- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

Meituan (SEHK:3690): Assessing Undervaluation and Growth Potential in a Changing Consumer Services Landscape

Reviewed by Kshitija Bhandaru

Meituan (SEHK:3690) has captured investor interest recently, with its stock showing a mix of short-term gains and longer-term declines. In a fast-evolving consumer services sector, there is plenty to unpack when it comes to performance and future value.

See our latest analysis for Meituan.

While Meituan’s share price has hovered around HK$105.8, momentum remains muted. Short bursts of positive movement have given way to a year marked by fading confidence, as highlighted by a 1-year total shareholder return of -48.4%. Investors are weighing up future growth potential against recent caution in the sector.

If you’re curious about where else momentum might be building, this is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and substantial business growth, is Meituan currently undervalued by the market? Or are investors already factoring in the company’s next chapter, leaving little room for further upside?

Most Popular Narrative: 19.5% Undervalued

With Meituan’s consensus fair value at HK$131.41 and a last close at HK$105.8, analysts see meaningful upside versus today’s price, but valuation comes with some strong underlying expectations that are worth examining.

Ongoing diversification into new business areas such as on-demand grocery delivery (Xiaoxiang Supermarket), international expansion (Keeta), and omnichannel retail positions Meituan to capture incremental revenue streams and reduce dependence on the saturated core food delivery market. This supports overall top-line resilience and long-term earnings potential.

Curious what bold transformations and rapid-fire revenue shifts could justify this pricing? There are ambitious expansion plans and aggressive financial forecasts tucked beneath the surface. The full narrative breaks down the growth engines, disruptive bets, and one crucial earnings projection that could make or break this valuation story.

Result: Fair Value of $131.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and the costs of scaling into new business lines could squeeze margins and derail growth assumptions for Meituan in the years ahead.

Find out about the key risks to this Meituan narrative.

Another View: Market Multiples Raise Questions

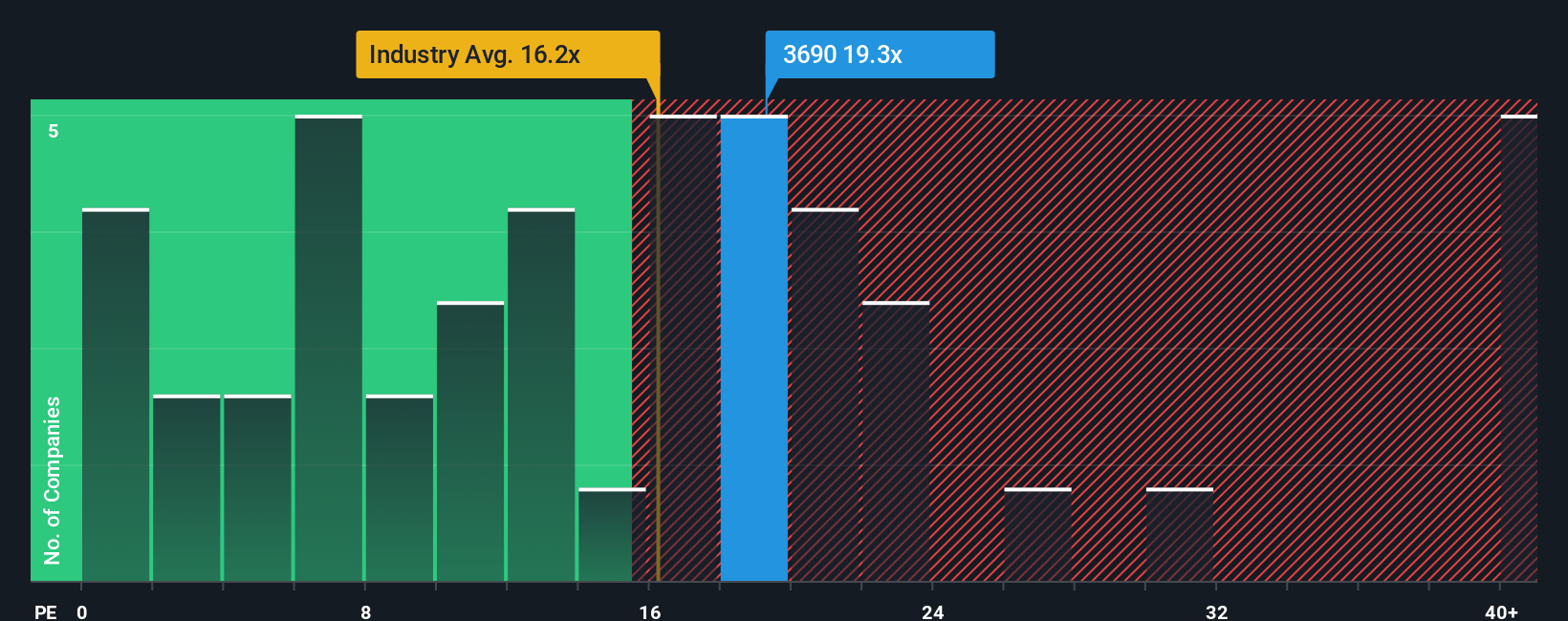

Looking through the lens of the price-to-earnings ratio, Meituan trades at 20x earnings, which is higher than both the Hong Kong Hospitality industry’s 15.7x and the peer group average of 16.7x. While the market’s fair ratio sits even higher at 34.6x, the current gap hints at elevated valuation risk if expectations shift. Could this premium be justified? Is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Meituan Narrative

If you see things differently or want to investigate the numbers for yourself, it’s quick and easy to build your own perspective on Meituan in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Meituan.

Looking for More Investment Ideas?

Smart investors look beyond just one stock. Supercharge your watchlist and get ahead of market moves with opportunities few others are noticing right now.

- Unlock income potential with steady returns and check out these 19 dividend stocks with yields > 3% with yields above 3% and resilient business models.

- Tap into the booming artificial intelligence revolution by reviewing these 23 AI penny stocks positioned to shape the way we live and work next.

- Capitalize on tomorrow’s breakthroughs with these 26 quantum computing stocks leading advancements in quantum computing, security, and transformative tech applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives