- China

- /

- Semiconductors

- /

- SHSE:688498

3 Asian Growth Companies With High Insider Ownership Growing Earnings Up To 92%

Reviewed by Simply Wall St

Amid heightened global trade tensions and economic uncertainty, Asian markets have been navigating a challenging environment as tariffs impact growth prospects. In this context, companies with strong insider ownership can be particularly appealing to investors, as they often demonstrate confidence in the company's potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 24.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| giftee (TSE:4449) | 34.3% | 67.1% |

| Synspective (TSE:290A) | 13.2% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 78.6% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 19.6% | 121.7% |

We'll examine a selection from our screener results.

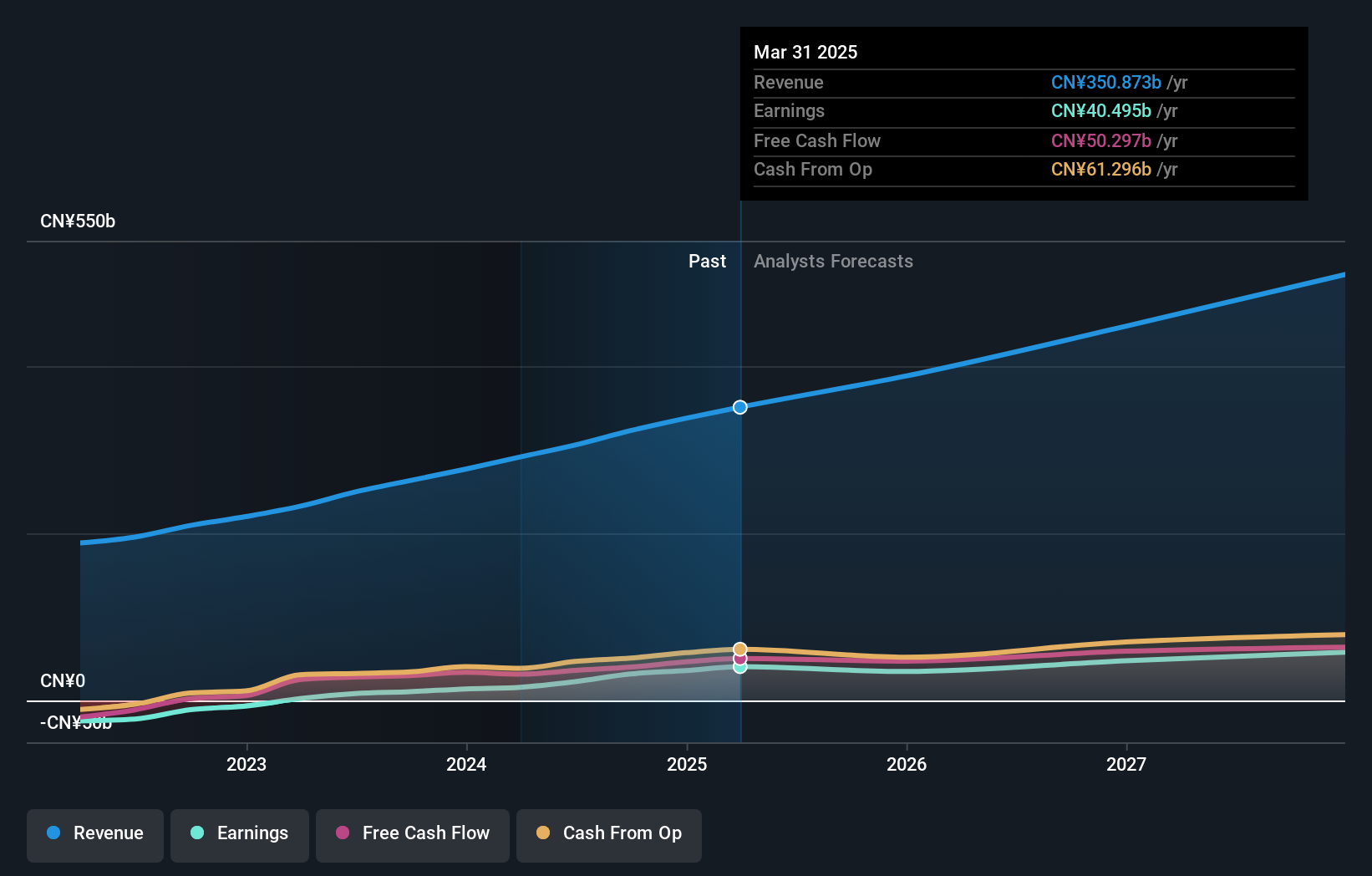

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan is a technology retail company operating in the People's Republic of China with a market cap of approximately HK$946.42 billion.

Operations: The company's revenue is derived from two main segments: Core Local Commerce, generating CN¥250.25 billion, and New Initiatives, contributing CN¥87.34 billion.

Insider Ownership: 11.7%

Earnings Growth Forecast: 17.4% p.a.

Meituan's robust financial performance, with net income rising to CNY 35.81 billion for 2024, underscores its potential as a growth company in Asia. Analysts expect earnings to grow at 17.38% annually, outpacing the Hong Kong market's average. Despite trading below fair value estimates and price targets, Meituan shows no recent insider trading activity. Additionally, ongoing discussions about acquiring a stake in Starbucks China highlight strategic expansion interests that could enhance growth prospects further.

