- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

Can Meituan Rebound After Antitrust Fines Spark Fresh Debate on Its Valuation?

Reviewed by Bailey Pemberton

If you’ve been watching Meituan’s stock price lately, you know it’s been quite a ride. Maybe you’re wondering if now is the moment to buy in, sit tight, or just move on, and if so, you’re not alone. Over the past year, Meituan shares have slid more than 50.3%, with a tough five-year decline of almost 60.7%. There has been some relief in the very short term, as the stock picked up 5.5% over the last seven days and 4.6% in the past month. While these recent bounces hint at renewed optimism, the broader trend is still defined by steep long-term losses and lingering worries on the part of many investors.

Behind these moves are shifts in China’s regulatory landscape and changing investor appetite for growth stocks, which have made the market more cautious about companies like Meituan. Some see these challenges as red flags, while others spot possibility in the selloff, especially considering Meituan’s strong core businesses and ongoing innovation in food delivery and local services. The market seems to be wrestling with whether old fears are overdone or if there is more trouble ahead.

If you’re trying to cut through the noise, there is no better place to start than with the numbers. Meituan’s valuation score currently sits at 3, meaning it is considered undervalued in half of the core checks we use for assessment. But before you decide what to do next, let’s walk through the main valuation methods, and keep reading to discover a twist that could change how you look at stock valuations altogether.

Why Meituan is lagging behind its peers

Approach 1: Meituan Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to their present value. This approach centers on how much cash Meituan can generate over the long term, providing a data-driven glimpse into whether today's share price reflects the company's true worth.

Currently, Meituan reports Free Cash Flow (FCF) of roughly CN¥37.0 billion. Analysts forecast strong growth ahead, with FCF projected to reach CN¥63.2 billion by 2028. Looking even further, Simply Wall St extrapolates these trends out ten years, estimating FCF could climb above CN¥124.9 billion by 2035. These projections are based on a two-stage Free Cash Flow to Equity model, with the first few years guided by analyst estimates and subsequent years modeled using expected growth rates.

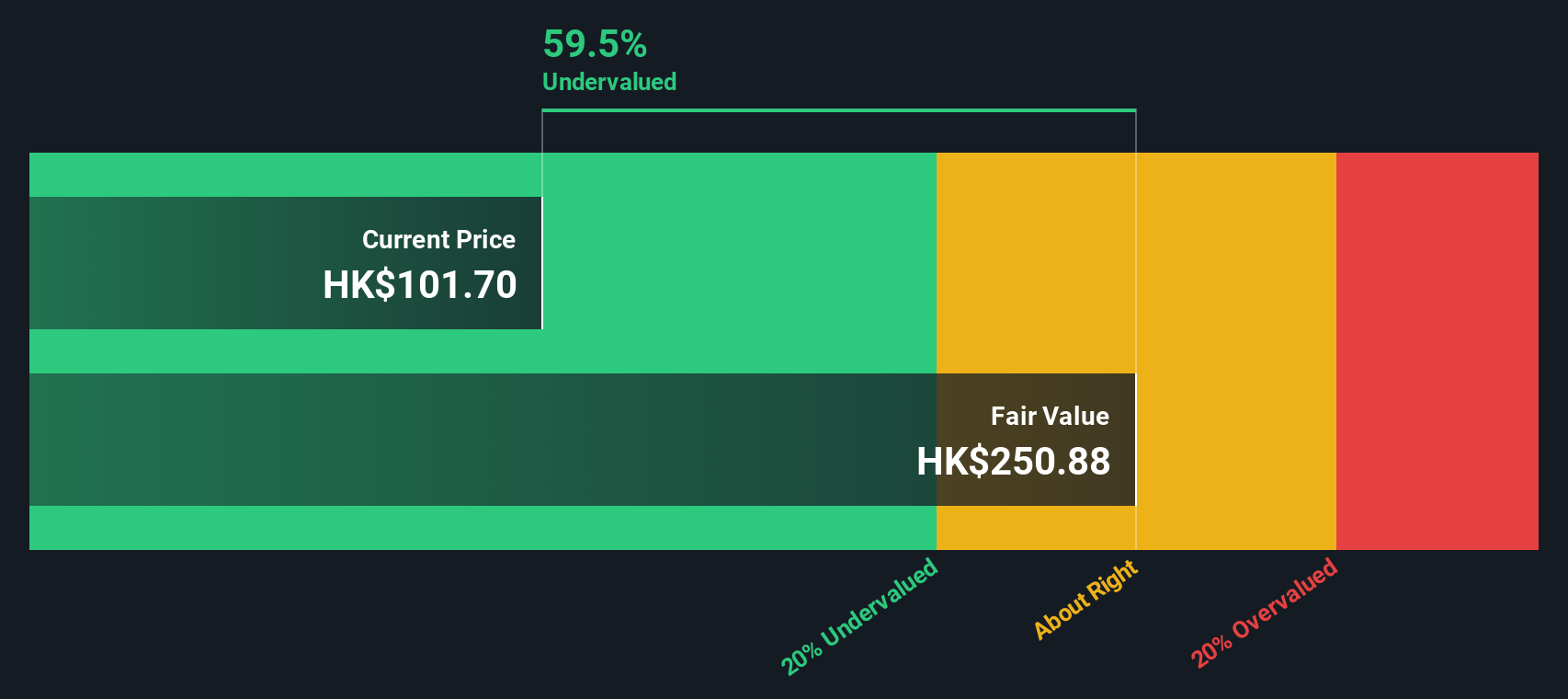

According to this DCF analysis, Meituan's estimated intrinsic value is HK$251.52 per share. Compared to the company’s current trading price, this represents a 57.8% discount. In other words, the market may be significantly undervaluing the long-term potential of Meituan’s cash-generating businesses.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Meituan is undervalued by 57.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Meituan Price vs Earnings (PE)

The price-to-earnings (PE) ratio is one of the most widely used tools for evaluating profitable companies, as it relates a firm's share price to its actual earnings. Since Meituan is now showing steady profits, using the PE multiple helps compare how much the market is willing to pay for each dollar of earnings versus other businesses in the same industry.

The “right” PE ratio for a company depends on factors such as growth potential, profitability, business risks, and investor sentiment. A higher PE is often justified for companies expected to grow earnings faster or perceived as lower risk, while slower growth or greater uncertainty tends to command a lower multiple.

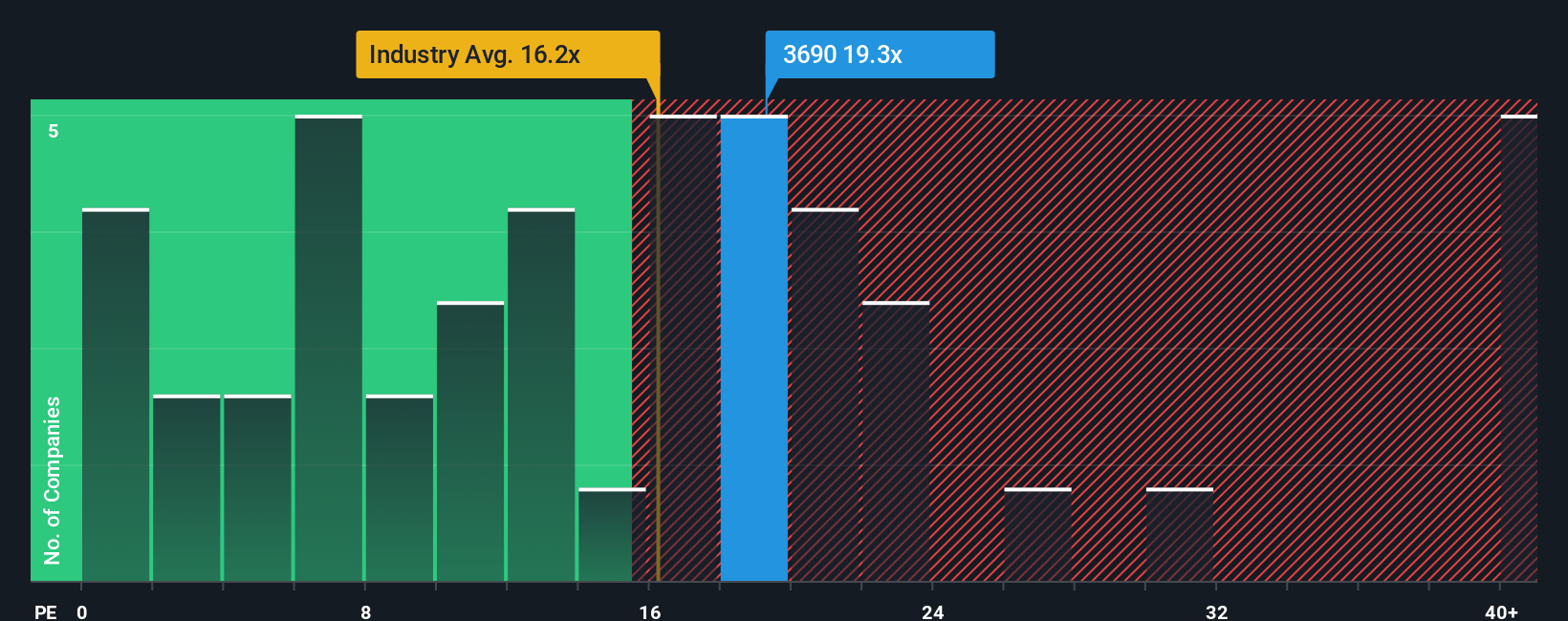

Meituan currently trades at a PE of 20.1x. For context, this is above the hospitality industry average of 16.05x and slightly higher than the average among its peers, which sits at 16.55x. However, instead of comparing only to these benchmarks, Simply Wall St calculates a “Fair Ratio” of 34.63x for Meituan. This reflects a more tailored assessment that factors in its earnings growth prospects, risk profile, profit margins, industry dynamics, and market cap.

The Fair Ratio offers a more nuanced perspective than simple peer or industry averages, as it recognizes the unique drivers and risks at play for Meituan. Rather than lumping it together with all companies in the sector regardless of their outlook or size, this method accounts for differences between firms. This approach can provide investors with a clearer signal as to whether the stock is trading at a discount or premium to expectations built into its fundamentals.

Comparing Meituan’s current PE of 20.1x with its Fair Ratio of 34.63x, the shares appear undervalued according to this method, as the market is pricing in less optimism than Simply Wall St’s analysis suggests is justified.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

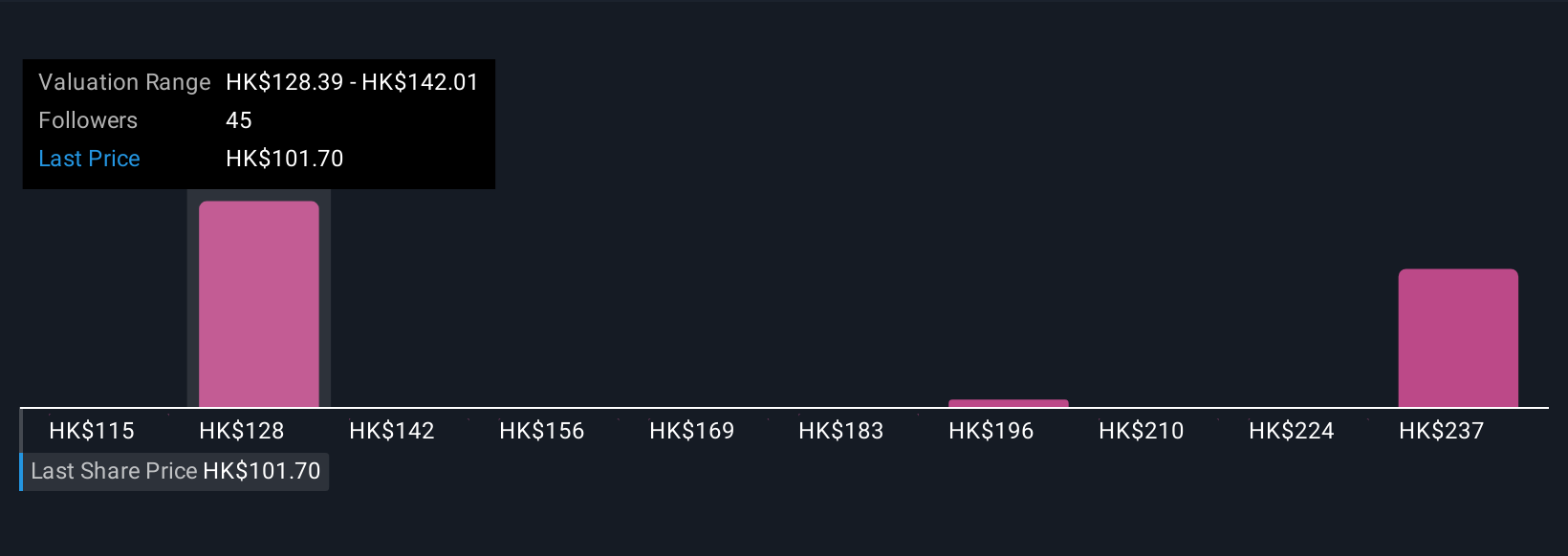

Upgrade Your Decision Making: Choose your Meituan Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is essentially your perspective, the story you believe about Meituan's future, which you express by setting your own assumptions for revenue, earnings, and margins, then translating those into your estimate of fair value. Narratives make investing more personal and intuitive by connecting your view of the company's story to a detailed financial forecast and ultimately to a fair price. On Simply Wall St’s Community page, you can easily create or browse Narratives used by millions of investors. You can compare your fair value with the live market price to help you decide when to buy or sell. These Narratives are updated dynamically whenever new information or earnings reports are released, keeping your outlook up to date. For example, while some investors see ongoing urbanization and technology adoption driving Meituan’s fair value as high as HK$300.96, others focusing on regulatory risks come up with much lower estimates, like HK$78.28. The platform lets you weigh all perspectives and build your own smarter investment thesis.

Do you think there's more to the story for Meituan? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives