- Hong Kong

- /

- Hospitality

- /

- SEHK:8052

Luk Hing Entertainment Group Holdings (HKG:8052) Has Debt But No Earnings; Should You Worry?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Luk Hing Entertainment Group Holdings Limited (HKG:8052) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Luk Hing Entertainment Group Holdings

How Much Debt Does Luk Hing Entertainment Group Holdings Carry?

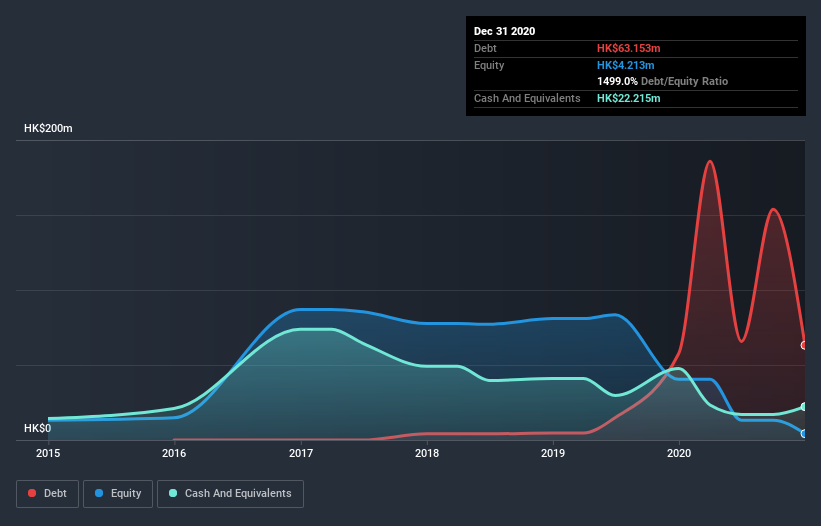

The image below, which you can click on for greater detail, shows that at December 2020 Luk Hing Entertainment Group Holdings had debt of HK$63.2m, up from HK$57.5m in one year. However, it does have HK$22.2m in cash offsetting this, leading to net debt of about HK$40.9m.

How Healthy Is Luk Hing Entertainment Group Holdings' Balance Sheet?

According to the last reported balance sheet, Luk Hing Entertainment Group Holdings had liabilities of HK$85.6m due within 12 months, and liabilities of HK$135.6m due beyond 12 months. Offsetting this, it had HK$22.2m in cash and HK$25.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$173.7m.

The deficiency here weighs heavily on the HK$50.4m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Luk Hing Entertainment Group Holdings would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Luk Hing Entertainment Group Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Luk Hing Entertainment Group Holdings had a loss before interest and tax, and actually shrunk its revenue by 28%, to HK$164m. To be frank that doesn't bode well.

Caveat Emptor

While Luk Hing Entertainment Group Holdings's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable HK$48m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. Of course, it may be able to improve its situation with a bit of luck and good execution. Nevertheless, we would not bet on it given that it lost HK$32m in just last twelve months, and it doesn't have much by way of liquid assets. So while it's not wise to assume the company will fail, we do think it's risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Luk Hing Entertainment Group Holdings you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Luk Hing Entertainment Group Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8052

Luk Hing Entertainment Group Holdings

An investment holding company, engages in the food and beverage, and entertainment businesses in Hong Kong.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026