- Hong Kong

- /

- Hospitality

- /

- SEHK:780

How Does Tongcheng Travel Stack Up After Strong 2025 Performance and Sector Growth?

Reviewed by Bailey Pemberton

If you have been keeping an eye on Tongcheng Travel Holdings, you know it is one of those stocks that sparks as many debates as it does interest. Are you looking at a unique opportunity or something you should cross off your watchlist? Let’s unpack what’s actually happening beneath the surface, especially with so many investors trying to decode its potential.

Looking at the returns, Tongcheng Travel is hardly a sleeper pick. Over the past year, the stock is up 9.5%, and its year-to-date gain sits at an impressive 27.5%. For those who have stuck around since three or even five years ago, you have enjoyed a 54.0% and 54.4% climb, respectively. That said, there has been some near-term volatility. The stock dropped by 1.7% in the last week despite a mild 2.4% gain over the past month. This pattern often hints at shifting risk sentiment, with traders recalibrating after periods of strong performance while broader market developments play into short-term moves.

If we shift our lens to valuation, Tongcheng Travel scores a 2 out of 6 based on our standard undervaluation checks. In other words, it passes two out of six key measures investors typically use to identify undervalued companies. That sounds middling, but as you are about to see, numbers alone often do not tell the full story.

So, how do we break down whether this company is really trading at a bargain or something else? Let’s walk through the main valuation methods analysts use, and stay tuned to the end for an even sharper approach to understanding what the current price actually means for investors like you.

Tongcheng Travel Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tongcheng Travel Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by forecasting a company's future cash flows and discounting them back to today. This provides an estimate of what the business may actually be worth right now. For Tongcheng Travel Holdings, this approach allows us to look beyond temporary price swings and focus on the company’s ability to generate cash over time.

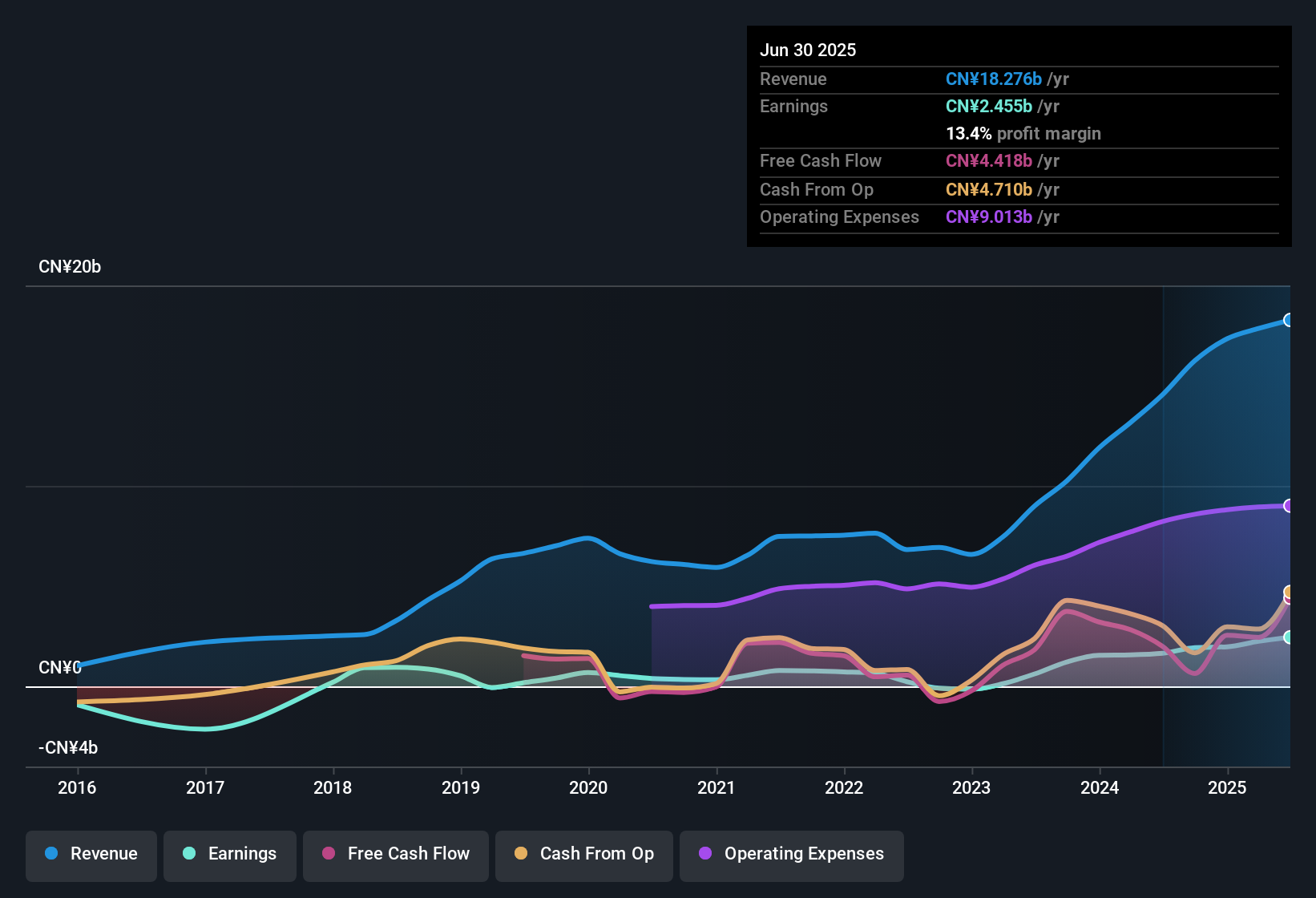

Currently, Tongcheng Travel’s last twelve months’ Free Cash Flow stands at approximately CN¥3.89 billion. Based on analyst forecasts and long-term projections, this figure is expected to rise over the coming decade. Estimates suggest Free Cash Flow could reach around CN¥5.77 billion by 2035. The model follows two stages: analysts gave direct estimates for the first five years, then long-term growth rates were applied for future years beyond that (projections by Simply Wall St).

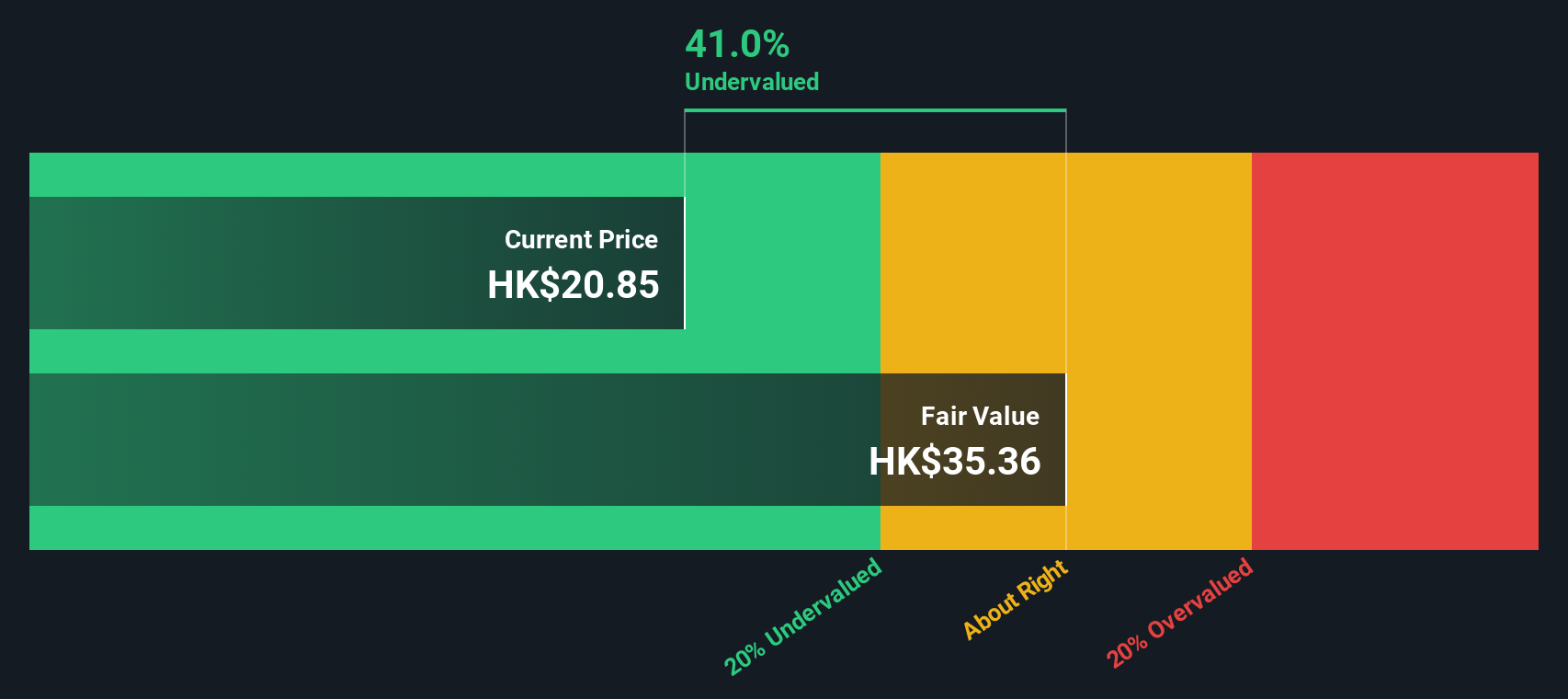

After modeling these cash flows and adjusting for the time value of money, the DCF model determines an intrinsic value of HK$33.85 per share. With the current stock price trading at a 33.2% discount to this valuation, Tongcheng Travel appears meaningfully undervalued through this lens.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tongcheng Travel Holdings is undervalued by 33.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

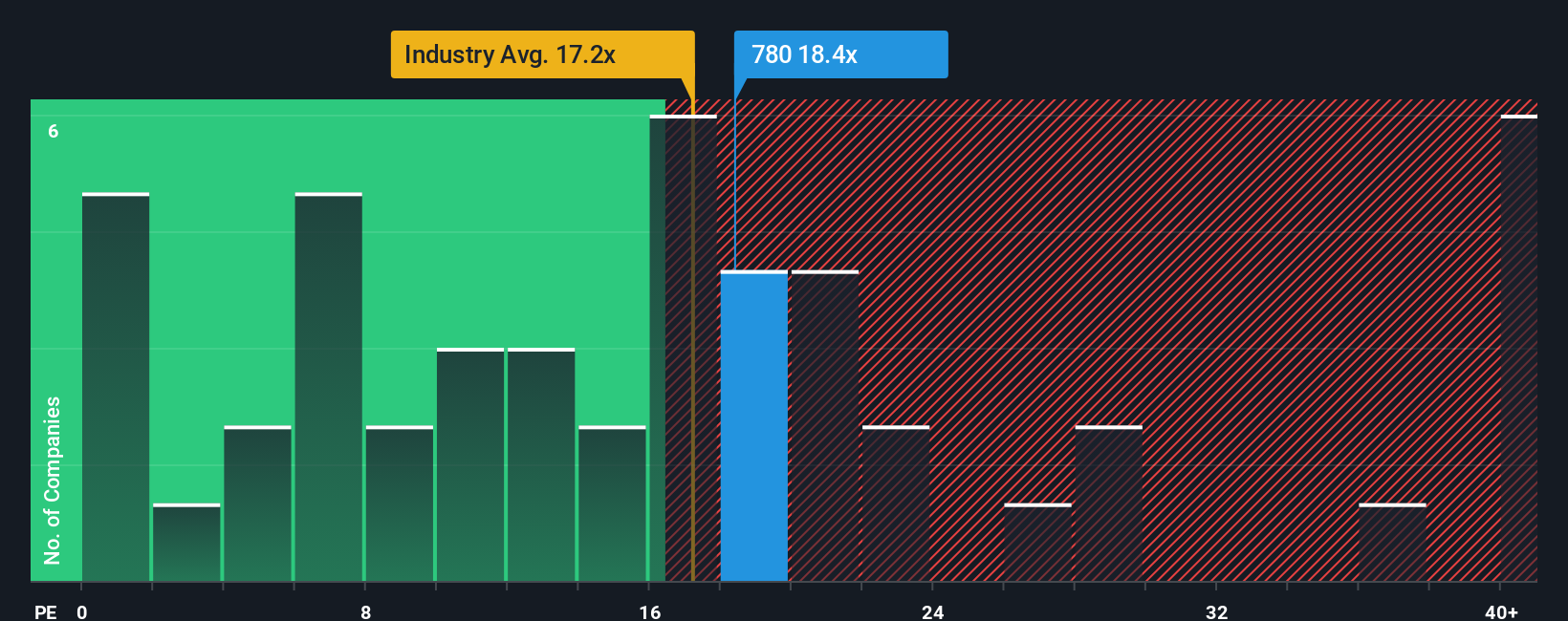

Approach 2: Tongcheng Travel Holdings Price vs Earnings

For profitable companies like Tongcheng Travel Holdings, the Price-to-Earnings (PE) ratio is a go-to valuation tool because it ties the company’s value directly to its earnings. The PE ratio is useful for investors since it helps them gauge how much they are paying for one unit of earnings, making it straightforward to compare across similar businesses.

Higher growth expectations typically justify a higher PE ratio. On the other hand, riskier businesses or those facing headwinds often deserve a lower one. Market sentiment, earnings volatility, and profitability all play a role in determining what a “normal” or “fair” PE should be.

Currently, Tongcheng Travel trades at a PE of 19.4x. That is above the hospitality industry average of 16.0x, and higher than the peer average of 13.2x. However, Simply Wall St’s proprietary “Fair Ratio” for Tongcheng Travel is 18.8x. This Fair Ratio factors in not just raw industry and peer numbers, but also the company’s unique characteristics including earnings growth potential, risk profile, market cap, and profit margins.

The Fair Ratio is a step up from simple peer or sector comparisons because it accounts for what makes Tongcheng Travel distinct. Instead of judging by a broad brush, this approach tailors the benchmark to the company’s specific context and gives investors a more nuanced view.

Comparing Tongcheng Travel’s actual PE of 19.4x to the Fair Ratio of 18.8x, the difference is just 0.6, which suggests the stock is valued about right given its fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tongcheng Travel Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter approach that goes beyond just the numbers by connecting your view of the company’s story with its financial future. Think of a Narrative as your personalized perspective: you craft the story of what you believe is driving Tongcheng Travel Holdings, estimate where revenue, earnings, and margins are headed, and see what that means for fair value. Narratives link the company’s latest developments, business strategies, and industry trends to concrete financial forecasts and an actionable valuation. This makes the process more intuitive and dynamic.

This tool is accessible to all users on Simply Wall St’s Community page, making it easy to compare your own forecasts and stories with those of millions of other investors in real time. Narratives help you decide when to buy or sell by highlighting how your fair value stacks up against the current share price. Since they update automatically with fresh news or earnings, you always have a current view. For example, one investor’s narrative on Tongcheng Travel might point to a future value as high as HK$30.22 due to aggressive expansion, while another might be more cautious and see a fair value closer to HK$18.53 based on competitive and regulatory risks.

Do you think there's more to the story for Tongcheng Travel Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tongcheng Travel Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:780

Tongcheng Travel Holdings

An investment holding company, provides travel related services in the People’s Republic of China.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion