- China

- /

- Electric Utilities

- /

- SHSE:600101

Undiscovered Gems in Asia to Explore This July 2025

Reviewed by Simply Wall St

As global markets continue to show mixed performances, with U.S. small-cap indices like the S&P MidCap 400 and Russell 2000 climbing significantly, attention is shifting towards Asia for potential investment opportunities. In this dynamic environment, identifying stocks that demonstrate resilience and growth potential amidst economic fluctuations can be key to uncovering undiscovered gems in the Asian market.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wuxi Xinan Technology | NA | 11.99% | 4.45% | ★★★★★★ |

| Maxigen Biotech | NA | 9.26% | 24.95% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 26.67% | 2.17% | -26.08% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 3.67% | 24.06% | 0.13% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Johnson Chemical Pharmaceutical Works | 8.73% | 9.88% | 7.83% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 121.34% | 2.97% | 8.06% | ★★★★☆☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 34.13% | 1.81% | 9.01% | ★★★★☆☆ |

| Sinomag Technology | 68.80% | 16.08% | 3.66% | ★★★★☆☆ |

| Shanghai Material Trading | 3.58% | -6.74% | -5.92% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Green Tea Group (SEHK:6831)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Green Tea Group Limited operates casual Chinese restaurants in Mainland China with a market capitalization of HK$6.11 billion.

Operations: Green Tea Group generates revenue primarily through its restaurant operations, amounting to CN¥3.84 billion. The company has a market capitalization of HK$6.11 billion.

Green Tea Group, a nimble player in the market, recently completed an IPO raising HKD 1.21 billion, indicating strong investor interest. The company is trading at 63% below its estimated fair value and boasts high-quality earnings with an impressive growth of 18.5% over the past year, outpacing the Hospitality industry’s modest 1.7%. Debt-free for five years, it maintains a robust financial position with positive free cash flow of US$396 million as of December last year. With earnings forecasted to grow by 25.8% annually, Green Tea Group seems poised for future expansion while rewarding shareholders with a special dividend of HKD 0.33 per share this August.

- Dive into the specifics of Green Tea Group here with our thorough health report.

Understand Green Tea Group's track record by examining our Past report.

Sichuan Mingxing Electric Power (SHSE:600101)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Mingxing Electric Power Co., Ltd. operates in the electric power industry with a market capitalization of CN¥6.55 billion.

Operations: The company generates revenue primarily from its electric power operations. It has a market capitalization of CN¥6.55 billion.

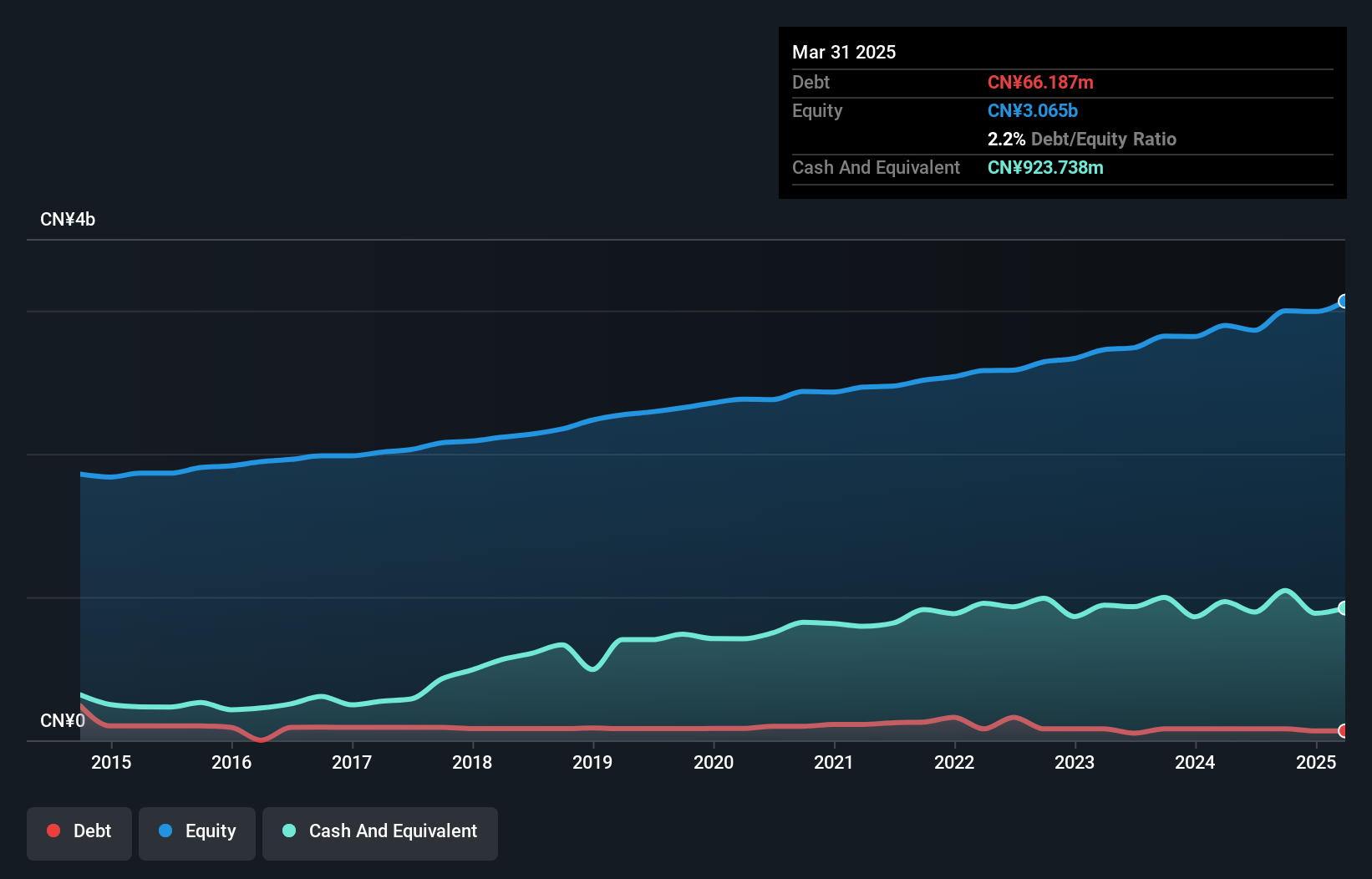

Sichuan Mingxing Electric Power showcases a promising profile with its earnings growth of 11% outpacing the industry average of -6.9%. The company's debt to equity ratio has improved from 3.5 to 2.2 over five years, indicating prudent financial management. Recent quarterly results reveal sales of CNY 776.97 million and net income of CNY 72.77 million, reflecting steady performance compared to last year’s figures. With a price-to-earnings ratio at 30.8x, it is attractively valued against the CN market's average of 39.4x, suggesting potential for investors seeking value in this sector.

Guomai Technologies (SZSE:002093)

Simply Wall St Value Rating: ★★★★★★

Overview: Guomai Technologies, Inc. operates in China, offering internet of things technology services, consulting and design services, science park operation and development services, as well as education services, with a market cap of CN¥13.86 billion.

Operations: Guomai Technologies generates revenue through its internet of things technology services, consulting and design services, science park operation and development services, and education services in China. The company has a market cap of CN¥13.86 billion.

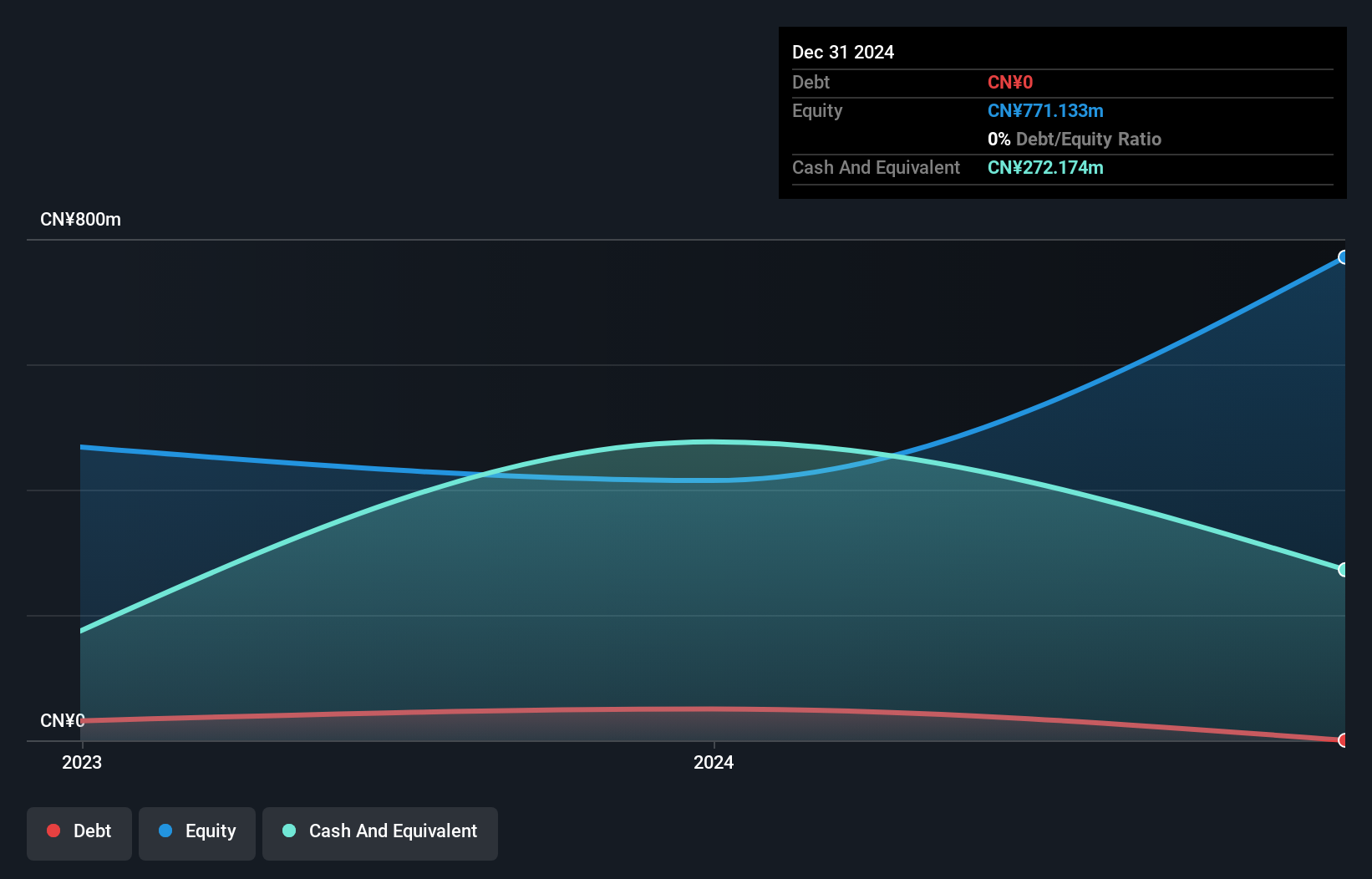

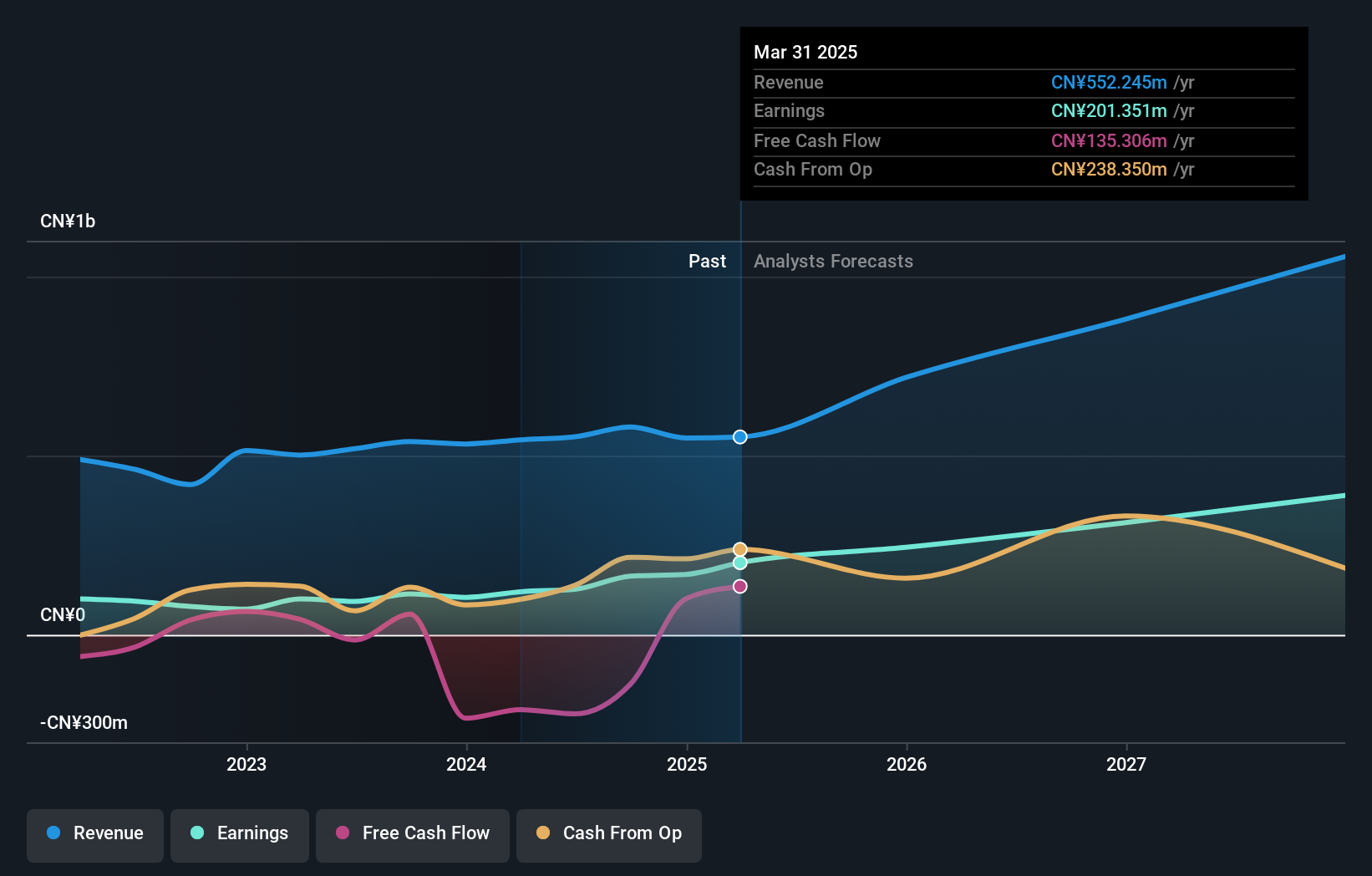

Guomai Technologies, a smaller player in the IT sector, has shown impressive earnings growth of 67.4% over the past year, outpacing the industry's -14.8%. The company is debt-free now, contrasting with a 12.6% debt-to-equity ratio five years ago. Its net income for Q1 2025 was CNY 91.38 million compared to CNY 58.65 million last year, reflecting strong performance despite an unusual CN¥81.8M gain impacting results for March 2025. With a price-to-earnings ratio of 68.8x below the industry average of 90x and positive free cash flow, Guomai seems well-positioned in its niche market space.

- Delve into the full analysis health report here for a deeper understanding of Guomai Technologies.

Examine Guomai Technologies' past performance report to understand how it has performed in the past.

Key Takeaways

- Click this link to deep-dive into the 2605 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600101

Sichuan Mingxing Electric Power

Sichuan Mingxing Electric Power Co., Ltd.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives