HK$42m. We would much prefer see growth.

So How Risky Is Royal Catering Group Holdings?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Royal Catering Group Holdings had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through HK$1.3m of cash and made a loss of HK$6.4m. However, it has net cash of HK$53.5m, so it has a bit of time before it will need more capital. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Royal Catering Group Holdings (1 is a bit unpleasant) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8300

Jin Mi Fang Group Holdings

An investment holding company, provides casual dining food catering services in Hong Kong and the People’s Republic of China.

Medium-low risk with questionable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026