- Delve into the full analysis future growth report here for a deeper understanding of Meituan.

- Insights from our recent valuation report point to the potential undervaluation of Meituan shares in the market.

Great Microwave Technology (SHSE:688270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Great Microwave Technology Co., Ltd. focuses on the research, development, production, and sale of integrated circuit chips and microsystems in China with a market capitalization of CN¥8.52 billion.

Operations: Great Microwave Technology Co., Ltd.'s revenue is primarily derived from its activities in integrated circuit chips and microsystems within China.

Insider Ownership: 21%

Earnings Growth Forecast: 57.7% p.a.

Great Microwave Technology's recent earnings reveal a sales increase to CNY 303.54 million for 2024, though net income fell to CNY 18.13 million. Despite this, analysts forecast significant annual profit growth of 57.7%, far exceeding the market average, with revenue expected to grow at 32.5% annually. However, return on equity is projected to remain low at 13.4%. The company completed a share buyback worth CNY 4.5 million but shows no recent insider trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of Great Microwave Technology.

- Our comprehensive valuation report raises the possibility that Great Microwave Technology is priced higher than what may be justified by its financials.

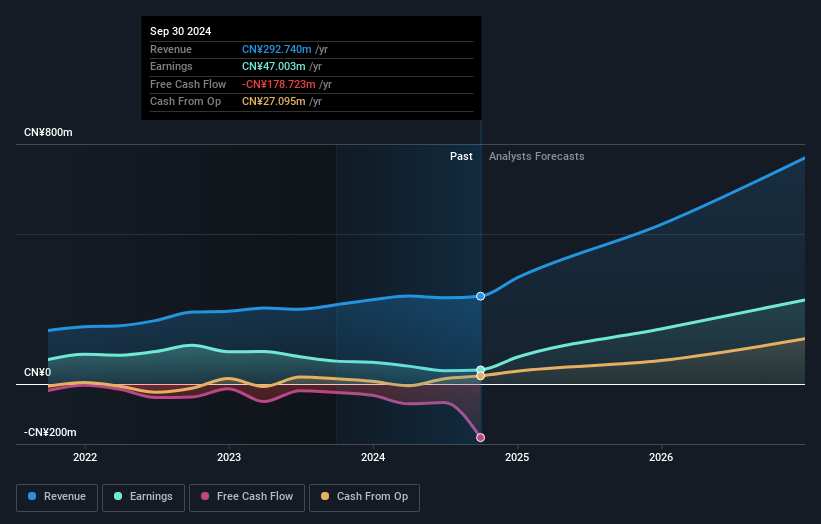

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yuanjie Semiconductor Technology Co., Ltd. (ticker: SHSE:688498) operates in the semiconductor industry and has a market cap of approximately CN¥9.83 billion.

Operations: Yuanjie Semiconductor Technology generates its revenue from various segments within the semiconductor industry, contributing to its market presence valued at approximately CN¥9.83 billion.

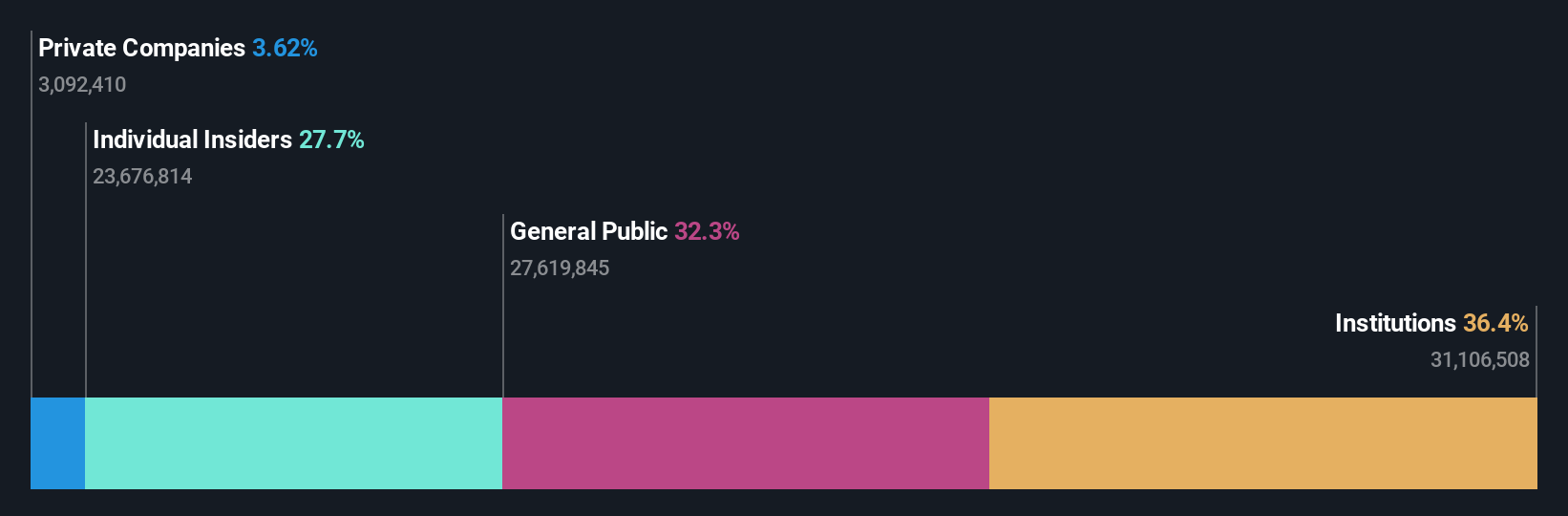

Insider Ownership: 27.9%

Earnings Growth Forecast: 92.4% p.a.

Yuanjie Semiconductor Technology's earnings for 2024 show a sales increase to CNY 252.17 million, but a net loss of CNY 6.13 million compared to the previous year's profit. Despite this setback, revenue is expected to grow at 44.2% annually, significantly outpacing the market average, with profitability anticipated within three years. The company completed a share buyback worth CNY 55.41 million and has not shown recent insider trading activity; however, its share price remains highly volatile.

- Dive into the specifics of Yuanjie Semiconductor Technology here with our thorough growth forecast report.

- The analysis detailed in our Yuanjie Semiconductor Technology valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Delve into our full catalog of 655 Fast Growing Asian Companies With High Insider Ownership here.

- Curious About Other Options? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688498

Yuanjie Semiconductor Technology

Yuanjie Semiconductor Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives