- Hong Kong

- /

- Hospitality

- /

- SEHK:45

Hongkong and Shanghai Hotels (HKG:45 investor five-year losses grow to 34% as the stock sheds HK$400m this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. So we wouldn't blame long term The Hongkong and Shanghai Hotels, Limited (HKG:45) shareholders for doubting their decision to hold, with the stock down 36% over a half decade.

After losing 4.1% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Hongkong and Shanghai Hotels

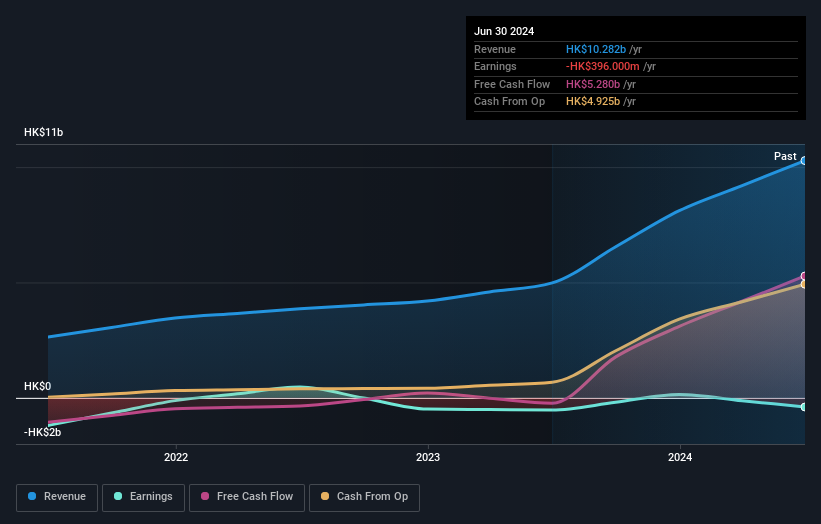

Because Hongkong and Shanghai Hotels made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Hongkong and Shanghai Hotels saw its revenue increase by 12% per year. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 6% per year, for five years: a poor performance. Those who bought back then clearly believed in stronger growth - and maybe even profits. The lesson is that if you buy shares in a money losing company you could end up losing money.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Hongkong and Shanghai Hotels' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Hongkong and Shanghai Hotels had a tough year, with a total loss of 5.7% (including dividends), against a market gain of about 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 6% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Hongkong and Shanghai Hotels better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Hongkong and Shanghai Hotels you should know about.

Of course Hongkong and Shanghai Hotels may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hongkong and Shanghai Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:45

Hongkong and Shanghai Hotels

An investment holding company, owns, develops, and manages hotels, and commercial and residential properties in China, rest of Asia, the United States, and Europe.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives