- Hong Kong

- /

- Consumer Services

- /

- SEHK:667

China East Education Holdings Limited (HKG:667) Stocks Shoot Up 28% But Its P/E Still Looks Reasonable

The China East Education Holdings Limited (HKG:667) share price has done very well over the last month, posting an excellent gain of 28%. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.9% in the last twelve months.

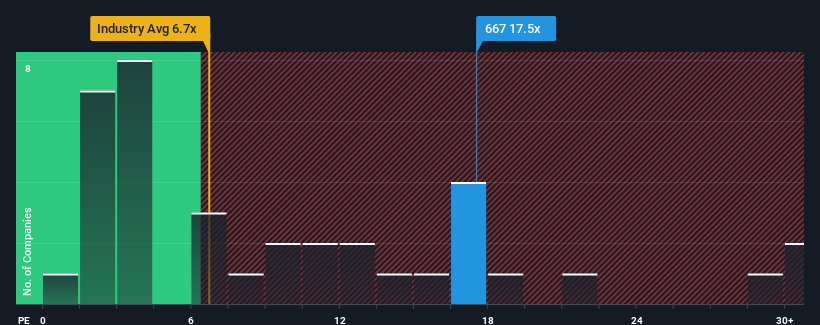

Since its price has surged higher, China East Education Holdings' price-to-earnings (or "P/E") ratio of 17.5x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, China East Education Holdings has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for China East Education Holdings

How Is China East Education Holdings' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like China East Education Holdings' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 3.3%. This was backed up an excellent period prior to see EPS up by 38% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 18% per annum during the coming three years according to the nine analysts following the company. That's shaping up to be materially higher than the 12% each year growth forecast for the broader market.

With this information, we can see why China East Education Holdings is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From China East Education Holdings' P/E?

Shares in China East Education Holdings have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that China East Education Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with China East Education Holdings.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:667

China East Education Holdings

An investment holding company, provides vocational training education services in the People's Republic of China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives