- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

Meituan (SEHK:3690) eyes Southeast Asia expansion to leverage growth amid strong earnings performance

Reviewed by Simply Wall St

Unlock comprehensive insights into our analysis of Meituan stock here.

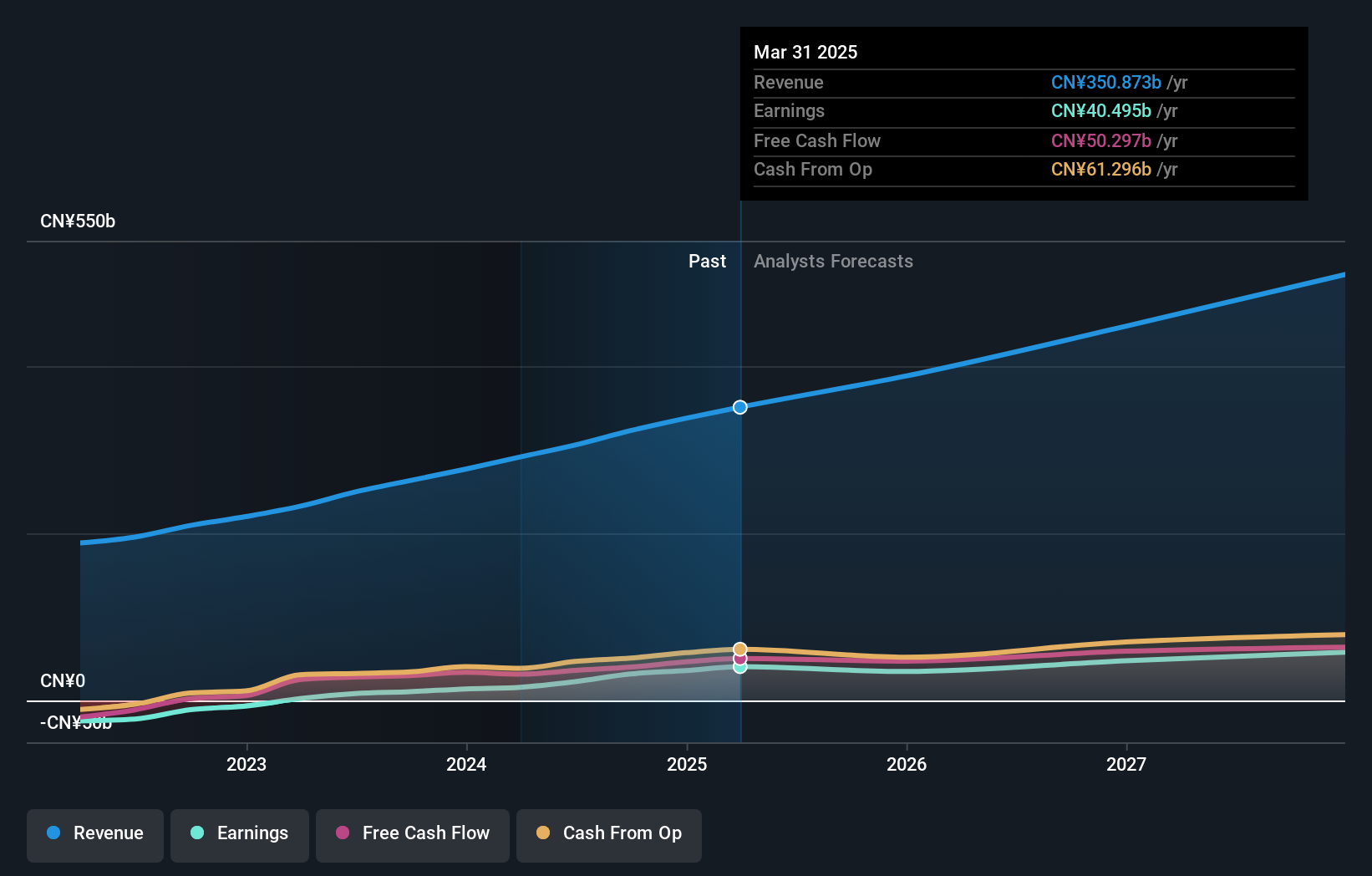

Core Advantages Driving Sustained Success for Meituan

With an impressive earnings growth of 175.5% over the past year, Meituan has outpaced the hospitality industry average of 12.1%. This performance is complemented by a significant acceleration in earnings growth, surpassing its 5-year average of 47.4% annually. The company's strategic focus on product innovation, particularly in the on-demand delivery segment, has led to a 30% increase in user engagement, as highlighted by COO Shaohui Chen. Additionally, Meituan's strong financial health is evident with interest payments being well-covered by EBIT, boasting a 64.7x coverage, and maintaining more cash than total debt. These financial metrics underscore the company's solid foundation and ability to sustain growth.

Strategic Gaps That Could Affect Meituan

Meituan's Return on Equity (ROE) at 14% remains below the benchmark of 20%, indicating room for improvement. CEO Xing Wang noted challenges with rising operational costs, which have slightly impacted profit margins. Furthermore, the company's earnings growth forecast of 28.1% annually is slower than its current growth rate, suggesting potential future constraints. The Price-To-Earnings Ratio of 43x is significantly higher than the industry average, which may pose challenges in aligning investor expectations.

Potential Strategies for Leveraging Growth and Competitive Advantage

Meituan is exploring expansion into Southeast Asia, a region with rapidly growing demand for its services. This move, as discussed by COO Shaohui Chen, could significantly boost revenue. The company's investment in AI and machine learning is expected to optimize logistics and enhance customer experience, reflecting a forward-thinking approach. Additionally, targeted marketing campaigns have successfully increased new customer sign-ups by 40%, demonstrating effective customer acquisition strategies.

Competitive Pressures and Market Risks Facing Meituan

Economic headwinds remain a concern, as highlighted by CEO Xing Wang, with potential impacts on consumer spending. Regulatory changes in delivery services pose additional challenges, requiring close monitoring by the company. Supply chain disruptions, acknowledged by CFO Scarlett Xu, could affect product availability and customer satisfaction. Moreover, significant insider selling over the past three months raises questions about management confidence and future performance.

Conclusion

Meituan's impressive earnings growth of 175.5% over the past year, driven by strategic product innovations and strong financial health, highlights its potential to maintain a competitive edge. However, the company's Return on Equity of 14% and rising operational costs suggest areas for improvement to sustain profitability. While expansion into Southeast Asia and advancements in AI present growth opportunities, the forecasted slower earnings growth rate of 28.1% annually and a high Price-To-Earnings Ratio of 43x, compared to industry averages, could challenge investor expectations and future performance. Economic headwinds, regulatory changes, and insider selling further emphasize the need for careful strategic execution to navigate potential risks and align with market demands.

Key Takeaways

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:3690

Meituan

Operates as a technology retail company in the People’s Republic of China.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives