- Hong Kong

- /

- Industrials

- /

- SEHK:8095

Here's Why Beijing Beida Jade Bird Universal Sci-Tech (HKG:8095) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Beijing Beida Jade Bird Universal Sci-Tech (HKG:8095). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Beijing Beida Jade Bird Universal Sci-Tech

How Quickly Is Beijing Beida Jade Bird Universal Sci-Tech Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Beijing Beida Jade Bird Universal Sci-Tech has grown EPS by 26% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The previous 12 months are something that Beijing Beida Jade Bird Universal Sci-Tech will want to put behind them after seeing a drop in EBIT margin and revenue for the period. Shareholders will be hoping for a change in fortunes if they're looking for profit growth.

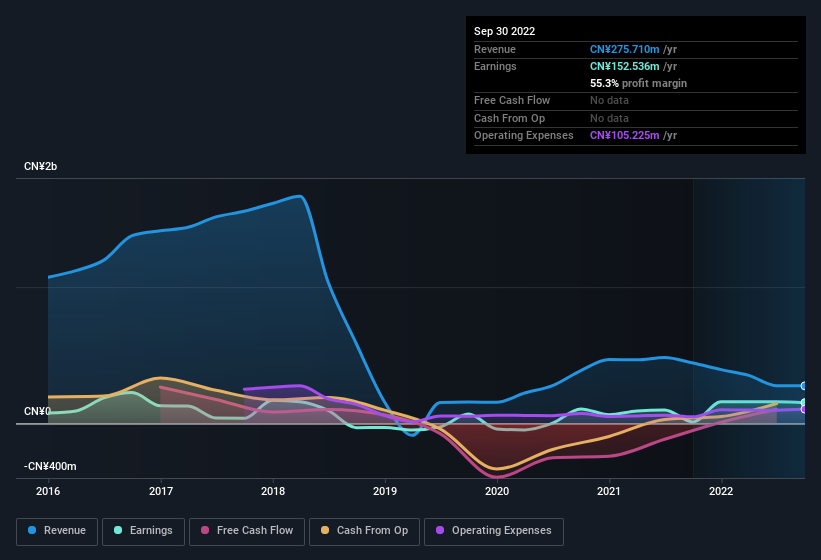

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Beijing Beida Jade Bird Universal Sci-Tech isn't a huge company, given its market capitalisation of HK$803m. That makes it extra important to check on its balance sheet strength.

Are Beijing Beida Jade Bird Universal Sci-Tech Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations under CN¥1.4b, like Beijing Beida Jade Bird Universal Sci-Tech, the median CEO pay is around CN¥1.7m.

The CEO of Beijing Beida Jade Bird Universal Sci-Tech only received CN¥726k in total compensation for the year ending December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Beijing Beida Jade Bird Universal Sci-Tech To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Beijing Beida Jade Bird Universal Sci-Tech's strong EPS growth. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. We think that based on its merits alone, this stock is worth watching into the future. Of course, profit growth is one thing but it's even better if Beijing Beida Jade Bird Universal Sci-Tech is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Beida Jade Bird Universal Sci-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8095

Beijing Beida Jade Bird Universal Sci-Tech

An investment holding company, engages in the trading of metallic products and tourism development in the People’s Republic of China, Hong Kong, and the United States.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.